Kenyans lay bare frustrations as hospitals reject NHIF cards

By Charity Kilei |

He criticized the government's plan to replace the NHIF with the new Social Health Insurance Fund (SHIF), with Kenyans being urged to register with the latter.

As many hospitals reject National Health Insurance Fund (NHIF) cards due to debts and failed remissions from the government, many Kenyans who have relied on NHIF for years have expressed their frustrations after being turned away when seeking medical services.

Abdulla Mohammed, a 46-year-old from Eastleigh, has endured months of pain due to hospitals rejecting NHIF cards. Diagnosed with a chronic heart condition in 2021 while working in Mombasa, Abdulla initially managed to cover his treatment costs. However, the expensive medications soon depleted his resources. His deteriorating health forced him to stop working as a driver and return to Eastleigh.

Keep reading

“It’s very painful to depend on my mother for medication and basic needs at my age, despite having paid for NHIF for many years,” said Abdulla.

He recalls the anguish of being turned away from multiple hospitals last year because NHIF had not paid the hospitals. “I went to many hospitals, but they refused to treat me because they won't accept NHIF cards. I desperately needed medication, and without a job due to my health, my family was heavily burdened,” he said.

The cost of Abdulla’s medication is about Sh8,000 for a two-week supply, a sum his family struggles to raise. “People like me are stranded despite having paid for the scheme for years. People take insurance covers for rainy days, but the government doesn’t care about our rainy days. How do they expect us to pay for the new fund consistently after failing to provide the services we paid for under NHIF?” he posed.

He criticized the government's plan to replace the NHIF with the new Social Health Insurance Fund (SHIF), with Kenyans being urged to register with the latter.

Doughlus Amisi, 37, who has worked for various companies and contributed to NHIF and NSSF for the past 17 years, feels frustrated with the new reforms.

“My father, now 67, has never received his NSSF funds despite paying all his life. Now, we have been unable to access treatment under NHIF since last year, and now they have introduced a new one. How do I know that after paying for this new SHIF, it won’t be the same situation as NHIF?” said Amisi.

He says his family continues to suffer due to the inaccessibility of the funds. “I lost my job and thought I would be cushioned because I was paying for NHIF. But the situation worsened when I was told to pay cash in different hospitals,” he said.

After being rejected by many hospitals, Amisi stopped paying for NHIF. “I don’t see the need to pay for insurance that doesn’t help me or my family. I’d rather know I don’t have insurance than pay for it yet I don't get the services,” he said.

Already burdened, he prefers to use whatever money he gets for basic sustainability.

Mercy Waithera, a businesswoman who used to pay for the services, stopped paying after the rejections. “I used to pay for NHIF myself because I’m not employed. Now, I don’t have the energy to pay for another fund,” Waithera explained.

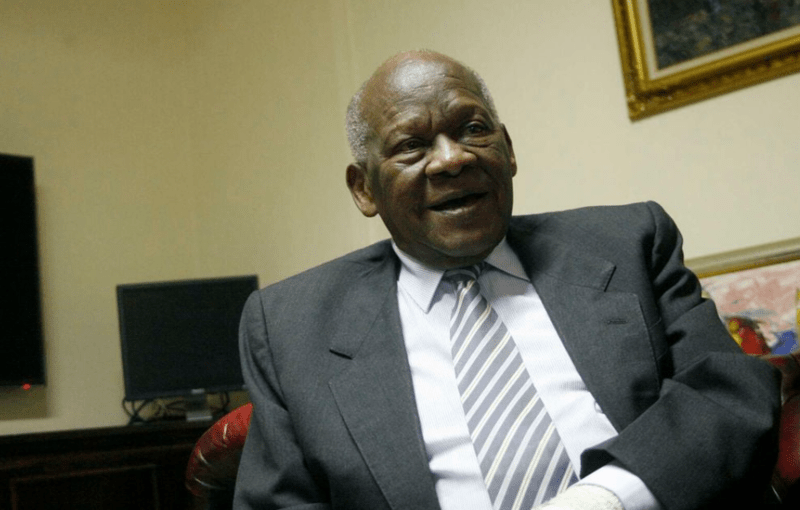

Abdulla Mohammed a patient suffering from a heart condition in Eastleigh. (Photo: Charity Kilei)

Abdulla Mohammed a patient suffering from a heart condition in Eastleigh. (Photo: Charity Kilei)

As of April, NHIF owed hospitals approximately Sh29 billion. A spot check by The Eastleigh Voice revealed that many hospitals now prefer upfront cash payments, turning away patients who depend on NHIF.

Appearing before Senators in April, Health CS Susan Nakhumicha stated that the debt owed to various health facilities will be paid once the National Treasury releases the funds.

"I want to assure facilities that there is no cause and they do not need to disrupt services. Once they have provided services, their claims have been verified and reconciled, and they are going to be paid," Nakhumicha said then.

New Fund

The Social Health Insurance Fund Act mandates that all Kenyans contribute to the new Social Health Insurance Fund to receive coverage. Employed individuals will contribute 2.75 per cent of their gross salary, with employers matching their contributions.

Similarly, Kenyans in the informal sector will also contribute 2.75 per cent of their income. For unemployed Kenyans over 25 years old, the contribution is set at Sh300.

Contributions to the Social Health Authority will be collected through payroll deductions for employed individuals, direct contributions from self-employed individuals, and government subsidies for indigent and vulnerable populations.

The fund aims to cover a comprehensive range of health services, including preventive, promotive, curative, rehabilitative, and palliative care at level 4, 5, and 6 health facilities.

According to the Ministry of Health, the benefits package under the new SHIF includes medical outpatient services, end-of-life services, surgical services, specialised pharmacy benefits, medical inpatient and critical care services, accident and emergency services, optical services, mental wellness services, specialised essential diagnostic services, renal care services, overseas treatment, dental healthcare services, rehabilitative services, screening for common diseases, assistive devices, maternity and child health services, oncology services, and medical imaging services.