Kenya Railways banks on property sales to settle Sh2.26 billion pension debt

The Kenya Railways Staff Retirement Benefits Scheme was set up in 2006 after the restructuring of the corporation, inheriting liabilities of more than Sh16 billion.

Kenya Railways Corporation (KRC) has announced a fresh plan to settle long-standing pension arrears, signalling new hope for retirees who have endured years of delayed payments under the Kenya Railways Staff Retirement Benefits Scheme.

The Corporation told senators that it is now banking on the sale of major Nairobi properties to raise the funds needed to finally clear the outstanding dues.

More To Read

- Kenya Railways hands over stalled Kibera project to State Department of Housing

- Kenya to raise Sh390 billion bond for Naivasha–Malaba SGR extension

- Auditor General warns Kenya Railways’ Sh569 billion loan default could burden taxpayers

- Kisumu rail services to resume by December after 2024 flood damage

- Makongeni Estate set for redevelopment under Ruto’s affordable housing plan

- Nairobi-Embakasi train service emerges as top-earning rail route

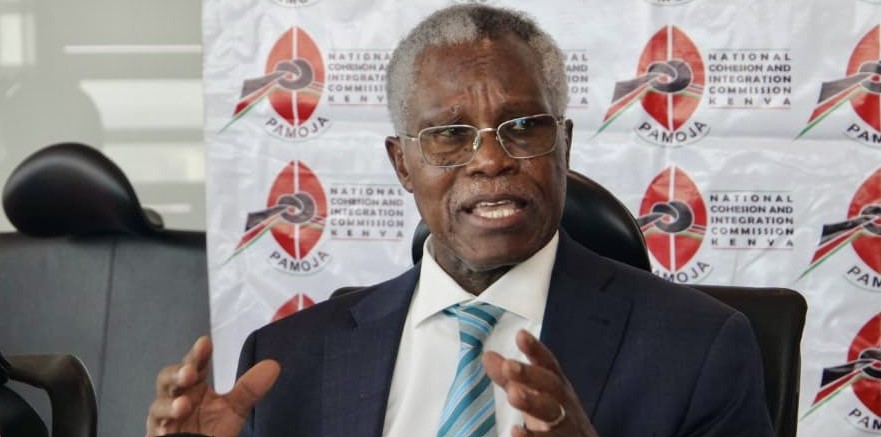

Appearing before the Senate Committee on Labour and Social Welfare, Managing Director Philip Mainga said a phased payment plan running up to January 2026 has already been set up, with the next major inflow expected from the Kenya National Highways Authority (KeNHA).

Mainga said the agency owes the Corporation about Sh2 billion from a land purchase, money that will go directly towards clearing the Sh2.26 billion owed for pensioners.

“We are waiting for KENHA to pay us for a parcel of land we sold to them, it's about Sh2 billion that will enable us to clear the balances and going forward, we are looking at other prime parcels like Makongeni Estate and Ngara to plan for future repayments,” Mainga told the Committee.

His remarks came as senators pressed the Corporation to address the long-running delays that have left pensioners in serious hardship.

Those who petitioned the committee recounted the strain of going for months without pay, struggling with daily expenses and medical bills, and in some cases losing loved ones who died before receiving their dues.

To support the recovery plan, Mainga said Kenya Railways intends to sell two high-value estates in Nairobi. Makongeni Estate has been valued at around Sh8 billion, while Ngara Estate is expected to bring in between Sh8 billion and Sh10 billion.

He noted that the proceeds will provide a firm financial base for the scheme and help restore predictable payment cycles.

“You know the law blocks us from taking other agencies to court for debt recovery, or auctioning of property to recover debt,” he added, saying this has contributed to the long delays.

Members of the Committee urged the Corporation to fast-track the asset disposal and explore temporary solutions to cushion retirees as they await full settlement.

Kajiado Senator Samuel Kanar Seki proposed a more aggressive debt follow-up process, including hiring recovery agencies to pursue government entities yet to remit their dues.

“It is unfair that pensioners who served this country diligently have to wait decades for their rightful dues,” said Senator Seki, calling for stronger oversight and faster disbursements from the Treasury.

The Kenya Railways Staff Retirement Benefits Scheme was set up in 2006 after the restructuring of the Corporation, inheriting liabilities of more than Sh16 billion.

These included unpaid pensions and unremitted staff contributions from the former state Corporation.

Although asset transfers and sales have been ongoing, the scheme has continued to face funding shortfalls caused by slow liquidation and administrative delays.

Mainga assured lawmakers that the new plan is designed to bring the crisis to an end.

“We have a clear plan to ensure this does not repeat itself. Our goal is to clear all outstanding balances by early next year and secure a sustainable payment structure going forward,” he said.

Top Stories Today