Dubai Unlocked: The politically exposed Kenyans investing in Dubai’s luxe landscape

By Africa Uncensored |

While much of the investment appears to be above board, lax regulations, transactions conducted in cash and cryptocurrency, and a reputation for secrecy have made Dubai an attractive destination for those looking to launder or hide money.

Key Findings

- Dubai Unlocked, an investigation by Africa Uncensored, OCCRP, and more than 70 other media outlets globally, reveals how the emirate’s status as a global financial hub has made it an attractive destination for investment, particularly in real estate.

- While much of the investment appears to be above board, lax regulations, transactions conducted in cash and cryptocurrency, and a reputation for secrecy have made Dubai an attractive destination for those looking to launder or hide money.

- Thanks to property records obtained through this investigation, we found drug lords, individuals accused of money laundering, and politically exposed persons, mentioned as owners of properties in some of Dubai’s most affluent areas.

- There are some Kenyans on the list, including politically exposed persons, wealthy families, and some mentioned in massive corruption scandals, who have significant real estate holdings in Dubai.

- Mary Wambui Mungai purchased two properties at over Sh105 million in 2016, three years after her appointment to the board of Kenyatta National Hospital. Wambui’s role in Kenyan politics and government remains cloaked in secrecy.

- Former Kamukunji MP Simon Mbugua acquired land worth Sh88 million in 2015. Mbugua has served as an EALA representative and is currently board chairman at the Policyholders Compensation Fund.

- Deepak and Rashmi Kamani, two Indo-Kenyan businessmen arraigned and later acquitted in the multi-billion shilling Anglo-Leasing corruption scandal, purchased villas, apartments and office units worth millions of dollars between 2007 and 2011.

- Kamlesh Mansukhlal Damji Pattni, accused of being the chief architect of the multi-billion shilling Goldenberg fraud scandal, bought three flats at over Sh56.5 million between 2017 and 2018. Pattni has been accused of running a large-scale gold smuggling and money laundering operation through Zimbabwe into Dubai

Keep reading

Dubai has achieved a storied place in the Kenyan mind, one of greener pastures and endless opportunities. While Kenyans have flocked to the Gulf Tiger looking for employment, they may find themselves in unfamiliar company, as wealthy Kenyans have also been drawn to the emirate, but for other reasons. Kenyans looking to invest in real estate have flocked to the United Arab Emirates (UAE) in their hundreds over the past few decades, looking to multiply their millions in Dubai’s luxurious real estate market. These include men involved in two of Kenya’s largest corruption scandals—Anglo Leasing and Goldenberg, and a public official once accused of evading tax amounting to Sh2.2 billion.

While a lot of information on who has invested where and how much their properties are worth remains hidden, the Dubai Uncovered leak offers a glimpse into the glossy underworld of offshore property ownership in the UAE.

There are hundreds of Kenyans named in the data, including politicians, public servants, business magnates, and politically exposed persons. While the ownership does not denote any illegality or involvement in corruption in itself, the presence of individuals linked to massive corruption scandals raises questions on whether these Kenyans chose to invest in Dubai due to attractive returns, or more nefariously, due to the lack of financial transparency.

Why Dubai?

To understand the significance of Dubai’s newfound status as a global real estate investment destination, one needs to see the allure it holds. Unlike most property markets, the UAE does not tax capital gains for investors. In contrast, Kenya has a 15% rate on Capital Gains Tax.

Tax free returns aside, what makes Dubai particularly attractive for dirty money is its minimal to nonexistent Know Your Customer (KYC) measures. Anyone can invest by providing minimal documentation, and avenues exist for residency through investment, where a real estate investor owning a property whose purchase value is equal to or more than AED 750,000 at the time of purchase can apply for a two-year renewable residence permit, and can go on to sponsor their spouse(s) and children.

This lack of serious scrutiny is abused by the world’s corrupt, including politically exposed persons and anyone who intends to launder money from illegal dealings. Moreover, according to Deloitte, Dubai’s residential property prices increased by 18% between 2022 and 2023, making the country an even more alluring destination to park money.

