State’s uniform revenue plan for counties faces strong opposition

By Maureen Kinyanjui |

Currently, most counties contract private firms to handle revenue collection, some of which charge high commissions.

The government's plan to implement a standardised revenue collection system across all 47 counties hangs in the balance as it faces stiff opposition.

Treasury Cabinet Secretary John Mbadi has revealed that discussions are ongoing with county governments to adopt a uniform revenue collection system, but no agreement has been reached yet.

Keep reading

- Controller of Budget report shows counties failed to meet set revenue targets

- Kenya Revenue Authority surpasses Sh1 trillion in revenue collection in five months

- Billions of taxpayer money lost in mismanaged loan-funded projects - Auditor General

- Tana River, Garissa among top performers in own source revenue collections - CoB

This push for standardisation follows growing concerns over potential revenue losses within counties due to inefficient and opaque systems.

Many counties are believed to be losing billions of shillings, prompting the need for more transparency and efficiency.

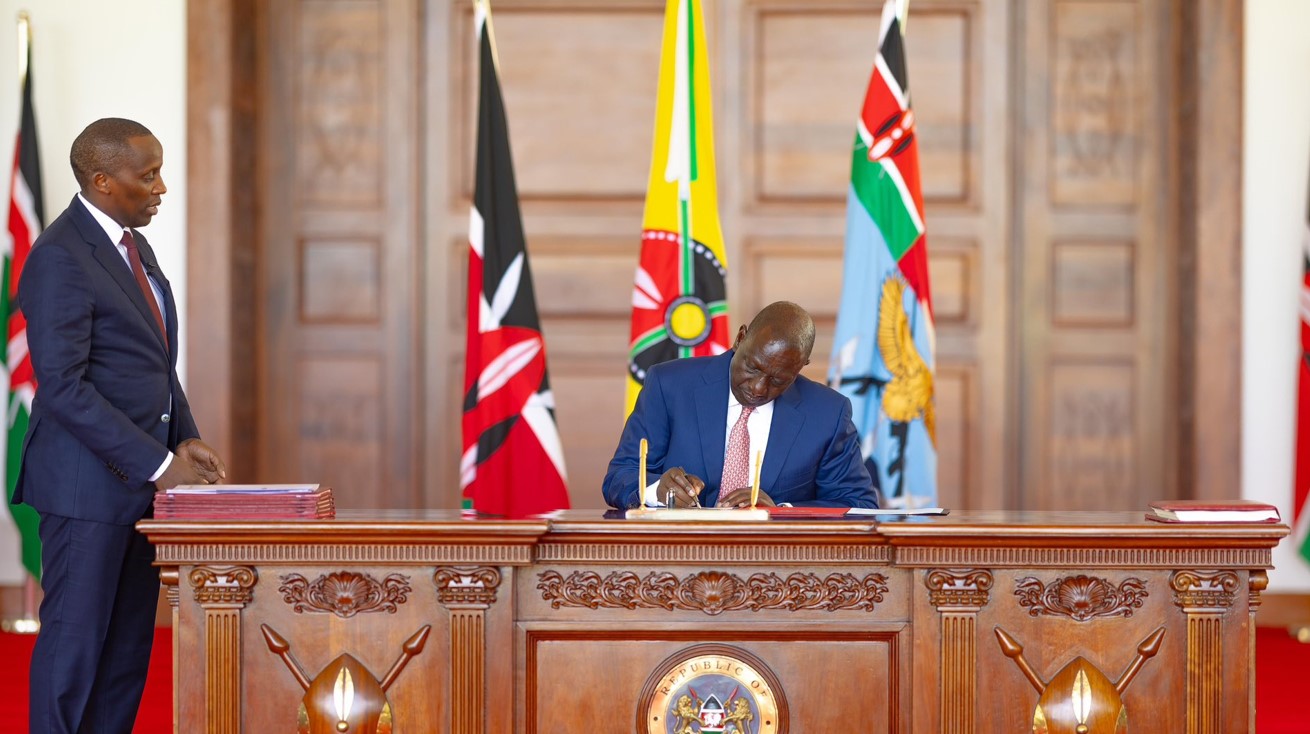

Speaking at a recent meeting of the Intergovernmental Budget and Economic Council (IBEC), chaired by Deputy President Rigathi Gachagua, Mbadi emphasised that standardisation would enhance counties' own-source revenue.

However, progress has been stalled as the Council of Governors has yet to reach a consensus on the issue.

"That process is ongoing. Unfortunately, consensus has not been reached with the Council of Governors. I appeared at the last economic council meeting, and the matter is still under discussion. I hope that we are going to find a way forward soon," Mbadi explained.

"We are a country with devolved units of government, but we need to have a standardised system of revenue collection so that if you come from Isiolo or get to Homa Bay, it is almost predictable what to pay, how much to pay, and even how to pay it," he added, stressing the importance of creating a predictable and uniform system.

Currently, most counties contract private firms to handle revenue collection, some of which charge high commissions.

These differences in fees have caused disparities across counties. Auditor-General Nancy Gathungu, in a recent Senate committee meeting, voiced concerns about the inconsistency of these rates.

"The rates should be standardised so that the commission charged by the firms does not vary from one county to another. The lack of standard rates is why counties are losing a lot of revenue," Gathungu told the Senate Committee on County Public Investment and Special Funds last month.

Following these concerns, senators have urged Gathungu to audit the external firms contracted by counties to handle revenue collection.

Lawmakers raised concerns over the accuracy of the figures reported by these firms, suggesting that they could be withholding billions of shillings from counties.

There are also claims that some governors and senior county officials have engaged in fraudulent activities by manipulating these contracts to steal public funds.

A report published by the Commission on Revenue Allocation (CRA) in June 2022 highlighted that counties are failing to tap into their full revenue potential.

The report titled ‘Comprehensive Own Source Revenue Potential and Tax Gap Study of County Governments’, found that counties could generate as much as Sh216 billion from key revenue streams — nearly seven times more than what they currently collect.

Despite the potential, counties have consistently fallen short of their own-source revenue targets. Over the last three financial years (2017-2020), counties collectively generated about Sh38 billion per year, far below their projected targets.

In the financial year ending June 30, 2021, for instance, counties collected Sh31 billion against a target of Sh54.3 billion.

Nairobi County has averaged local revenue collections of Sh9.5 billion over the last three years, despite its estimated potential exceeding Sh25 billion.

Even with recent improvements, collecting Sh12.8 billion in the fiscal year ending June 2024, Nairobi still missed its Sh20.06 billion target by Sh7.26 billion.

The CRA report also pointed to the untapped revenue potential of other counties, highlighting that Kiambu, Nakuru, and Mombasa could generate Sh5.2 billion, Sh4.5 billion, and Sh4.4 billion per year, respectively.

As discussions on standardising the revenue collection system continue, county governments and national officials face the challenge of bridging the gap between potential and actual revenue collection while ensuring transparency and efficiency.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!