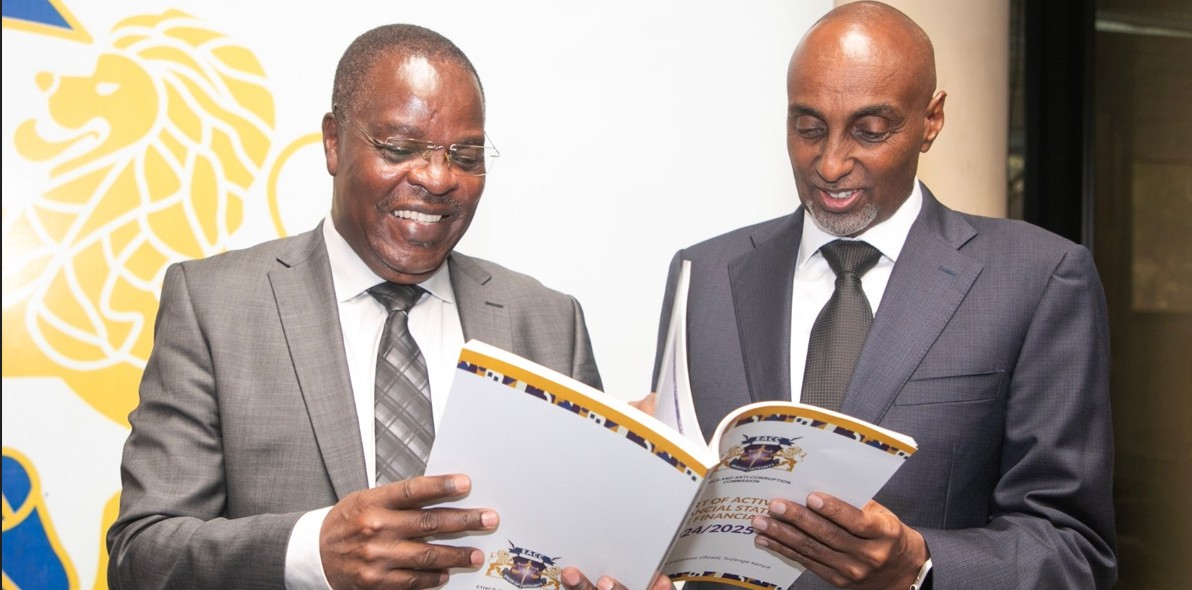

Kenya’s EACC will fast-track money laundering investigations and asset recovery, seeking delisting from the FATF grey list after filing record recovery suits and boosting convictions.

The hubs are designed to support hands-on learning, track student progress more effectively and provide teachers with tools to assess competencies beyond traditional examinations.

TSC said the internship programme equips teachers with practical teaching experience, improves pedagogical skills and provides jobs for unemployed youth, but stressed that it does not automatically lead to permanent and pensionable employment.

While international standards recommend a learner-to-teacher ratio of 1:25, Kenya’s figures vary widely: 1:38 in pre-primary, 1:46 in primary, 1:38 in junior school and 1:34 in secondary.

UASU petitioned the IMF Wage Bill Mission to Kenya over what it describes as persistent breaches of collective bargaining rights and long-standing pay injustices affecting university lecturers.

The warning follows multiple complaints from teachers, who argue that the proposed election framework favours incumbents and violates the court’s stay order.

Roasting allows heat to circulate evenly, crisps the skin, and enhances natural flavours without requiring excessive oil.

A Nanyuki nutritionist explains why gentle cooking of vegetables like spinach, tomatoes and carrots can boost nutrient absorption, improve digestion and make meals easier on the stomach.

Whether you eat eggs or prefer an eggless option, homemade mayonnaise can be surprisingly simple and far superior to store-bought ones.

Before you start splurging on machines and accessories, there are several things to consider to ensure your setup is functional, enjoyable, and tailored to your taste.

Kenyan travel is shifting from budget trips to curated luxury, with travelers planning and saving for premium stays, fine dining and short high-end getaways driven by social media and rising expectations.

President Ruto says Kenya’s economic progress, from housing projects to universal health care and youth jobs, is proof of “promises made and promises...