This report resulted from a leak of 800,000 property ownership records obtained from the Centre for Advanced Defense Studies (C4ADS) through the Organised Crime and Corruption Reporting Project (OCCRP) and a collaboration of more than 70 media partners from 58 countries.

A report by the Organisation for Economic Co-operation and Development (OECD) estimates that Africa loses $60 billion annually to illicit financial flows. United Arab Emirates was added to the Financial Action Task Force’s (FATF) greylist in 2022 for deficiencies in its anti-money laundering and terrorism financing (AML/TF) policies but later removed in February 2024.

A month later, in March 2024, a salesperson with Dubai real estate investment firm Damac unknowingly offered undercover reporters from Sweden’s SVT a chance to purchase a flat in “bags of cash” or cryptocurrency, with “zero questions”. “In properties, you are not going to be questioned from any department… especially the developer himself,” the salesperson pitched, “Anyone who wants to buy can buy.” Damac denied these allegations, insisting that it does sufficient due diligence and only accepts payment in UAE dirhams.

So, who are these Kenyans mentioned on the list?

Mary Wambui

One person mentioned in the leaked property and transactions data is Mary Wambui Mungai, who has been named as having bought two off-plan plots of land purchased at $817,060 (Sh105.4 million) on April 7, 2016, in the Al Yufrah 3 area of Dubai.

Al Yufrah 3 is described as a self-sustaining community located in a prime location and surrounded by lots of green and open space. It is a mixed-use area with a collection of residential apartments, commercial units and hotels.

While owning the property itself is not in question, it does raise questions about whether Wambui’s significant but unexplained role in politics and government in Kenya over the past decade may have helped to finance its acquisition.

Wambui was appointed as chairperson of the Board of the Communications Authority of Kenya (CAK) in 2022. Before this, she served two three-year terms as a member of the board of Kenyatta National Hospital (KNH) in 2010 and 2013 after an appointment by the then Minister for Medical Services, Anyang’ Nyong’o. Sitting allowances for private citizens serving as members on government boards and committees stood at Sh10,000 per day ($77.5).

Wambui’s companies have done business with the Government of Kenya in various sectors, some under investigation for irregular tendering processes. In June 2023, the then Cabinet Secretary of Investment, Trade and Industry, Moses Kuria, appeared before the Senate to answer questions about the import of fertilizers, cooking oil, rice and beans by the Kenya National Trading Corporation (KNTC) in 2022. One particular scandal involved the importation of 182,227 metric tonnes of edible oil by irregularly recommended companies duty-free, contrary to procurement laws. At least two of those companies have Wambui as the sole shareholder.

