Experts call for higher carbon credit pricing as global trading takes shape

The current pricing mechanisms are insufficient to meet the ambitious goals of the Paris Agreement which aims to limit global temperature to 1.5°C above pre-industrial levels.

Ambitions to cut down global warming and cushion vulnerable communities against climate disasters through the imposition of carbon trading will remain rhetoric if the carbon credits are not priced high enough.

According to the international economic think tank, World Economic Forum (Wef), the current pricing mechanisms are insufficient to meet the ambitious goals of the Paris Agreement which aims to limit global temperature to 1.5°C above pre-industrial levels.

More To Read

- What’s at stake in the COP30 negotiations?

- Africa’s land holds the future of climate adaptation: Why COP30 can’t overlook it

- UN warns global climate adaptation funds running dangerously low

- From sea ice to ocean currents, Antarctica is now undergoing abrupt changes

- Somalia’s climate crisis demands global action, says IOM

- Historic climate change ruling from the International Court of Justice: What it means for Africa

This comes barely four months after countries agreed at the COP29 climate conference to kick-start global carbon credit trading.

“As one of the most promising systemic solutions to the climate crisis, carbon pricing where the external costs of greenhouse gas emissions are reflected in the prices that businesses and consumers pay for carbon-intensive goods and services has come a long way. But not far enough,” Wef said.

It adds that almost a quarter of global energy emissions are now covered by some kind of carbon pricing, but only an estimated one per cent of total emissions are priced high enough to meet Paris Agreement temperature targets.

“For carbon pricing to fulfil its potential as an accelerator of positive change, coverage must be broader and prices must rise significantly.”

Carbon trade refers to the buying and selling of credits that permit a company or other entity to emit a certain amount of carbon dioxide or other greenhouse gases.

In other terms, a company (X) in the country or from another jurisdiction whose activities result in substantive carbon emissions, pays firm (Y) partaking in greening initiatives as a token for offsetting the carbon emissions.

Ideally, company (Y) sells the carbon credits while the company (X) becomes the buyer.

Despite the lack of a harmonised global standard for determining carbon credits and their value, the World Bank notes that one credit equals one ton of reduced carbon emissions expressed in tons of CO2 equivalent (tCO2eq).

Regulations

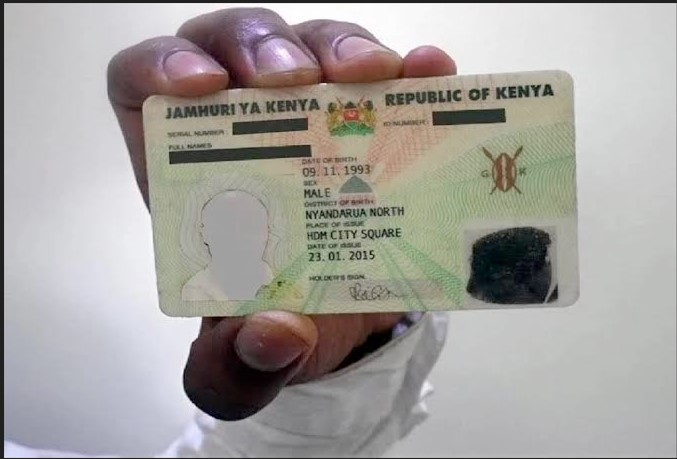

Notably, Kenya has no specific carbon trading framework but has introduced regulations and legal frameworks establishing a ground for implementing carbon projects and supporting Kenya's climate change goals.

The government last year published the Climate Change (Carbon Markets) Regulations, 2024 which provides a framework for implementing carbon projects, encouraging greenhouse gas emissions reduction and supporting Kenya's Nationally Determined Contribution (NDC) under the Paris Agreement.

However, the World Bank in its 'State and Trends of International Carbon Markets' report says much remains to be done, as the country has existing gaps that would compel it to face extended timelines in coming up with a well-designed framework for trading.

Experts under the World Economic Forum further highlight the lack of awareness among stakeholders as another barrier to the potential of carbon trading.

“Simple lack of awareness is itself a huge barrier. While the economics of carbon pollution are well-known among climate policymakers, they remain poorly understood by the general public and even some ardent climate activists,” Wef said.

“Many, for example, confuse carbon pricing policies which aim to reduce demand for carbon-intensive energy, products and services with carbon credits and offsets, which have a different, less fundamental role to play.”

The think-tank therefore says carbon pricing needs a more compelling story with the need to communicate more creatively and rigorously in order to gain public awareness, understanding and ultimately consent.

Top Stories Today