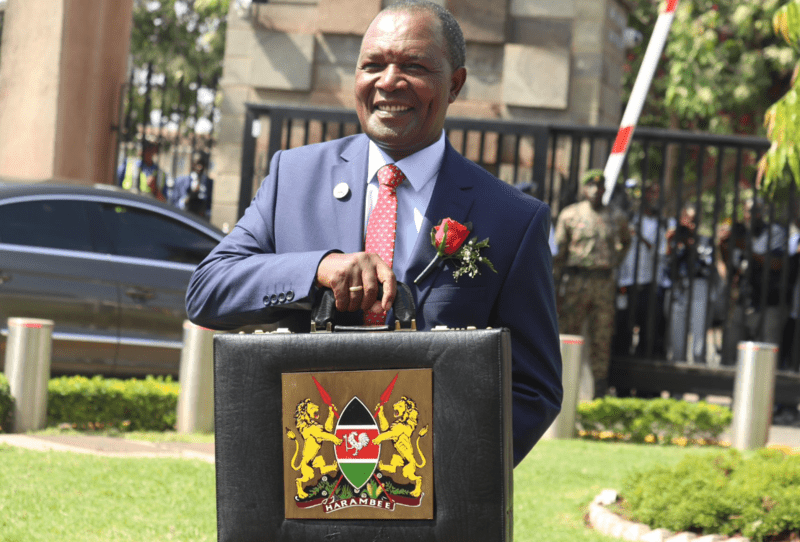

Government increases borrowing target by Sh82.3bn ahead of budget speech

The new borrowing target represents an increase from the previously stated Sh514.7 billion deficit that Prof Ndung’u had presented to the National Assembly.

The government has raised its borrowing target for the upcoming fiscal year by Sh82.3 billion, bringing the total to Sh597 billion. Just hours before National Treasury Cabinet Secretary Njuguna Ndung'u's scheduled budget speech, the government made this change, signalling a potential shift in fiscal strategy.

The new borrowing target represents an increase from the previously stated Sh514.7 billion deficit that Prof Ndung’u had presented to the National Assembly. If spending does not increase from the current projection of Sh2.95 trillion, this adjustment suggests a likely downward revision of the tax collection target.

More To Read

- Ruto says 15,000 jobs on the horizon following launch of landmark highway expansion

- Ruto says Kenya can attain first-world status within three decades

- Petition filed to stop multi-billion Rironi–Nakuru–Mau Summit road project

- ‘Manifesto-free campaigns will sink you,’ Ruto warns opposition after by-election wins

- President Ruto launches Nairobi–Nakuru–Mau Summit, Maai Mahiu–Naivasha road projects

- Treasury’s plan to abolish six development authorities raises fears over 423 projects, 1,500 jobs

The decision aligns with President William Ruto's fiscal consolidation strategy, aimed at reducing the country's debt vulnerabilities by enhancing tax collection and trimming spending. A Cabinet dispatch released on Thursday emphasised the government's commitment to this strategy, highlighting efforts to halve the budget deficit by 2027.

“In line with the administration’s fiscal consolidation strategy, which seeks to reduce government borrowing, and in pursuit of the aspiration to achieve a balanced budget by 2027, the proposed budget consolidates these efforts by reducing the budget deficit by nearly 50 per cent,” the dispatch read.

The communiqué detailed the reduction in the deficit from Sh1 trillion in the financial year 2021/22 to Sh925 billion in 2023/24, and now to Sh597 billion for 2024/25. Given the government's recent borrowing trends, which often exceed Sh700 billion, we viewed the initial target of Sh514.7 billion as ambitious.

Kenyans are now eagerly awaiting Prof Ndung’u’s speech to learn the specifics of the government’s borrowing plans from domestic and external creditors. Initially, the Treasury had projected borrowing Sh256.8 billion externally and Sh257.9 billion from the domestic market to cover the Sh514.7 billion deficit.

National Treasury Principal Secretary Chris Kiptoo, while addressing the National Assembly’s Finance Committee, defended the push for increased taxes and a broader tax base. He warned that Kenya’s debt situation could worsen if not addressed promptly.

“Our capacity to carry more debt is not sustainable, so we have to raise revenue and cut expenditure. Any further accumulation of debt would mean we would have no fiscal space,” Dr. Kiptoo stated.

The government's strategy to reduce debt is also part of its agreement with the International Monetary Fund (IMF), focusing on boosting domestic revenue. Besides tax hikes, Dr Ruto’s administration aims to increase the collection of fees and fines by various ministries, departments, and agencies.

However, the proposed tax measures in the Finance Bill 2024 have sparked significant controversy. Many Kenyans, including businesses, consumers, NGOs, and churches, have expressed strong opposition. Contentious proposals include a 2.5 per cent car tax, a 16 per cent VAT on banking services, a new eco levy, VAT on bread, and a 25 per cent excise duty on crude and refined vegetable oils.

As the government navigates these fiscal challenges, all eyes will be on Prof Ndung’u’s budget speech to see how these adjustments will impact Kenya's economic landscape.

Top Stories Today