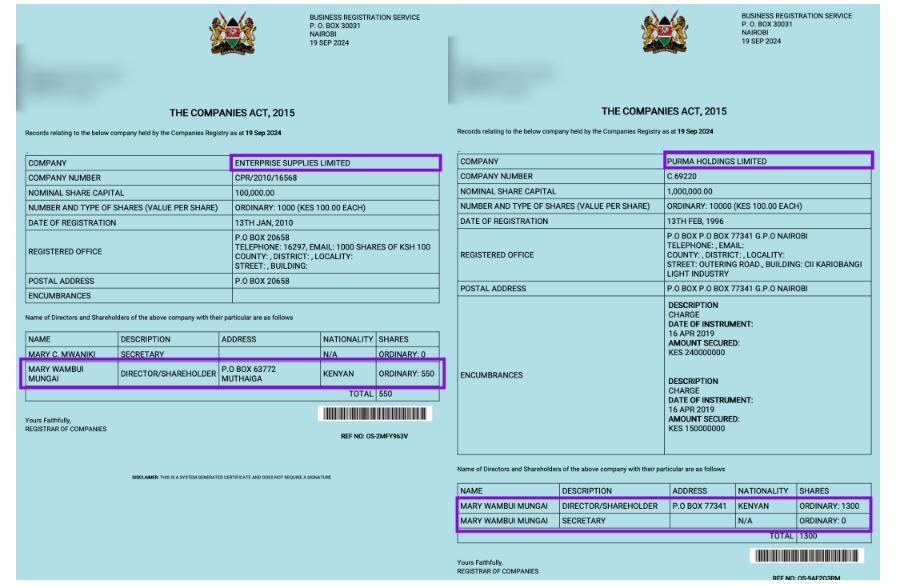

The first company, Purma Holdings Limited, registered in 1996 has Wambui as its sole shareholder. Purma Holdings Limited was contracted to deliver 625,000 jerrycans (20L) of cooking oil at Sh2.3 billion ($17.7 million), but an investigation by the Office of the Director of Public Prosecutions (ODPP) found that managers at KNTC flouted procurement laws during the awarding of the said tenders to various companies, including Purma Holdings. The second company, Enterprise Supplies Limited, was also on the list of those awarded a contract by KNTC, contracted to deliver 312,500 jerrycans of cooking oil. Similarly, Wambui is the sole shareholder of Enterprise Supplies Limited.

Mary Wambui Mungai is the sole shareholder at two companies unprocedurally awarded lucrative contracts by KNTC to import cooking oil, rice, and beans. The deals are under investigation by the EACC and DCI. Source: Business Registration Service. (Photo: Africa Uncensored/eCitizen)

Mary Wambui Mungai is the sole shareholder at two companies unprocedurally awarded lucrative contracts by KNTC to import cooking oil, rice, and beans. The deals are under investigation by the EACC and DCI. Source: Business Registration Service. (Photo: Africa Uncensored/eCitizen)

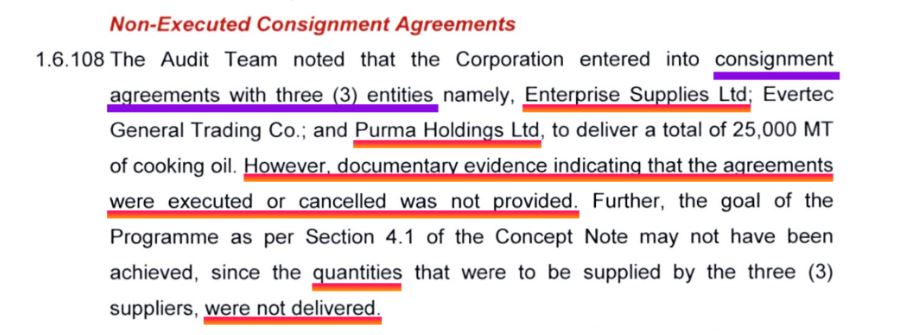

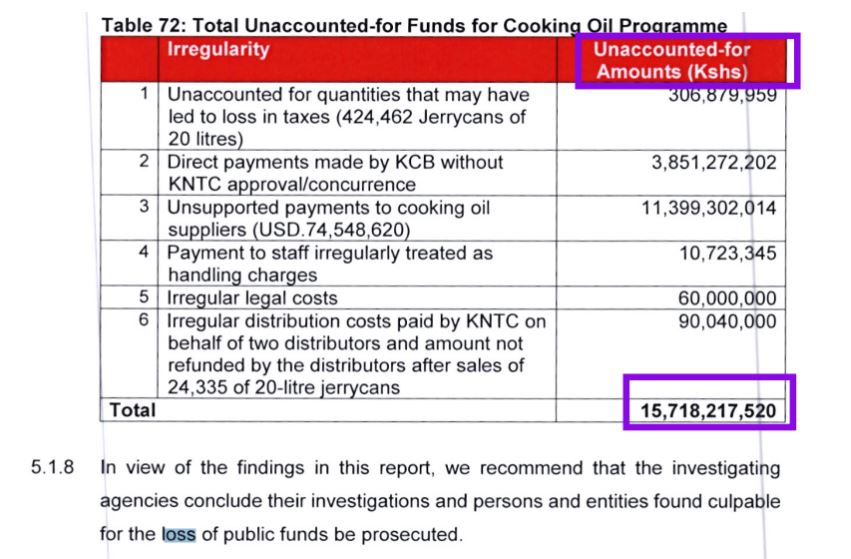

Similar findings were unearthed by the Auditor General in a special audit report published in August 2024, including tonnes of unexecuted consignments by Purma Limited, Enterprise Supplies Limited, and Evertec General Trading Company, one of the firms contracted. According to the auditor general’s estimates, over Sh15.72 billion ($121.85 million) was unaccounted for in the cooking oil programme.

