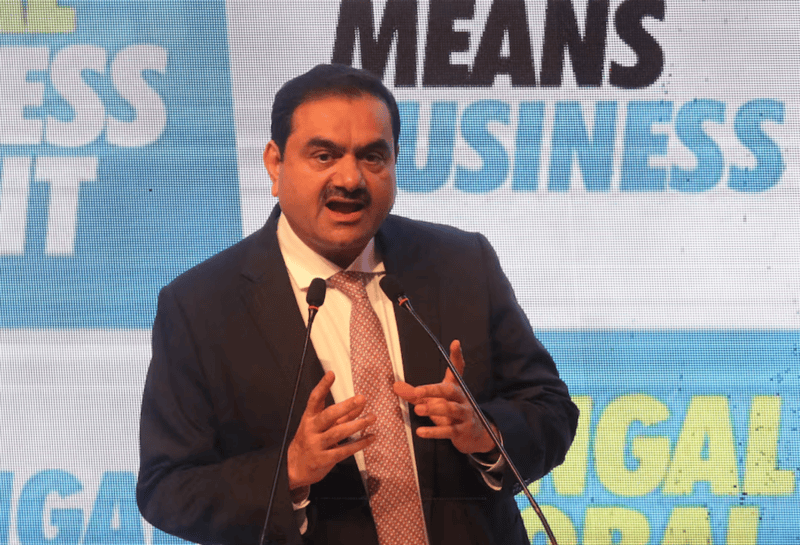

India's Adani Group billionaire Gautam Adani charged in US with bribery

By Reuters |

Authorities said Adani and seven other defendants agreed to pay about $265 million in bribes to Indian government officials for contracts.

Gautam Adani, the billionaire chair of Indian conglomerate Adani Group and one of the world's richest people, has been indicted in New York over his role in a $265 million (Sh34 billion) bribery scheme, according to US prosecutors.

US authorities said Adani and seven other defendants, including his nephew Sagar Adani, agreed to pay the bribes to Indian government officials to obtain contracts expected to yield $2 billion (Sh259 billion) of profit over 20 years and develop India's largest solar power plant project.

Keep reading

- Adani fallout: Spotlight now turns to Sh104 billion health system deal

- LSK now wants President Ruto to reveal costs of cancelled Adani Deals

- How Indian billionaire Adani's alleged bribery scheme took off and unravelled

- What next? Lawmakers question legal, financial implications of terminating Adani deals

A judge has issued arrest warrants for Gautam Adani and Sagar Adani and prosecutors plan to hand those warrants to foreign law enforcement, court records show.

Prosecutors also said the Adanis and another executive at Adani Green Energy, former CEO Vneet Jaain, raised more than $3 billion (Sh389 billion) in loans and bonds by hiding their corruption from lenders and investors.

Gautam Adani, Sagar Adani and Jaain were charged with securities fraud, securities fraud conspiracy and wire fraud conspiracy, and the Adanis were also charged in a US Securities and Exchange Commission civil case.

Stocks tumble

Falling-out for the Adani empire, which was rocked by a short-seller attack in February 2023, was immediate with shares in the conglomerate's listed companies’ stocks tumbling between 10 per cent and 20 per cent.

Adani Green Energy also cancelled plans on Thursday to raise $600 million (Sh77.8 billion) in US dollar-denominated bonds. The bond had been priced but was pulled following the news.

Adani dollar bonds slumped in Asian trading, with prices down between 3-5c on bonds for Adani Ports and Special Economic Zone. The falls were the largest since the Adani Group came under a short-seller attack in February 2023.

According to an indictment, some conspirators referred privately to Gautam Adani with the code names "Numero uno" and "the big man," while Sagar Adani allegedly used his cell phone to track specifics about the bribes.

The Adani Group has not responded to requests for comment.

Gautam Adani, Sagar Adani and Jaain were charged with securities fraud, securities fraud conspiracy and wire fraud conspiracy, and the Adanis were also charged in a US Securities and Exchange Commission civil case.

Five other defendants were charged with conspiring to violate the Foreign Corrupt Practices Act, a US anti-bribery law, and four were charged with conspiring to obstruct justice.

None of the defendants is in custody, a spokesperson for US Attorney Breon Peace in Brooklyn said. Gautam Adani is believed to be in India.

Shares in GQG Partners, an Australia-listed investment firm that is a major Adani backer, slid 20 per cent. The decline was the stock's largest one-day fall since it was listed three years ago.

GQG last year bought 3.4 per cent of Adani Enterprises – the group's flagship firm, 4.1 per cent of Adani Ports and Special Economic Zone 2.5 per cent of Adani Transmission and 3.5 per cent of Adani Green Energy. It said in a statement that it was monitoring the charges.

Gautam Adani, 62, is worth $69.8 billion according to Forbes magazine. He is one of the few billionaires formally accused in the United States of criminal wrongdoing.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!