No more loans for defaulting parastatals, Treasury declares

Mbadi outlined the measure in a circular to chief executives of State corporations, emphasising that defaulting entities will also be denied government guarantees for future borrowings.

Parastatals that have defaulted on loan repayments and accrued pending bills will no longer be allowed to borrow additional funds, the National Treasury has said.

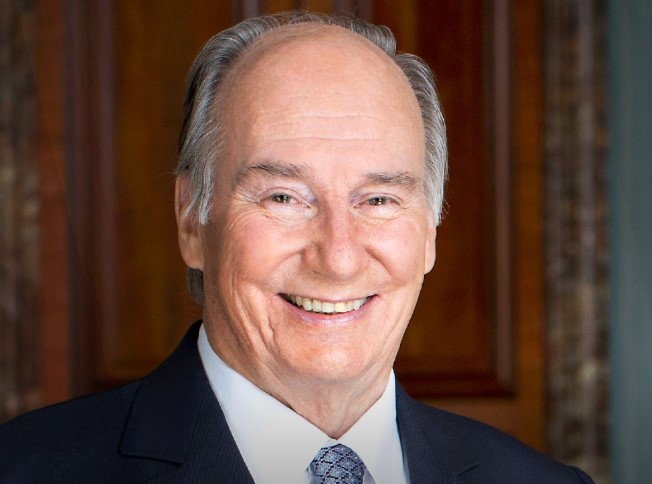

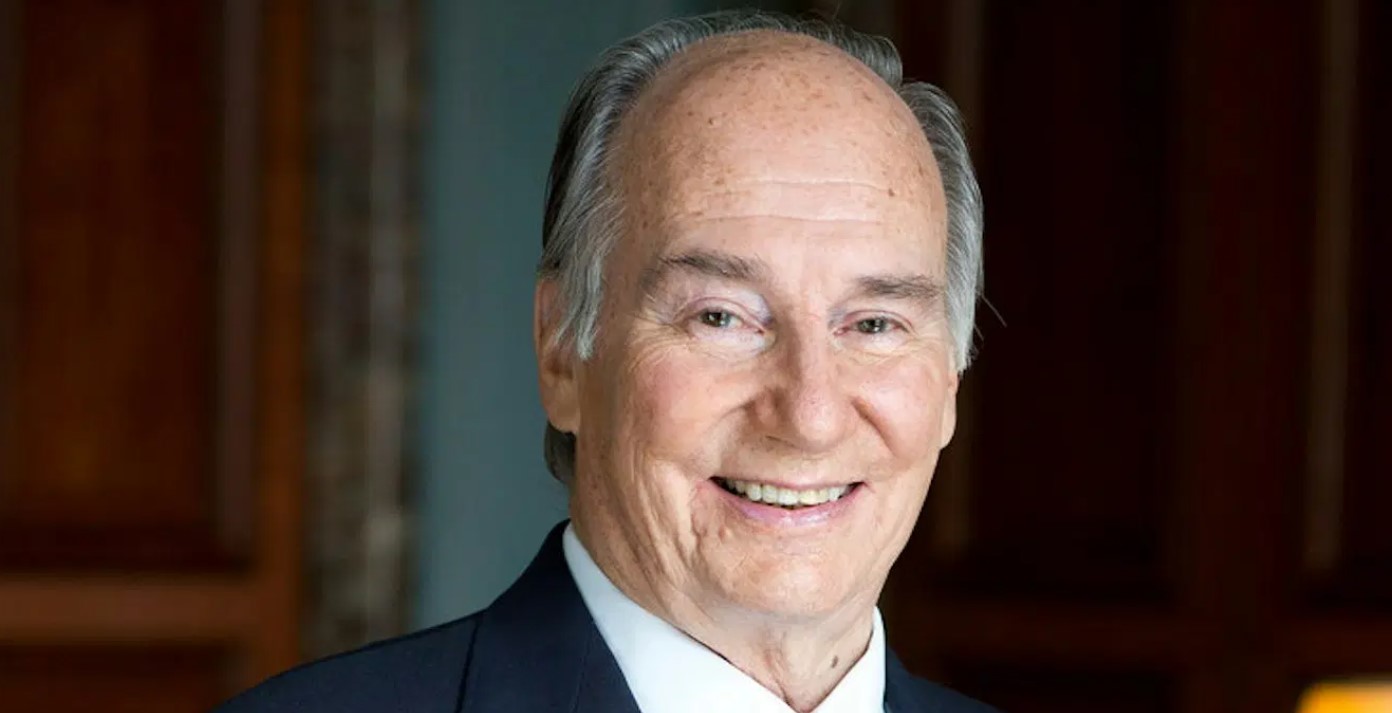

Treasury Cabinet Secretary John Mbadi said the directive, aimed at reducing the financial burden on taxpayers, will be implemented starting July 2025.

More To Read

- Treasury cuts tax revenue target by Sh93 billion amid economic slowdown

- Treasury extends mandate of taskforce scrutinising pending bills by six months

- Senators want Treasury to use part of shareable revenue to pay county debts

- Kiptoo: Pensioners not on new portal by February deadline to be suspended from payroll

He outlined the measure in a circular to chief executives of State corporations, emphasising that defaulting entities will also be denied government guarantees for future borrowings.

“The National Treasury and Economic Planning will not give concurrence for borrowings or, where applicable, grant guarantees for State corporations which are in default of loan repayments and pending bills,” Mbadi said in the circular as quoted by Business Daily.

This comes as the debt owed by State-owned enterprises (SOEs) reached Sh1.38 trillion in the last financial year. The total comprises Sh1.197 trillion in on-lent loans, Sh100.2 billion in guaranteed debt and Sh78.21 billion in non-guaranteed debt.

In addition to loan defaults, SOEs are struggling with Sh410.7 billion in arrears to contractors and suppliers as of September 2024. The Treasury has categorised the debts as contingent liabilities, meaning the government only steps in if SOEs fail to meet repayment obligations.

Leading among the parastatals with high debts are Kenya Airways (Sh99.92 billion), Kenya Electricity Generating Company (Sh78.62 billion), Kenya Power (Sh71.32 billion), and Athi Water Works Development Agency (Sh55.1 billion).

Some of these entities had sought debt write-offs in the last financial year due to their inability to meet financial obligations.