A special audit report found that Purma Holdings Limited and Enterprise Supplies Limited, both owned by Wambui, did not deliver the quantities of cooking oil as contracted. Source: Auditor General’s Special Audit Report on Edibles Oils at Kenya National Trading Corporation Ltd. (Photo: Africa Uncensored)

A special audit report found that Purma Holdings Limited and Enterprise Supplies Limited, both owned by Wambui, did not deliver the quantities of cooking oil as contracted. Source: Auditor General’s Special Audit Report on Edibles Oils at Kenya National Trading Corporation Ltd. (Photo: Africa Uncensored)

Sh15.72 billion ($121.85 million) spent on the cooking oil programme was unaccounted for as of August 2024 according to the auditor general. Source: Auditor General’s Special Audit Report on Edible Oils at Kenya National Trading Corporation Ltd. (Photo: Africa Uncensored)

Sh15.72 billion ($121.85 million) spent on the cooking oil programme was unaccounted for as of August 2024 according to the auditor general. Source: Auditor General’s Special Audit Report on Edible Oils at Kenya National Trading Corporation Ltd. (Photo: Africa Uncensored)

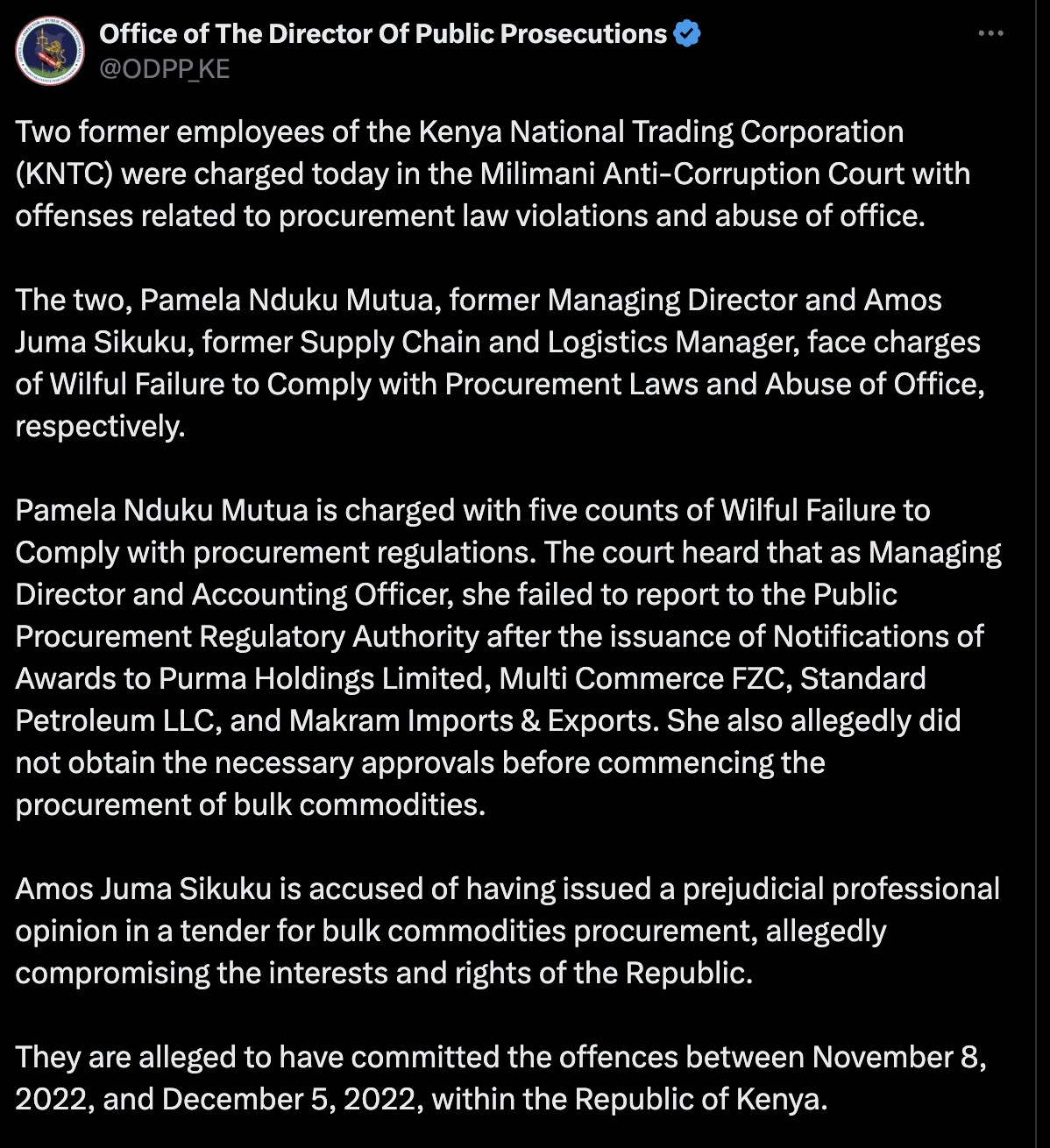

Two managers at KNTC were charged on June 20, 2024, for failing to comply with procurement laws concerning that tender, named by the Office of the Director of Public Prosecution as Pamela Nduku Mutua, former Managing Director, and Amos Juma Sikuku, former Supply Chain and Logistics Manager. The two would face charges of wilful failure to comply with procurement laws and abuse of office.

The two were charged on July 30, 2024. (Photo: ODDP/Screengrab)

The two were charged on July 30, 2024. (Photo: ODDP/Screengrab)

This is not Wambui’s first brush with the law. In 2021, an arrest warrant was issued for Wambui and her daughter, Purity Njoki Mungai, over Sh2.2 billion in unpaid taxes through Purma Holding Limited—the same company implicated in the cooking oil scheme. The case was withdrawn by the Director of Public Prosecutions in January 2023 after ‘negotiations were concluded’, just six months before Purma Holdings reappeared in the KNTC corruption case.

