Treasury announces Sh21.1 billion cut to 2025-26 budget amid revenue shortfalls

The shortfall reflects lingering economic disruptions from the 2024-25 fiscal year, when the withdrawal of the Finance Bill 2024 and months of protests curtailed business activity and reduced tax inflows.

The National Treasury has announced plans to reduce the 2025-26 budget by Sh21.1 billion, signalling the first supplementary adjustments for the financial year.

The revision, detailed in the Draft 2025 Budget Review and Outlook Paper (BROP), lowers the government’s total spending target to Sh4.269 trillion, down from the Sh4.291 trillion initially approved.

More To Read

- MPs warn Treasury over lapses in fiscal discipline, pension system delays

- Government shifts cargo clearance to Nairobi, Naivasha in bid to decongest Mombasa Port

- Treasury ordered to draft rules for on-lent loans amid oversight concerns

- Mbadi confirms Treasury deliberately influencing shilling’s value against dollar

- Government clears Sh93 billion in road bills after borrowing Sh104 billion from banks

- Finance Committee slams CS Mbadi for dodging key oversight sessions

The adjustment comes as the Treasury struggles to match its spending plans with weaker-than-expected revenue collections.

Kenya Revenue Authority (KRA) figures show that in July 2025, the government collected Sh212.6 billion, falling Sh20.1 billion short of the monthly target of Sh232.7 billion.

The shortfall reflects lingering economic disruptions from the 2024-25 fiscal year, when the withdrawal of the Finance Bill 2024 and months of protests curtailed business activity and reduced tax inflows.

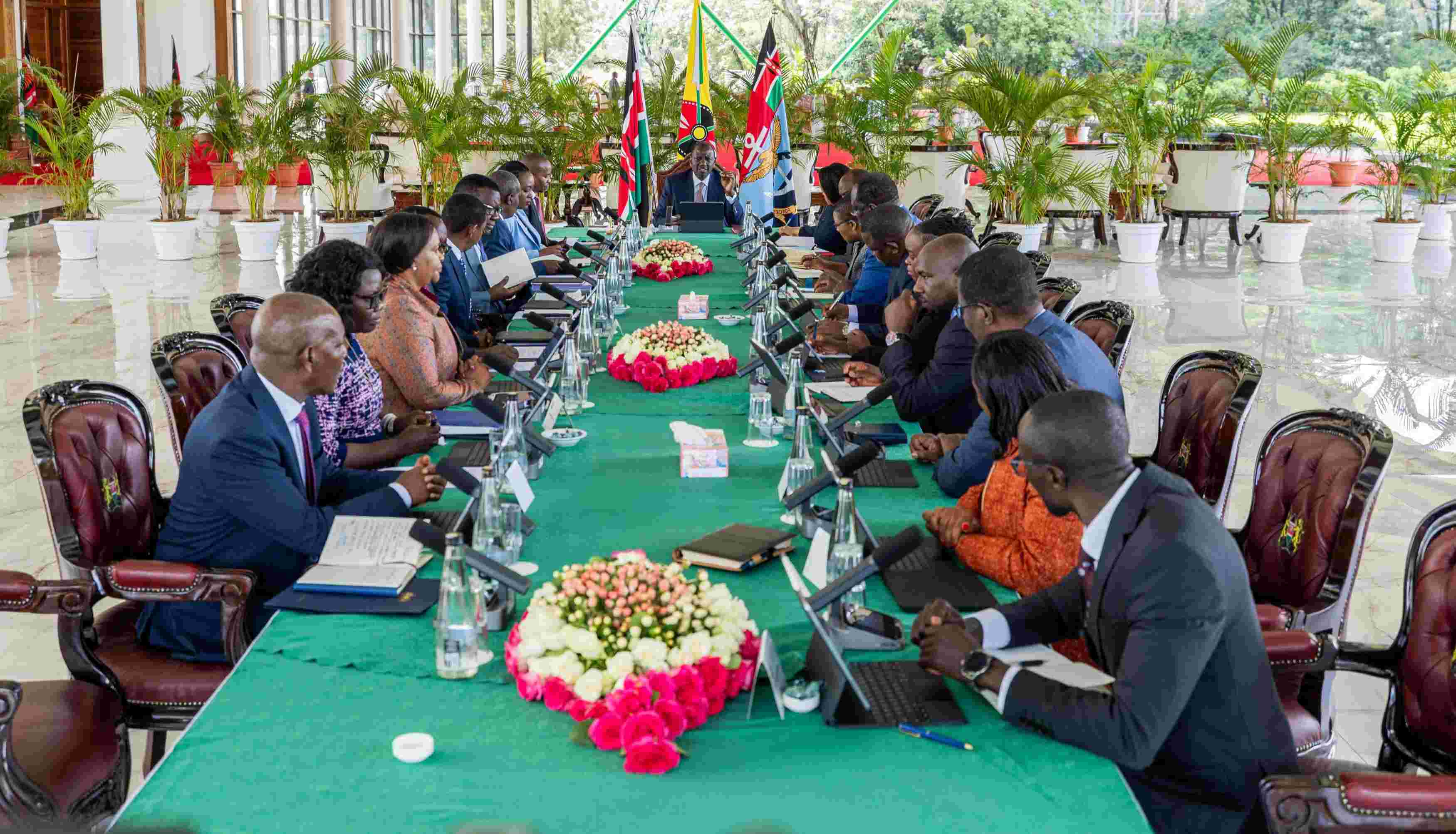

“This performance, coupled with the weak budget outturn in FY 2024-25, points to continued fiscal pressures and underscores the need for realistic revenue projections in preparing the FY 2026-27 budget,” said National Treasury Cabinet Secretary John Mbadi.

Although the Sh21.1 billion cut is relatively modest within the context of a Sh4.2 trillion budget, Treasury intends it to help shrink the fiscal deficit to 4.7 per cent of GDP in 2025-26, down from 5.8 per cent in the previous year.

Kenya’s debt burden, however, remains a pressing concern. Exchequer data show that by June 2025, public debt had reached 64 per cent of GDP, exceeding the 55 per cent level the International Monetary Fund deems sustainable.

Debt service now consumes over 60 per cent of government revenue, meaning that for every Sh100 collected, Sh60 goes toward repaying loans.

“The financial year 2026-27 and medium-term budget are being developed against persistent fiscal challenges, including revenue shortfalls, rising public debt and debt servicing costs, accumulation of pending bills and increasing demands for priority funding,” Mbadi added.

Treasury also warned that pending bills continue to strain resources. By June 2025, ministries, departments, and state corporations owed Sh525.9 billion to suppliers and contractors, highlighting the need for tighter expenditure control.

Despite the budget squeeze, key programmes under President William Ruto’s Bottom-Up Economic Transformation Agenda (BETA) will be protected. Spending will remain focused on agriculture, support for small businesses, affordable housing, healthcare, and the digital economy.

The BROP emphasises that ministries and departments must review projects carefully and eliminate low-impact spending. Mbadi noted, “The zero-based budgeting approach—where every expenditure must be justified afresh is expected to guide allocations in both the supplementary and future budgets.”

In past years, budget adjustments have often shifted funds from development initiatives to recurrent costs such as salaries, pensions, and interest payments, a challenge Treasury aims to minimise under the new plan.

Top Stories Today