African governments trapped in debts over climate change - Ruto

By John Mbati |

Ruto highlighted that the frequency of extreme weather events continuously diminishes the resources available for public investment and the provision of critical public goods such as healthcare, education, and other social services.

President William Ruto says that African governments are increasingly sourcing funds to curb climate change effects, including seeking loans, which worsen their debt situation.

Speaking at the African Development Bank Group (AfDB) 2024 Annual Meetings at the Kenyatta International Convention Centre (KICC) in Nairobi on Wednesday, Ruto advocated for a better, more responsive, and fairer international development financial architecture to save developing countries from spiralling debts.

Keep reading

“Climate change and sovereign debt are interconnected, trapping governments in a vicious cycle where increasing losses and damage from climate impacts lead to rising costs of mobilising resources for public investments,” Ruto lamented.

According to Ruto, climate change is a threat multiplier, with its direct impacts and related responses negatively affecting the fiscal position of African governments through reduced revenues and increased public spending.

He highlighted that the frequency of extreme weather events continuously diminishes the resources available for public investment and the provision of critical public goods such as healthcare, education, and other social services.

Ruto reiterated his advocacy for financial restructuring by showcasing how African countries have continuously highlighted their plight at various global conferences. He cited the COP28 conference held in Dubai in December last year, where African leaders emphasised the need to accelerate the mobilisation of finance and technology.

They also warned that it would be impossible to meet the goals of the Paris Agreement if sufficient finance could not be delivered and recognised the urgency to move from billions to trillions to address the climate finance gaps.

At the conference, representative countries laid out the contours of a new financial architecture to make financing available, accessible, and affordable.

During the African Climate Summit held in Nairobi in September last year, African leaders also advocated changes in the issuance of loans by global financial institutions such as the World Bank and the International Monetary Fund (IMF).

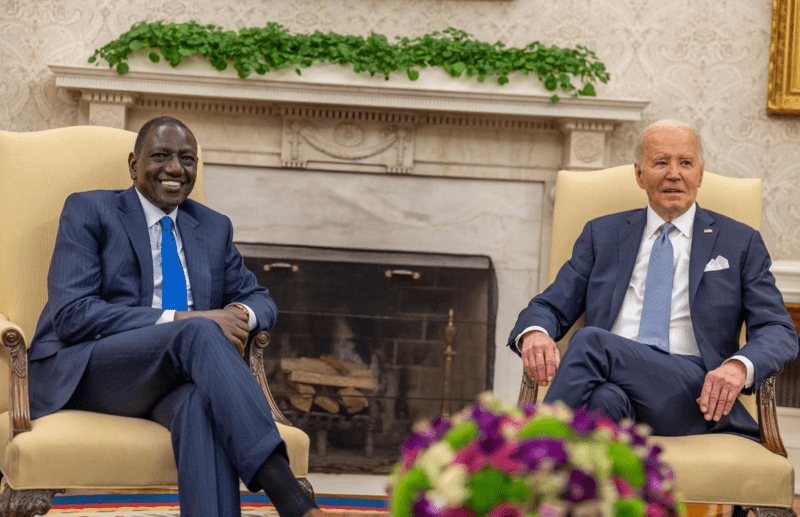

President William Ruto addresses presidents and heads of state at the Kenyatta International Convention Centre, Nairobi, during the African Development Bank Group and Africa Development Fund Annual Meetings on Wednesday, May 29, 2024. (Photo: PCS)

President William Ruto addresses presidents and heads of state at the Kenyatta International Convention Centre, Nairobi, during the African Development Bank Group and Africa Development Fund Annual Meetings on Wednesday, May 29, 2024. (Photo: PCS)

“We have been clear and consistent in our advocacy. Africa is neither seeking handouts nor asking for charity. We are a continent of sovereign people who aspire to grow in a just multilateral system and access development financing on fair terms. We were clear at the African Climate Summit last year when we called for reforms of international financial institutions and a range of new global taxes to fund climate action,” Ruto reiterated.

“We were clear at COP28 in Dubai last December when we once again emphasised the urgent need to mobilise investment for climate transition in developing countries from public and private sources globally. We also agreed to support the creation of markets that can mobilise resources at scale and called for the reform of the international financial architecture,” he added.

During the International Development Association (IDA) for African Heads of State held in Nairobi last month, Ruto also led African heads of state and presidents in appealing for a substantial 17th replenishment of the African Development Fund by at least approximately Sh3.3 trillion (USD 25 billion) to increase its capacity to continue providing concessional financing to the least developed African countries.

