Nairobi residents invited to final discussions on tax amendment bills

By Lucy Mumbi |

Key proposals under the Tax Procedures Amendment Bill include an extension of the Tax Amnesty Programme, which, if approved, will allow taxpayers to clear arrears without penalties until June 30, 2025.

Nairobi residents will have three days this week to present their views on the Tax Laws Amendment Bill 2024 and the Tax Procedures Amendment Bill 2024 during the public participation phase at the Kenyatta International Conference Centre (KICC).

This marks the final stage of public consultations following earlier sessions held across six counties, where concerns over corruption and the use of tax revenues dominated discussions.

Keep reading

Key proposals under the Tax Procedures Amendment Bill include an extension of the Tax Amnesty Programme, which, if approved, will allow taxpayers to clear arrears without penalties until June 30, 2025.

Meanwhile, the Tax Laws Amendment Bill introduces notable changes, such as the replacement of the Digital Service Tax with a six per cent Significant Economic Presence Tax (SEPT).

The Bill is expected to raise Sh178 billion to support the 2024/2025 national budget by revising key tax categories, including excise duty, income tax, and VAT.

The bill also seeks to include the Housing Levy and SHIF contributions as allowable deductions.

Filling Finance Bill gap

The Treasury views this bill as essential to filling the gap left by the withdrawal of the Finance Bill 2024 and financing key development projects.

The hearings, which are part of a wider public consultation process, allow Kenyans the chance to voice their opinions on the proposed tax changes. The focus is on the Tax Laws Amendment Bill, which is designed to generate additional revenue for the government.

Taxation has remained a contentious issue in Kenya, with calls for transparency featuring prominently during public hearings.

In Kericho and Mombasa, participants urged the government to address corruption and ensure accountability in the utilisation of tax revenues.

Kanini Kega, a key figure in the legislative process, reiterated the importance of balance in tax policies.

"We must be careful with our tax policies. We don’t want to introduce punitive taxes that scare away investors and lead to job losses," he cautioned during one of the hearings.

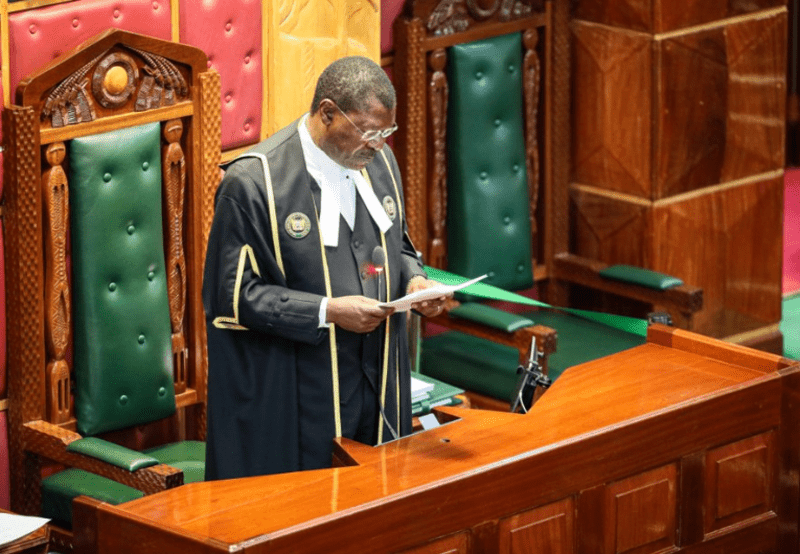

National Assembly Finance Committee Chairman Kuria Kimani sought to allay public concerns, assuring participants that their input would shape the legislative process.

"Proposals that face widespread rejection will be reconsidered before moving forward," he said.

The two bills were first introduced in the National Assembly on November 13, 2024, before being handed over to the Departmental Committee on Finance and National Planning for further deliberation and reporting.1

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!