Business operators protest excessive permits and taxes, demand unified permit system

Some entrepreneurs are forced to obtain up to 20 different clearances, with costs running into hundreds of thousands of shillings before they can fully launch operations.

Business operators have decried the numerous permits and certifications required to start and run businesses in Kenya, warning that the excessive levies are driving away investors and hampering growth.

According to the Kenya National Chamber of Commerce and Industry (KNCCI), some entrepreneurs are forced to obtain up to 20 different clearances, with costs running into hundreds of thousands of shillings before they can fully launch operations.

More To Read

- SMEs see brighter outlook but struggle with market access, corruption - report

- Turkana County to ban dual wholesale-retail businesses, warns of closures after June 30 deadline

- Kenya tops East Africa in investment appeal on low risk profile

- Why innovation investment falters despite businesses’ thirst - study

- Garissa traders call for unified business permit to ease licensing burden

- Kenya's small-scale farmers to benefit from Sh10.9 billion funding boost

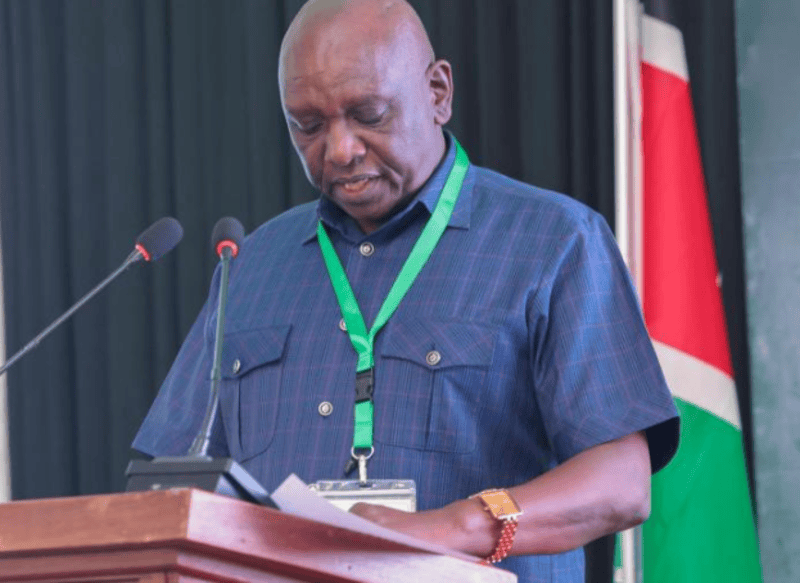

KNCCI President Dr Erick Rutto expressed concern over the burden placed on entrepreneurs by regulatory agencies, government institutions, and county governments, arguing that the overlapping requirements are stifling business growth and discouraging investment.

He cited the case of a food processing company seeking to establish operations in Kajiado County, which employs between 30 and 50 people but is required to pay for 20 different clearances totalling more than Sh337,000.

“This is not competitive as a country, and that is why the companies that have been there for a long time are the ones that still exist; you cannot add more into the pipeline,” Rutto said during an interview with Spice FM on Wednesday.

“We have to do away with extremely punitive barriers to entry as a country. The big companies will not innovate.”

Among the certifications and licenses the food processor must obtain are a Sh34,000 Kenya Bureau of Halal Certification, which is valid for only 12 months, a Sh58,000 Kenya Bureau of Standards permit and a Sh50,000 food and hygiene license. The company must also pay Sh13,000 for a unified business permit from the county government.

“We want a unified business permit for the entire country, not one for each county,” Rutto said, stressing the need to harmonise licensing regimes across the country.

While acknowledging the high skill level and innovation of Kenyan entrepreneurs, Rutto insisted that the current barriers to entry must be eased. He proposed the introduction of phased tax payment plans and tax holidays for new businesses, which he believes would not only encourage formalisation but also expand the tax base.

“After five years, when they are in the sixth year and can now run, the government can come in. That would enhance formalisation and bring businesses to the tax bracket, enhance our competitiveness, and diversify our products,” he said.

Rutto further noted that the KNCCI will present its views when the National Assembly Finance Committee commences public hearings on the 2025 Finance Bill. The Chamber intends to push for a stable and predictable tax regime, warning that erratic policy shifts are dampening both domestic and international investor confidence.

“Tanzania has had a relatively stable tax regime for the last seven years. Kenya is not leading in terms of attracting Direct Foreign Investments. Uganda has beaten us, Tanzania is fast rising… Ethiopia gets almost twice, while Somalia attracts half of our gains despite its challenges,” he lamented.

He argued that consistency in tax policy for at least five years is necessary to rebuild investor trust and solidify Kenya’s status as East Africa’s economic powerhouse, which currently accounts for 40 per cent of the region’s Gross Domestic Product (GDP).

Rutto lauded the 2025 Finance Bill for not introducing new taxes but urged the government to also tackle other pressing challenges such as high electricity costs, expensive credit, lack of access to capital and bureaucratic red tape.

The Chamber also pledged to oppose a clause in the 2025 Finance Bill that proposes to expand the Kenya Revenue Authority’s (KRA) powers to access company data without a High Court order.

“In the Finance Bill 2025, they are suggesting that they can come to our records without getting a High Court order,” Rutto said, warning that such provisions could breach intellectual property rights and expose confidential business information.

Instead of prioritising capital-intensive infrastructure projects, Rutto urged the government to channel more resources toward industrial production subsidies, which he argued would have a more direct impact on economic growth and employment creation.

However, he acknowledged that some of the Finance Bill’s proposals could benefit the wider economy and ease the financial burden on employees, especially if deductions for the housing levy, the Social Health Authority (SHA), and the National Social Security Fund (NSSF) are revised downwards.

“In general, this Finance Bill will stimulate the economy and increase the take-home amounts for employees,” Rutto said.

Top Stories Today