More than half of the 54 monitored SOEs, including Kenya Airways, made no repayments during the financial year ending June 2024. The Treasury, on behalf of Kenya Airways, paid Sh17.4 billion in guaranteed debt, reflecting the exposure taxpayers face from non-performing parastatals.

The Treasury’s records also show that on-lent loan arrears, including unpaid principal and accrued interest, rose to Sh266.5 billion. A major portion, Sh167.5 billion, is tied to Kenya Railways’ standard gauge railway loans, for which repayments have yet to commence. Water sector entities also owe Sh34.1 billion, while Sh2.3 billion in loans to the sugar sector have been written off.

In the circular, Mbadi called for better financial management within SOEs.

“State corporations are required to entrench prudent financial management practices in their planning and enhance cost control measures to deliver services most cost-effectively,” he said.

He also warned that any expenditures incurred without approval from the Treasury or relevant ministries would be deemed irregular, with accounting officers personally liable.

Kenya has 248 State corporations, including 46 commercial entities, primarily in transport and energy, and 201 non-commercial agencies. Despite their strategic roles, many rely heavily on bailouts due to financial mismanagement and inefficiency.

In June 2024, the High Court suspended efforts to reform SOEs, pending a legal challenge by the Law Society of Kenya. The petitioners argued that some proposed changes encroached on the mandate of the Public Service Commission (PSC), which oversees public service operations.

PSC Chairperson Anthony Muchiri criticised the reforms outlined in Executive Order No. 3 of 2024, calling them unconstitutional.

“The guidelines violate several court decisions that found that it is only the Commission (PSC) that has the power to establish offices and approve human resource instruments in the public service,” he wrote in a letter to the Head of Public Service, Felix Koskei.

As parastatals continue to face mounting financial pressure, the Treasury’s directive aims to curb further exposure while ensuring that SOEs adopt sustainable financial

Top Stories Today