World Bank assures Kenya’s debt sustainable if properly managed

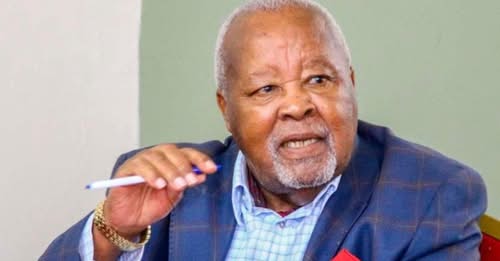

World Bank Country Director for Kenya, Qimiao Fan, emphasised that the sustainability of Kenya’s debt should not be judged only by the current numbers, but by the direction in which the fiscal trajectory is headed.

The World Bank has warned that Kenya remains at high risk of debt distress, despite a modest drop in its debt-to-GDP ratio from over 70 per cent to around 66–67 per cent, citing growing fiscal pressures.

According to the Bank, although the slight decline in the ratio signals progress, the country’s fiscal path remains concerning. With large portions of the budget consumed by debt servicing, wages, and pensions, little remains for key development priorities such as infrastructure, education, and healthcare.

More To Read

- Africa’s share of global extreme poverty rose by 30 per cent in 10 years - World Bank

- National Treasury secures Sh437.8 billion loan to plug budget deficit

- Revenue raise, prudent debt key to Africa’s 2026 upgraded growth prospects - IMF

- Africa lags in ID cards coverage as experts urge inclusive access

- Kenya Railways hands over stalled Kibera project to State Department of Housing

- Droughts wipe out up to 900,000 jobs annually in Africa - report

Speaking during an interview on Nation FM and NTV simulcast, World Bank Country Director for Kenya, Qimiao Fan, emphasised that the sustainability of Kenya’s debt should not be judged only by the current numbers, but by the direction in which the fiscal trajectory is headed.

“There’s nothing intrinsically wrong with debt,” he said, “The question is how you use that debt, whether it’s put to productive use that can help increase growth and create jobs.”

He added that if managed well, debt can help expand the economy and create more borrowing space in the long term.

Fan explained that about a third of Kenya’s tax revenue goes toward interest payments alone. In total, over 86 per cent of government expenditure is taken up by interest, wages, and pensions.

“That means you don’t have much money left for everything else,” he said. “You have very little left to build roads, to invest in schools, and to create more healthcare facilities.”

He further noted that debt sustainability is not static but depends on the trajectory of the country’s fiscal policies.

While the reduction from over 70 per cent to around 66–67 per cent is a step in the right direction, Fan stressed that further progress is needed to avoid economic strain and support inclusive growth.

“It’s the trajectory, where it’s going,” he said. “Are fiscal policies helping to gradually reduce the ratio to a sustainable level? Sustainability is not static; it must be looked at dynamically.”

Since Kenya joined the World Bank in 1964, the institution has provided about $25 billion(approximately Sh3.23 trillion) in support through loans, credits, and grants.

Fan clarified that all the terms of the Bank’s financing to Kenya, including durations and any policy-based conditions, are public and available on the World Bank website.

“There’s nothing opaque about World Bank financing to Kenya,” he said.

The Bank supports Kenya through three main financing instruments: project-based loans for sectors like health, education, and energy; results-based financing tied to measurable goals; and budget support for policy reforms initiated by the government.

The first, he said, is investment project financing, which targets specific projects such as the construction of school classrooms, healthcare facilities, transport infrastructure, and energy projects.

“We have supported the building of over 30,000 classrooms and the paving of thousands of kilometres of roads, including key projects like the Nairobi–Mombasa highway and the Tana River hydropower plant,” he said.

Fan added that the second instrument is the Programme-for-Results (PforR), where financing is tied to the achievement of specific outcomes. He gave an example of loans issued to improve the education sector, where disbursement depends on meeting agreed results such as higher enrolment rates or improved retention.

"That is, say in education, we provide you a, say, four or five hundred million dollar loan. And the condition is that you achieve certain results. In other words, we pay for results that the country achieves," he said.

The third form of support, he said, is Development Policy Operations (DPO), commonly referred to as budget support.

Fan explained that this financing supports government-led policy reforms. Fan also clarified that the Bank does not unilaterally choose which projects to fund.

Instead, it works closely with the Kenyan government, which outlines its national priorities. The Bank then supports areas where it has both technical expertise and the financial capacity to contribute meaningfully.

Top Stories Today