Government under pressure to settle Sh161 billion debt by October 2025

Mbadi provided a breakdown of the repayment obligations, attributing the looming financial pressure to Eurobond and syndicated loans.

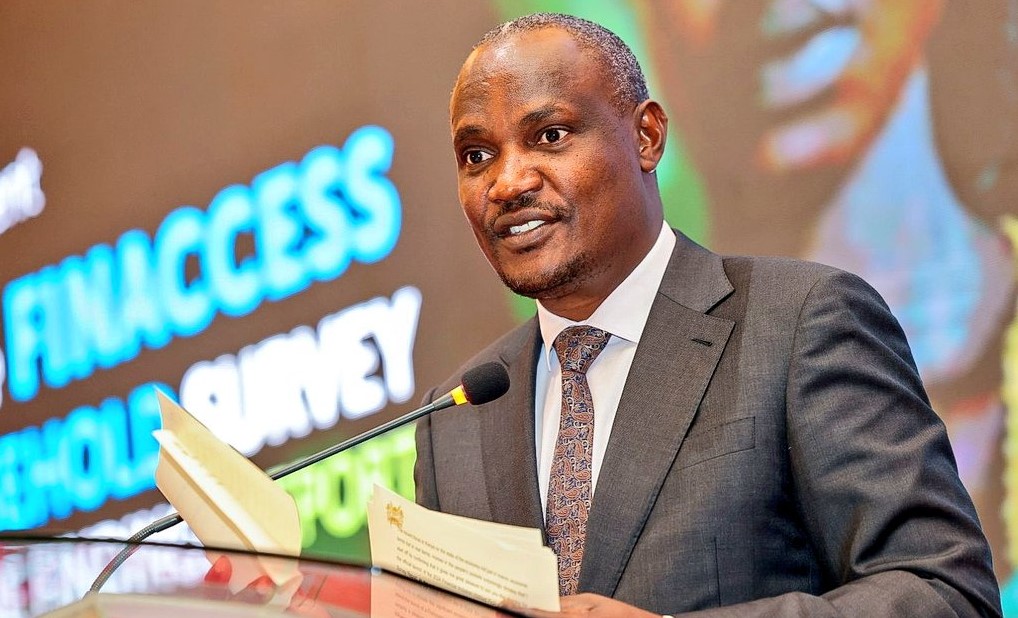

Kenya will be required to pay Sh161 billion by October 2025, signalling a deepening debt crisis driven by persistent fiscal deficits and heavy borrowing, Treasury Cabinet Secretary John Mbadi has revealed.

Speaking on Thursday, Mbadi provided a breakdown of the repayment obligations, attributing the looming financial pressure to Eurobond and syndicated loans.

More To Read

"Among the payments due are Sh25.8 billion to the Trade and Development Bank, another Sh10 billion, Sh83.5 billion, and Sh3.4 billion, bringing the total to Sh123 billion by October," Mbadi said during an interview with Spice FM.

"This is in addition to the Eurobond repayment, which requires Sh38 billion in 2025. That is the kind of pressure we're in."

He further noted that Kenya is expected to pay Sh116 billion in Eurobond debt by May 2027. The payments will be made in three equal instalments of Sh38.8 billion annually.

Additionally, Kenya has accrued Sh952 million in syndicated loans, which must be settled within the next eight months. These commercial loans, including Eurobonds and syndicated loans, are provided by financial institutions that deal directly with the Kenyan government.

Mbadi highlighted that Kenya's domestic and foreign debt currently maintains a near 50:50 ratio, a policy aimed at shielding taxpayers from interest rate fluctuations.

"Domestic borrowing is almost balancing 50/50. Right now, we have almost Sh5.6 trillion in domestic borrowing and about Sh5.1 trillion in foreign debt," he said.

Debt burden

The country's growing debt burden has been a longstanding challenge for both past and present administrations, impacting economic stability and growth. Kenya's debt portfolio comprises three categories: multilateral, bilateral, and commercial loans.

Multilateral debt is sourced from international financial institutions such as the World Bank, International Monetary Fund (IMF), and the African Development Bank Group. It is considered a more affordable option for nations experiencing debt distress.

Bilateral debt involves loans between Kenya and other sovereign nations, while commercial debt, such as Eurobonds and syndicated loans, is acquired from financial institutions under commercial terms. The high interest rates associated with commercial loans place significant pressure on the government to meet repayment obligations and avoid default.

As the repayment deadlines approach, Kenya faces increasing financial strain, raising concerns about the sustainability of its debt management strategy.

Mbadi also highlighted concerns over wastage of public resources within the government, despite President William Ruto’s austerity measures announced last year. He identified procurement processes as a major area where significant financial losses occur.

"I cannot deny there is still wastage in the government, and one of the most critical steps for us now is having a procurement management system. That is where we lose a lot of resources alongside budgeting," Mbadi said.

To curb these losses, he noted that the government has introduced a zero-based budgeting approach, requiring every expenditure to be justified rather than relying on incremental budgeting.

Online procurement system

Additionally, he said an online procurement system is being rolled out to enhance transparency and efficiency.

"We are rolling out e-procurement, which I expect to start operating by the end of this quarter and effectively cover all government departments by July 1," he said.

"We have also moved to technical accrual basis accounting from cash basis to capture all government commitments and revenue, and are also rolling out treasury singular accounts to avoid having multiple accounts."

Defending recent renovations at State House, which have drawn criticism over their high cost, Mbadi explained that the facelift was necessary despite the government's cost-cutting efforts.

"It had reached a point where State House was leaking. One can question the extent of the renovation, but you cannot question whether we needed a facelift of the facility. This is where we host all international delegations," he said.

He added that various budget lines for State House, including confidential expenditures, had been removed in the current financial year, leaving only operational and administrative costs to support presidential activities.

The Controller of Budget (CoB) recently unveiled a Sh10.7 billion plan to refurbish state houses and lodges over 12 years, ending in June 2027. Records indicate that no funds were allocated between June 2024 and December 2024 due to budget cuts following the withdrawal of the finance bill in response to last year’s protests.

However, work on State House renovations has continued, with the newly refurbished building unveiled last month.

In the 2022/2023 financial year ending June 2023, State House spent Sh59.8 million, likely for initial renovations under President Ruto’s administration.

Top Stories Today