Betting firms may be rigging outcomes to avoid paying taxes, MPs warn

KRA’s Chief Manager for Betting and Gaming, Joseph Otieno, acknowledged that the taxman suspects some betting firms could be engaging in practices that deny the government its rightful share of revenue.

Members of Parliament have accused betting and gaming companies of manipulating their systems to evade taxes, warning that the government could be losing billions of shillings in potential revenue.

The National Assembly’s Departmental Committee of Finance and National Planning has now demanded a thorough audit of the companies’ operations to determine whether they are complying with tax laws and remitting the correct amounts to the Kenya Revenue Authority (KRA).

More To Read

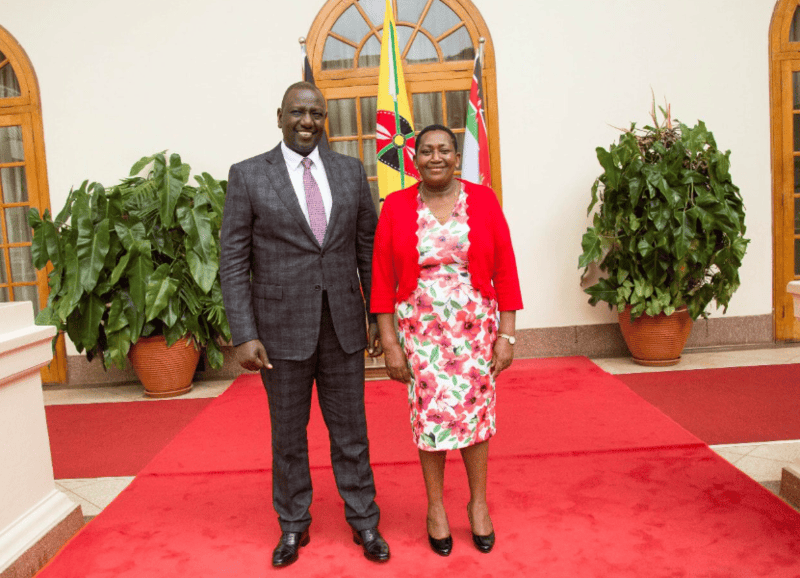

- Ruto signs laws to regulate gambling, shorten tenure of roads agency bosses

- MPs pass Gambling Bill, impose heavy fines and jail terms

- Betting crisis: Why Kenya cannot ban popular Aviator game

- Sh50 million capital, ID selfies among proposals as Kenya moves to rein in betting boom

- Content creators give BCLB 48-hour ultimatum to suspend gambling ad ban

- Betting firms to finance rehabilitation of addiction victims under proposed gambling law

Appearing before the committee, KRA’s Chief Manager for Betting and Gaming, Joseph Otieno, acknowledged that the taxman suspects some betting firms could be engaging in practices that deny the government its rightful share of revenue. However, he did not provide specific details.

Molo MP Kuria Kimani, who chairs the committee, pointed to inconsistencies in a KRA document, saying that while excise duty collections from betting companies had grown in recent financial years, withholding tax on winnings had continued to decline, a trend he believes may suggest manipulation of bet outcomes to avoid taxation.

“Based on the documents you have presented to this committee, I have observed an interesting scenario. While there is growth in excise duty on betting and gaming activities for the last two financial years, the withholding tax on wins continues to reduce,” Kimani said.

He further noted that the suspected foul play comes at a time when the government is struggling to raise adequate revenue to support its operations.

“It is important that we establish if the betting companies are carrying out their business as per the laws of the land. There has to be a balance between the profits made by the companies and the requirements of the law,” Mr Kimani said.

Otieno agreed with the committee’s concerns, saying, “I agree with you that there ought to be an increase in earnings from the betting and gaming activities”.

Excise duty was introduced as a deterrent to betting and gaming, with the tax rate set at 15 per cent since December 27, 2024. It applies to betting, gaming, horse racing, lotteries, and prize competitions, excluding charitable lotteries. However, the increase in sin tax has not led to a reduction in betting activities.

Data presented to Parliament by the KRA shows that the government collected Sh19.6 billion in excise duty and income taxes from betting and gaming companies in the 2024/25 financial year, an increase of Sh2.53 billion compared to the 2023/24 period.

From July 2024 to March 2025, Sh9.976 billion was collected in excise duty, up from Sh8.03 billion during the same period in the previous financial year. In contrast, withholding tax from successful players fell to Sh4.8 billion, down from Sh5.7 billion.

An increase in excise duty generally indicates a rise in betting activity, and therefore, in company profits. Withholding tax is imposed on players’ winnings, meaning that if winnings decline, the government collects less tax. MPs suspect that some betting companies may be influencing game outcomes to minimise winnings, thereby reducing their withholding tax obligations.

“When you lose a bet, it means that the government loses out on withholding tax. It therefore means that betting companies involved have every reason to manipulate the system and deny the government taxes to make more money,” Kimani said.

Kesses MP Julius Ruto, a member of the committee, questioned why the government should continue allowing betting and gaming activities, given the alleged lack of transparency and revenue loss.

“What would happen if we closed all the betting and gaming companies in the country? Is there a need to proceed with a sin tax on their activities if they are not transparent?” Ruto posed

In response, Otieno warned that banning betting and gaming altogether would come at a steep cost.

“The loss would be so significant to the country,” he said.

Top Stories Today