The 16th replenishment by donors raised a historic amount of approximately 1.2 trillion ($8.9 billion) in December 2022 and is set to conclude in 2025.

“Climate change has often resulted in substantial reallocation of resources towards mitigation, adaptation, and resilience. This is why Africa advocates a financial architecture that integrates the issues of climate change and public finance,” President Ruto stated, adding that he was proud of African Heads of State who joined the clarion call.

More challenges for African countries

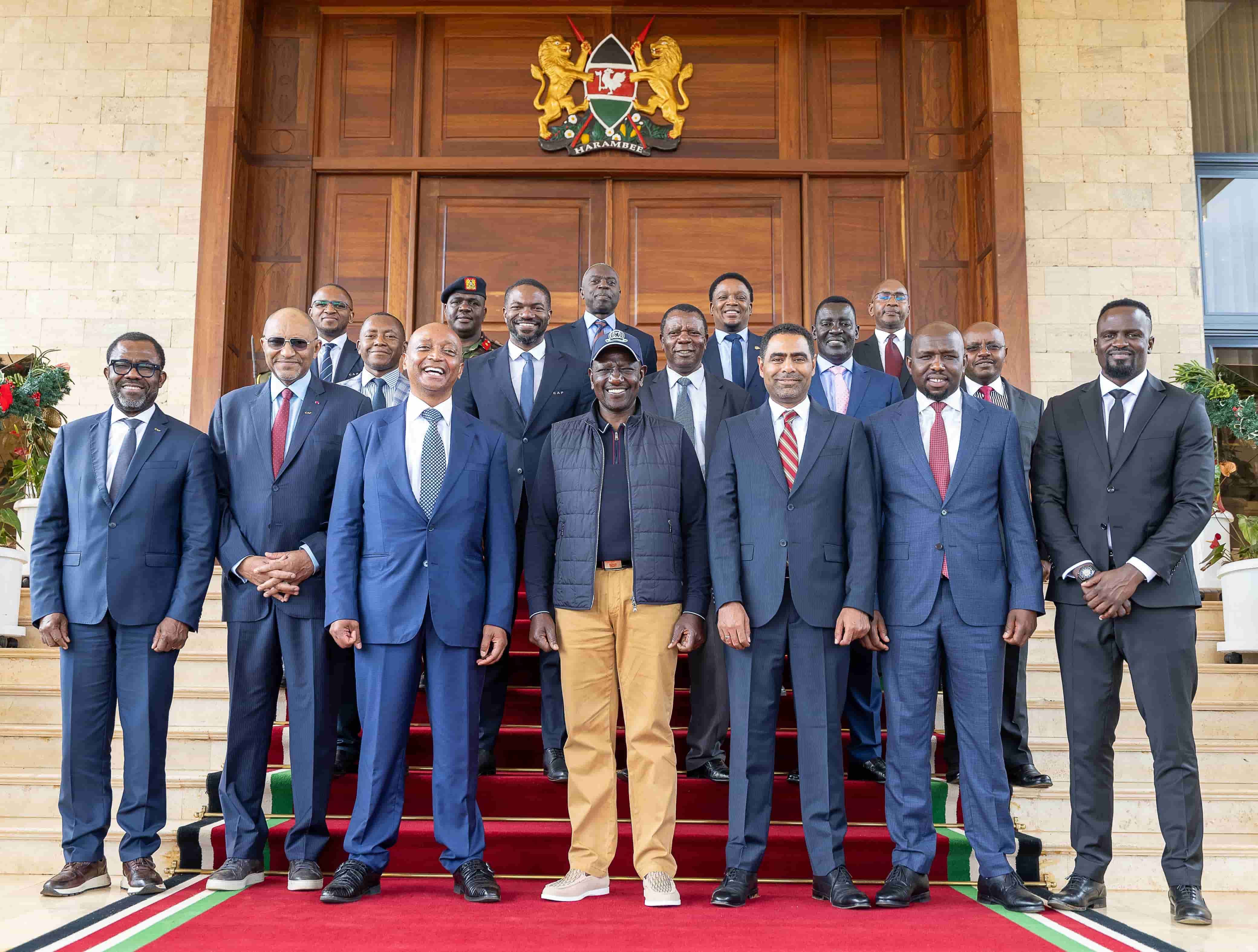

African heads of state including President William Ruto (Kenya), Paul Kagame (Rwanda), Emerson Mnangagwa (Zimbabwe), Mohamed al-Menfi (Libya), and Hassan Sheikh Mohamud (Somalia), pose for a photo at the Kenyatta International Convention Centre, Nairobi, during the African Development Bank Group and Africa Development Fund Annual Meetings on Wednesday, May 29, 2024. (Photo: PCS)