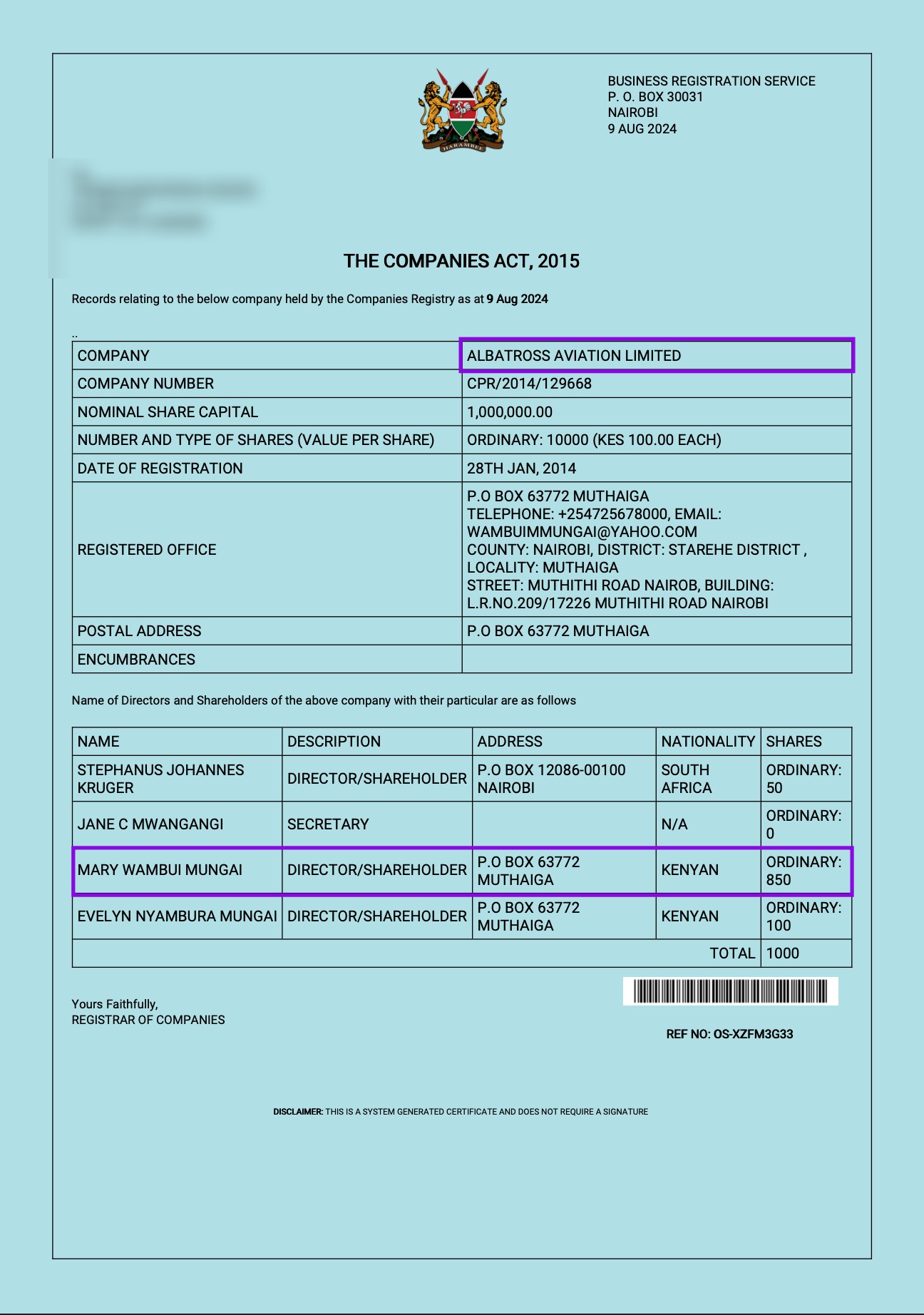

According to additional OCCRP Aleph records, Albatross Aviation Ltd, an additional company in which Wambui has majority shares, was awarded a Sh1.48 million tender in November 2022 for chopper services for the then Trade Cabinet Secretary Moses Kuria. Kuria was still cabinet secretary for investment, trade and industry when Wambui’s companies were awarded contracts for supplying tonnes of rice, cooking oil and beans to KNTC in 2022.

CR12 records for Albatross Aviation Limited from the Business Registration Service prove Mary Wambui Mungai and her daughter Evelyn Wambui own majority shares of the company. Source: Business Registration Service. (Photo: Africa Uncensored/eCitizen)

CR12 records for Albatross Aviation Limited from the Business Registration Service prove Mary Wambui Mungai and her daughter Evelyn Wambui own majority shares of the company. Source: Business Registration Service. (Photo: Africa Uncensored/eCitizen)

Mary Wambui pictured next to the then Deputy President William Ruto before the 2022 general election and after the election in 2023. (Photo: Mary Mungai/Facebook)

Mary Wambui pictured next to the then Deputy President William Ruto before the 2022 general election and after the election in 2023. (Photo: Mary Mungai/Facebook)

Wambui did not respond to our request for a response by the time of publishing this article.

Rashmi Chamanlal Kamani & Deepakkumar Chamanlal Kamani

Wambui is not the only Kenyan with questionable wealth tied to Dubai. The Kamani family, central figures in the Anglo-leasing scandal, have also had luxury property purchases in the UAE. Using their Kenyan passports, Rashmi and Deepak Kamani purchased seven properties between them in Dubai between 2007 and 2011. The properties range from office units to villas and apartments for millions of dollars in Dubai’s prestigious prime real estate market. The property owned by the two brothers is located in Dubai’s upmarket area of Palm Jumeirah.

