Gen Z protests, cash flow shortages lead Treasury to emergency loans

Thousands of young protesters took to the streets in Kenya's major towns in June to oppose proposed tax hikes in the now-shelved Finance Bill 2024.

Tax collections in July 2024 grew at the slowest rate in over a decade, excluding the Covid-19 period. This was mainly attributed to the impact of business disruptions following the deadly Gen Z protests.

As a result, the Treasury was forced to rely more on costly overdrafts. Data released by Treasury Cabinet Secretary John Mbadi reveal that tax collection in the first month of this Financial Year 2024-2025 increased by 2.87 per cent to Sh159.51 billion compared to the same period last year.

More To Read

- MPs want time to review budget policy statement extended by seven days

- President Ruto, DP Kindiki offices seek Sh1.6 billion for renovations

- Former DP Gachagua accuses Ruto of intentionally sabotaging reconstitution of IEBC ahead of 2027 polls

- CS Muturi: My family has suffered, enforced disappearances must end

The slow performance in July, compared to an 18.73 per cent growth in the same month last year, pushed the Treasury to use expensive overdrafts to avoid missing payments on some domestic debt.

The cash shortage in July forced the Treasury to seek an emergency loan from the Central Bank of Kenya (CBK), drawing around Sh22.6 billion to settle domestic debts that were due late in the month.

The Treasury's overdraft limit is capped at approximately Sh97 billion, which is five per cent of the last audited revenues. This facility is used by the State to meet urgent cash needs, such as paying salaries and settling debts, when funds are running low.

On July 30, 2024, Treasury principal secretary Chris Kiptoo said that [withdrawal of Sh22.6 billion] was majorly due to the settlement of Treasury bonds of Sh26.1 billion on July 22, 2024.

"As of July 29, we had utilised Sh60.5 billion [of the Sh97 billion limit]," he stated.

In July, businesses reported a significant drop in cash flow, with demand for goods and services falling to levels not seen since the country recovered from the Covid-19 economic struggles in 2020 and 2021.

Taxes on company and individual earnings, as well as consumption of goods and services, experienced the most sluggish start to a financial year in recent history, according to an analysis of exchequer data from the past decade.

Thousands of young protesters took to the streets in Kenya's major towns in June to oppose proposed tax hikes in the now-shelved Finance Bill 2024.

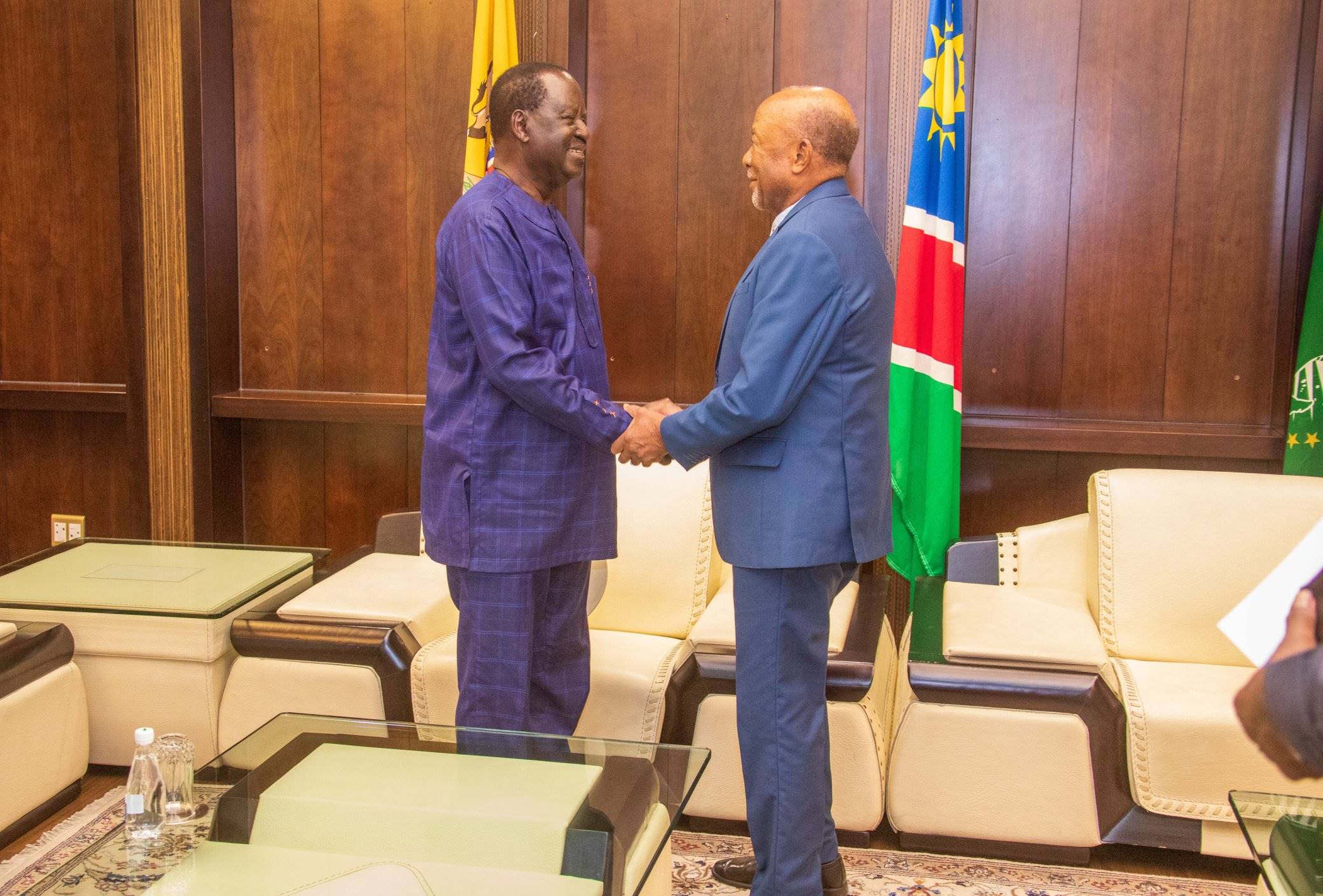

The youth-led protests prompted President William Ruto to drop the Finance Bill 2024 and form a broad-based government that has included five members of the main opposition party, ODM.

The protests, which authorities claimed were infiltrated by criminal elements, disrupted businesses in major urban centres, as traders feared a repeat of the looting that occurred at its peak on June 25, 2024, when several youths were shot dead and Parliament was invaded.

The collapse of the Finance Bill 2024 has forced the Treasury to reduce tax collection targets for the full year ending June 2025 by Sh270.15 billion, bringing the target down to Sh2.48 trillion.

However, these adjustments are not enough to cover the budget shortfall, leading the Treasury to increase the borrowing target by Sh172.19 billion, bringing it to Sh1 trillion for the year ending June 2025.

To address the estimated Sh344.3 billion gap left by shelving the new tax measures, the government cut the budget by Sh145 billion and raised the borrowing goal to Sh1 trillion for the same period.

Top Stories Today

Trending