African heads of state including President William Ruto (Kenya), Paul Kagame (Rwanda), Emerson Mnangagwa (Zimbabwe), Mohamed al-Menfi (Libya), and Hassan Sheikh Mohamud (Somalia), pose for a photo at the Kenyatta International Convention Centre, Nairobi, during the African Development Bank Group and Africa Development Fund Annual Meetings on Wednesday, May 29, 2024. (Photo: PCS)

Other than climate action, he cautioned that African countries are also struggling to achieve sustainable development goals. Any financial architecture, he insisted, should integrate the continent’s most challenging development issues of debt sustainability and climate vulnerabilities to achieve the SDGs and Agenda 2063 commitments.

African countries are also straining to invest in low-carbon and climate-resilient development owing to higher financing costs and constrained government budgets.

Frequent climate shocks like the recent heavy rains, floods, and the 40-year historic drought in the Horn of Africa have also increased the number of climate refugees.

“Africa remains most vulnerable to the effects of climate change, as evidenced by recent devastating floods in Kenya, and droughts in Southern Africa, from which we are still working to recover, as well as other climate-related disasters across the continent. The adverse impact of climate change on the fiscal sustainability of many economies, especially in developing countries in Africa, deserves our serious attention. Despite contributing only 4 per cent of global carbon emissions, we bear the brunt of climate change effects.

“We therefore call on our donors and development partners to scale up their investments in our continent’s premier development financial institution,” he further pleaded while addressing delegates at the AfDB 2024 Annual Meetings.

However, he stated that he was encouraged by the AfDB’s vision for the continent, underpinned by the “High 5s” strategies, and the objectives of the newly adopted 2024–2033 10-Year Strategy, which provide important foundations for critical continental objectives.

He advocated for strengthening the capacity of Africa’s multilateral development institutions, through re-channelling Special Drawing Rights (SDRs) through the African Development Bank, as endorsed by the African Union’s Assembly of the Heads of State and Government.

This will increase the capacity of AfDB to lend to African governments, which in turn fast-tracks high-priority and transformational development projects hampered by a lack of funds.

“Given the glaring shortcomings of the current climate financing ecosystem, we need to fundamentally reconfigure prevailing financing patterns and adopt more innovative financing structures that eliminate access barriers. I commend the African Development Bank Group for developing innovative financial instruments tailored to our continent’s unique needs.

“These instruments have facilitated more ambitious financing of significant development projects, including heavy investment in smart agriculture and clean energy generation. However, more financial resources need to be channelled towards climate adaptation in Africa,” he advised.

Questions over carbon credit

Environment technicians gather biodata from vegetation being quantified for carbon sequestration at Kasigau Wildlife Corridor in Taita-Taveta County on August 9, 2023. (Photo: Tony Karumba, AFP)

Environment technicians gather biodata from vegetation being quantified for carbon sequestration at Kasigau Wildlife Corridor in Taita-Taveta County on August 9, 2023. (Photo: Tony Karumba, AFP)

Nonetheless, despite raising concerns about climate action and sovereign debts, Ruto did not address questions on funds set to be raised through selling carbon credits.

In September last year, Ruto said Africa's carbon sinks were an "unparalleled economic goldmine" with the potential to absorb millions of tonnes of carbon dioxide annually, translating into billions of dollars.

Reports allege that Kenya issued more carbon credits than any other African country and approximately 20 per cent of total African credits, according to the Kenya Private Sector Alliance. One credit represents one tonne of carbon dioxide removed or reduced from the atmosphere.

Global companies purchase credits generated through tree planting exercises, renewable energy, or protecting forests, but the markets are largely unregulated.

During the COP27 held in Sharm El Sheikh, Egypt, in November 2022, the UN-endorsed African Carbon Market Initiative projected to generate 300 million credits annually by 2030, 19 times more than the current volumes.

African countries have since pushed for a bigger market share, with Kenya leading the line. Ali Mohamed, Kenya’s Climate Change Envoy and President William Ruto's executive climate advisor, confirmed the same and told the AFP that Kenya was drafting legislation to foster transparency amid the highly generated interest.

“There is massive interest. We have 25 per cent of the African market (for carbon credits) in Kenya, and it's our ambition to expand this," Ali Mohamed stated last year.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!