Rashmi Kamani is listed as the beneficial owner to properties totalling at least Sh2 billion ($15.57 million) in Dubai’s most exclusive locations – two office units at Tiffany Towers and Saba Towers, just 3.5 miles southeast of the Palm Jumeirah archipelago and one apartment at the Marina Residences 1 tower in the Palm Jumeirah area bought at over Sh202.5 million ($1.57 million).

Images of a 3-bedroom apartment in Marina Residences, similar to one which Rashmi Kamani’s wife, Chitra Rashmi Kamani, is listed as a beneficial owner of. (Photo: bayut.com)

Images of a 3-bedroom apartment in Marina Residences, similar to one which Rashmi Kamani’s wife, Chitra Rashmi Kamani, is listed as a beneficial owner of. (Photo: bayut.com)

Another property is one prestigious villa, bought at Sh1.6 billion ($12.55 million), also within Palm Jumeirah Island purchased in 2008. Some of the properties mentioned above list Chitra Rashmi Kamani, Rashmi Kamani’s wife as the beneficial owner.

Former Anglo Leasing accusee Rashmi Kamani owns a luxury villa in Dubai’s affluent Palm Jumeirah island bought at over Sh1.6 billion ($12.55 million) in 2008. (Photo: Google Earth)

Former Anglo Leasing accusee Rashmi Kamani owns a luxury villa in Dubai’s affluent Palm Jumeirah island bought at over Sh1.6 billion ($12.55 million) in 2008. (Photo: Google Earth)

Similarly, Deepak Kamani is listed as the beneficial owner of two office units also located in Tiffany Towers purchased at a sum of Sh76 million ($589,400) on the same day on April 4, 2011.

Deepakkumar Chamanlal Kamani purchased two office units in Tiffany Tower at Sh76 million. (Photo: Source: Google Maps and bayut.com)

Deepakkumar Chamanlal Kamani purchased two office units in Tiffany Tower at Sh76 million. (Photo: Source: Google Maps and bayut.com)

The Kamanis first attained notoriety in 2015, after Deepak Kamani and his brother Rashmikant (Rashmi) Kamani faced charges of conspiracy to defraud the government of Kenya due to their involvement in the multibillion-shilling Anglo Leasing scandal, an enduring corruption scandal that involved top government officials and dubious security deals struck with non-existent companies between 1997 and 2004. A report by the then auditor general, Evans Mwai, listed 18 projects – for the supply of oceanographic vessels, passport printing equipment and other sensitive state contracts – later established to be irregularly tendered or overpriced and linked to offshore companies based in the UK, the British Virgin Islands and Switzerland.

At the centre of the embezzlement scheme was Anglo Leasing and Finance Ltd, a UK shell company linked to the Kamani family. An OCCRP and Africa Uncensored investigation in 2022 revealed details of Deepak and Rashmi Kamani’s Credit Suisse account that saw millions of dollars might have been channelled through it.

https://www.youtube.com/watch?v=8kFdQ-P0qDU

The Kamanis have business interests in horticulture through Primarosa Flowers based in Nairobi, and hospitality under the Zuri Group, which owns the Diani Reef Beach Resort & Spa and resorts in India.

When contacted for comment by OCCRP and Africa Uncensored, the Kamanis stated that they were no longer under investigation, adding that they had been acquitted in the two cases against them in Kenya.

When contacted for comment on the ownership of the properties, and if there was any connection to the Anglo Leasing scandal, both Rashmi and Deepak issued identical statements: “I have been fully exonerated in the ‘Anglo Leasing Affair”, the Kamanis said, adding that all their investments are from bonafide sources of income.

Kamlesh Mansukhlal Damji Pattni

Kamlesh Pattni’s questionable dealings came to light in the early 1990s in what is perhaps Kenya’s largest corruption scandal– the Goldenberg Affair. At the heart of it was Goldenberg International Limited (GIL), a company in which Pattni was director and shareholder alongside the then police intelligence chief James Kanyotu. A judicial commission of inquiry into the scheme revealed a fraudulent export compensation plot that cost Kenya billions of shillings. The probe into the scheme found a paper trail implicating a number of senior government officials. Although Pattni was acquitted of all Goldenberg-related criminal charges in Kenya, after negotiations in which he surrendered some of his property to the state, he was later implicated in a 2023 Al Jazeera investigative documentary, Gold Mafia, as part of a large-scale gold smuggling and money laundering racket operating out of Zimbabwe and Dubai.

