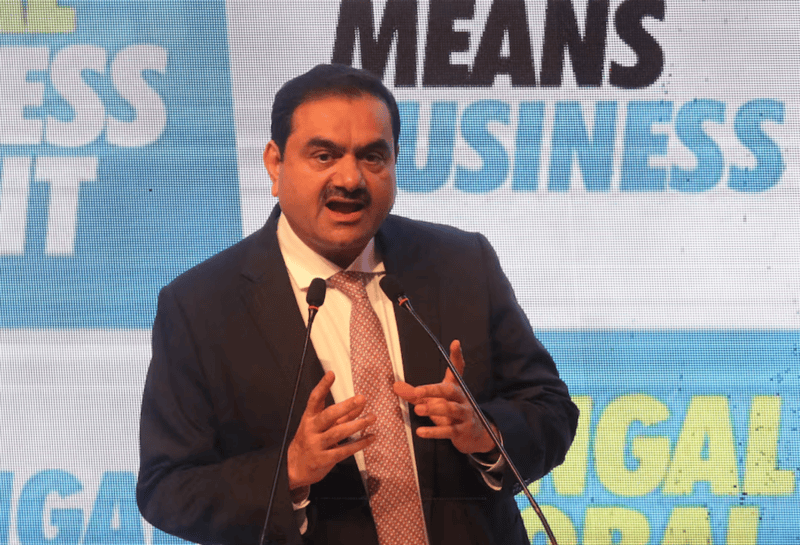

Adani Group's value drops by Sh3.6 trillion after billionaire's US indictment

By Reuters |

Gautam Adani's flagship company Adani Enterprises tumbled 23 per cent, while other comapnies fell between 20 per cent and 90 per cent.

Shares of Adani Group companies lost about $28 billion (Sh3.6 trillion) in market value in morning trade on Thursday after US prosecutors charged the billionaire chairman of the Indian conglomerate in an alleged bribery and fraud scheme.

Gautam Adani's flagship company Adani Enterprises tumbled 23 per cent, while Adani Ports, Adani Total Gas, Adani Green, Adani Power, Adani Wilmar and Adani Energy Solutions, ACC, Ambuja Cements and NDTV fell between 20 per cent and 90 per cent.

Keep reading

- What next? Lawmakers question legal, financial implications of terminating Adani deals

- JKIA-Adani deal cancellation not enough, scrap SHIF contract too - Kenyans tell Ruto

- Mbadi: Adani deals still in early stages, can be cancelled anytime

- Ruto cancels JKIA, KETRACO deals with Adani Group after bribery scandal

Adani group's 10 listed stocks had a total market capitalisation of about $141 billion (Sh18.3 trillion) at 0534 GMT, compared to $169.08 billion (Sh21.9 trillion) on Tuesday.

US authorities said Adani and seven other defendants, including his nephew Sagar Adani, agreed to pay about $265 million (Sh34 billion) in bribes to Indian government officials to obtain contracts expected to yield $2 billion (Sh259 billion) of profit over 20 years and develop India's largest solar power plant project.

Adani Green in a statement on Thursday said the US Justice Department had issued a criminal indictment against board members Gautam Adani and Sagar Adani and the Securities and Exchange Commission had issued a civil complaint against them.

The US Justice Department also included Adani Green board member Vneet Jaain in the criminal indictment, it said.

Adani Green's units had decided not to proceed with the proposed US-dollar-denominated bond offerings due to developments, it added.

"Investors will shy away from Adani Group stocks ... and that's what this sharp selling is signifying," said Saurabh Jain, assistant vice president of retail equities research at SMC Global Securities.

"This could hurt the credibility of the group and maybe borrowing costs will rise," he said.

The indictment comes nearly two years after US short-seller Hindenburg Research alleged that Adani had improperly used tax havens and was involved in stock manipulation, allegations the conglomerate denied.

Also in early Asian trading on Thursday, Adani dollar bonds slumped, with prices down 3c-5c on bonds for Adani Ports and Special Economic Zone.

The falls were the largest since the Adani Group came under a short-seller attack in February 2023.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!