MPs push for revision of pay deductions rule as workers’ take-home diminishes

By Maureen Kinyanjui |

The meeting highlighted the growing pressure on public servants due to the mismatch between salary deductions and the legal framework.

Lawmakers are raising concerns over a growing trend where public servants are receiving salaries that violate the constitutional one-third rule, a situation exacerbated by recent tax changes.

As a result, The Public Accounts Committee of the National Assembly has called for urgent discussions with National Treasury Cabinet Secretary John Mbadi to address these challenges, which have left many civil servants earning less than the legally required amount.

Keep reading

- Civil servants' medical scheme extended to November 21 after strike threat

- Teachers demand up to 900% increase in allowances for KCSE exam duties

- Details of the new salary structure, housing allowance changes for civil servants

- State commits to fully implement civil servants' pay agreement as strike looms

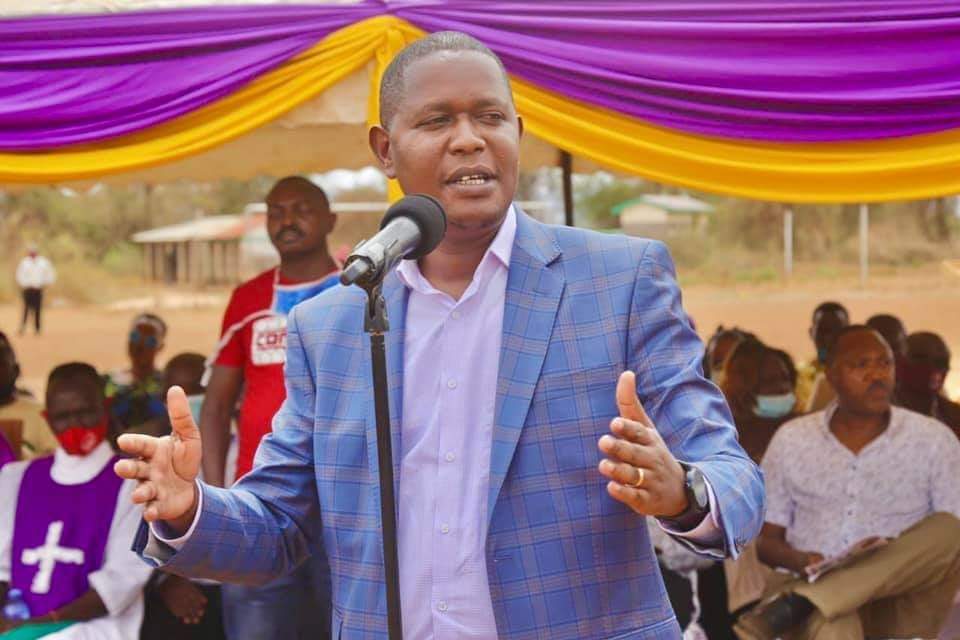

On Tuesday, the committee, led by Butere MP Tindi Mwale, pointed to recent tax measures introduced over the past two years as a key factor in this issue.

These tax changes, which include new mandatory contributions, have had a significant impact on the salaries of public employees.

Over the last two years, workers have seen deductions of 1.5 per cent of their gross salary for tax purposes, along with an additional 2.75 per cent deducted for the Social Health Insurance Fund.

These new deductions, while intended for social welfare programmes, have pushed many civil servants below the one-third threshold of their basic salary, which is required by the Employment Act of 2007.

According to the law, no employer should deduct more than two-thirds of an employee's basic pay.

However, the additional taxes and contributions are forcing workers to take home less than they should, in breach of the legal framework that ensures employees receive a minimum of one-third of their basic salary.

As concerns grow, MPs on the committee are calling for urgent engagement with the Treasury to find a solution.

"It is time we engage with the National Treasury to find out why public servants are not complying with the law," said Lugari MP Nabii Nabwera.

He was supported by Rarieda MP Otiende Amollo, who emphasised the need to review existing policies to align them with the new tax realities.

"We need to engage so that we can recommend changes to the policy," said Amollo, pointing out the importance of revisiting the rules in light of the recent financial and tax adjustments.

The issue came to light following an audit report by the Office of the Auditor General, which flagged several state departments for failing to adhere to the salary regulations.

In the 2022-23 report, Auditor General Nancy Gathungu identified a case where 131 employees in the state department were taking home less than one-third of their basic pay, despite the constitutional requirement.

The MPs raised these concerns during a meeting with Roads Principal Secretary Joseph Mbugua, where they discussed the findings of the Auditor General's report.

The meeting highlighted the growing pressure on public servants due to the mismatch between salary deductions and the legal framework.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!