https://www.youtube.com/watch?v=evWEuVR1XIs

Fresh data from the Dubai property ownership leak reveals that Kamlesh Pattni owns three flats in Dubai’s gated Discovery Gardens just 8 kilometres (5 miles) south of the Palm Jumeirah area. The flats include two studio apartments and a 1-bedroom apartment. All the property was purchased at a sum of Sh56.5 million ($438,345) on diverse dates between 2017 and 2018. Pattni did not respond to our efforts to reach him for comment.

In the Al Jazeera documentary, Pattni admits to his role in the Goldenberg scandal, and he also admits to running his money laundering scheme in Dubai. “Dubai is the centre for Africa,” Pattni says, “You don’t need to have the paperwork too much, it’s much easier.” In response to the allegations put forward by AlJazeera, Pattni denied any involvement in money laundering.

Simon Mbugua Ng’ang’a

A month after his appointment to the Non-Governmental Organisations (NGO) Coordination Board in October 2015, Simon Mbugua Ng’ang’a acquired a parcel of land in Dubai’s DAMAC Hills 2 area. Mbugua served as a Member of Parliament (MP) for Kamukunji between 2008 and 2013 earning up to Sh9.98 million ($126,000 according to the average $/Ksh exchange rate in 2010) in salaries and allowances annually. Mbugua’s 0.043-acre property transaction worth Sh88 million was initiated on November 16, 2015.

At the time of purchase, the land was set to be developed into a residential area bought as an off-plan property. Due to the existence of only the purchase transaction in the leak, we cannot ascertain whether Mbugua sold the property or not. Mbugua did not respond to our efforts to reach him for comment.

Real estate, the laundromat of choice

Kenya has a troubling history with offshore money laundering, with public funds being lost through corruption and finding their way out of the country. The Anglo Leasing Scandal saw billions siphoned out of Kenya through shell companies and dodgy contracts in secrecy jurisdictions like Switzerland, as well as procurement fraud whose perpetrators are only now coming to light.

Dubai’s property market offers real estate in two categories – off-plan and ready. The former means that the property was bought before or while under development. Foreigners are permitted to own off-plan property, a trend that was observed in many transactions involving Kenyans. “According to the 2022 leak and our estimates, foreigners owned a minimum of 218.000 residential real estate properties in Dubai, including off-plan properties under development. All together they were worth more than USD 100 billion that same year,” says postdoctoral fellow Andreas Økland of the School of Economics and Business, Norwegian University of Life Sciences (NMBU).

What the leak reveals is troubling for Kenya, Africa and the world at large. Dirty money can find its way out of the underworld and into legitimate circulation, effectively bypassing any money laundering policies deployed, and potentially threatening the foundational tenets of democracy. Another disturbing trend was the owning of property by offshore companies registered in secrecy jurisdictions. This not only hides the nationality of the actual beneficial owners but also their identity. Økland, who researched the Dubai leak, says that a considerable chunk of real estate worth about $99 billion belongs to owners whose identity and country remain uncertain.

Kenya’s unregulated real estate sector makes it ripe for money laundering. FATF added the East African country to its infamous grey list, indicating that the country would face increased monitoring and scrutiny for suspicious economic activity, and indicating that there is a need to tighten fiscal regulations and enhance transparency. A 2022 Eastern and Southern Africa Anti-Money Laundering Group (ESAAM) mutual evaluation report of Kenya found that the sector was highly vulnerable to money laundering risks. “The sector is considered high risk mainly due to high participation of unregistered players that are not regulated and the use of cash,” the report reads, “The acceptance of cash in purchase/sale transactions takes away the opportunity of having a paper trail of the transactions.”

Read the original article by Africa Uncensored's Timothy Mukhwana:

[embed]https://africauncensored.online/dubai-unlocked-the-politically-exposed-kenyans-investing-in-dubais-luxe-landscape/[/embed]

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!