Small banks face uncertainity in govt's plan to raise capital requirement ten times

Kenya has nearly 39 licenced banks, and more than half of them may be affected by the CBK's new measure. Out of these, only 9 banks control the lion's share at 75.1%

Small banks in the country might suffer a major blow if the government implements its new measure to increase the core capital (the minimum amount a bank has to operate) from the current 1 billion to 10 billion shillings.

The move to raise the core capital for banks tenfold was attributed to fiscal policies set out to ensure financial stability in the banking sector.

More To Read

- Government, miners form joint committees to curb exploitation, protect communities

- Parliamentary Budget Office warns Sh2.2 trillion projects at risk over funding delays

- Treasury’s plan to abolish six development authorities raises fears over 423 projects, 1,500 jobs

- National Treasury secures Sh437.8 billion loan to plug budget deficit

- MPs raise alarm over alleged misappropriation of College of Insurance land

- MPs question rising debt despite Treasury’s reduced CBK borrowing

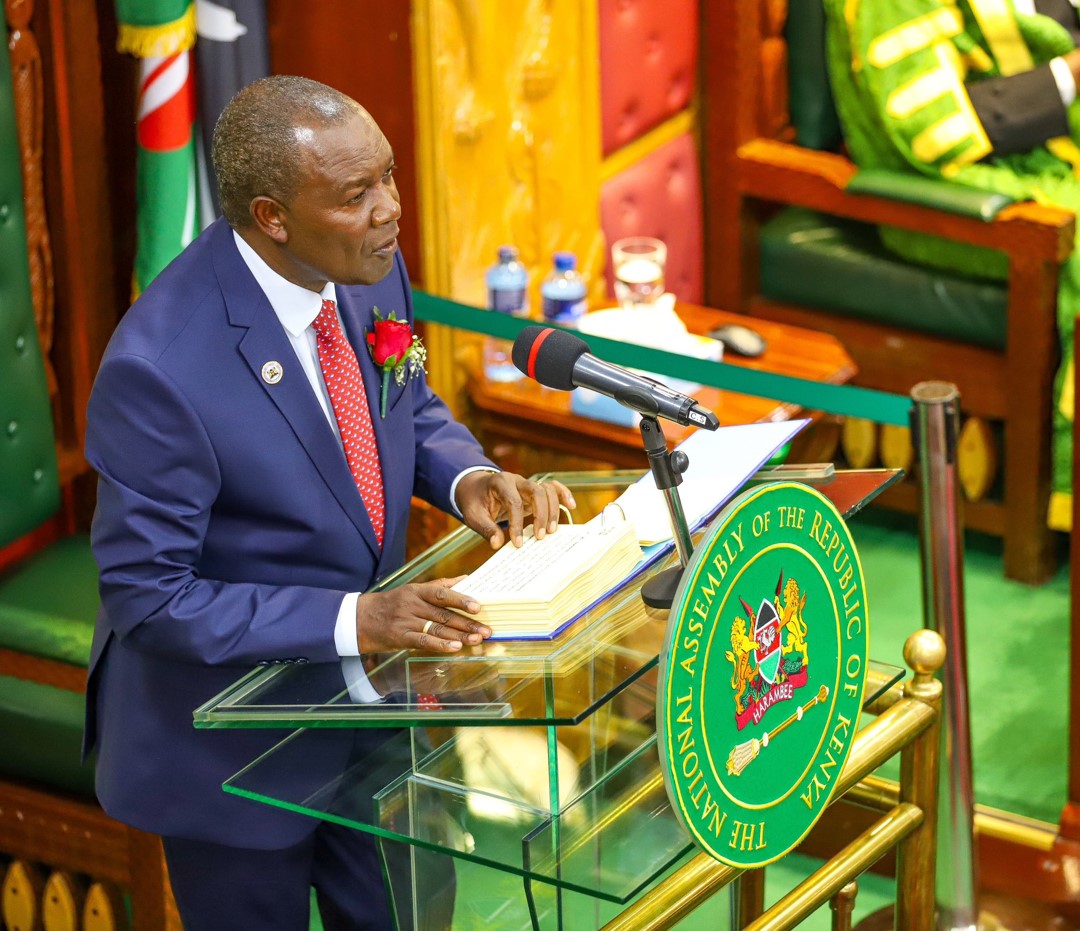

Treasury Cabinet Secretary Njuguna Ndung'u revealed the plans for the Central Bank to review the minimum capital requirement for banks while he was presenting the Sh3.992 trillion 2024/25 budget in Parliament last week.

"The Central Bank of Kenya intends to progressively increase the minimum core capital for banks from the current 1 billion to 10 billion shillings," said CS Njuguna.

This requirement will have a major impact on small banks in the industry, including the consolidation of banks once the CBK enforces the changes. Banks that cannot attain the minimum threshold of 10 billion shillings will likely face mergers, acquisitions, or closures.

The CS claimed that the new measures will help banks be able to withstand any challenges brought about by innovations and advancements in technology.

National Treasury Cabinet Secretary Njuguna Ndung'u presents the 2024/25 budget in Parliament on June 13, 2024. (Photo: X/Parliament)

National Treasury Cabinet Secretary Njuguna Ndung'u presents the 2024/25 budget in Parliament on June 13, 2024. (Photo: X/Parliament)National Treasury Cabinet Secretary Njuguna Ndung'u presents the 2024/25 budget in Parliament on June 13, 2024. (X/Parliament)

"This is intended to strengthen the resilience and increase the banks' capacity to finance large-scale projects while creating a sufficient capital buffer to absorb and withstand shocks caused by continuous emerging risks associated with the adoption of technology and innovation," said the CS.

The core capital, also known as Tier 1 capital, is crucial for a bank to incorporate losses and protect depositors. The capital comprises a bank's equity capital and disclosed reserves.

The current core capital requirement was set in 2012.

CBK Governor Kamau Thugge said early this year that there was a need to increase the core capital due to the rise of threats like cybersecurity.

He further pointed out the rise of non-performing loans in the banking sector. In February this year, non-performing loans stood at 15.5%, up from 14.8% at the end of last year.

In 2015, parliament rejected a similar proposal to raise the minimum capital threshold for lenders to 5 billion shillings. The then Treasury Cabinet Secretary, Henry Rotich, wanted the proposal to be implemented in 3 years.

CBK requires banks to maintain 10.5% core capital to total risk-weighted assets, 14.5% to risk-weighted assets, and 8% to deposit

Kenya has nearly 39 licenced banks, and more than half of them may be affected by the CBK's new measure. Out of these, only 9 banks control the lion's share at 75.1%

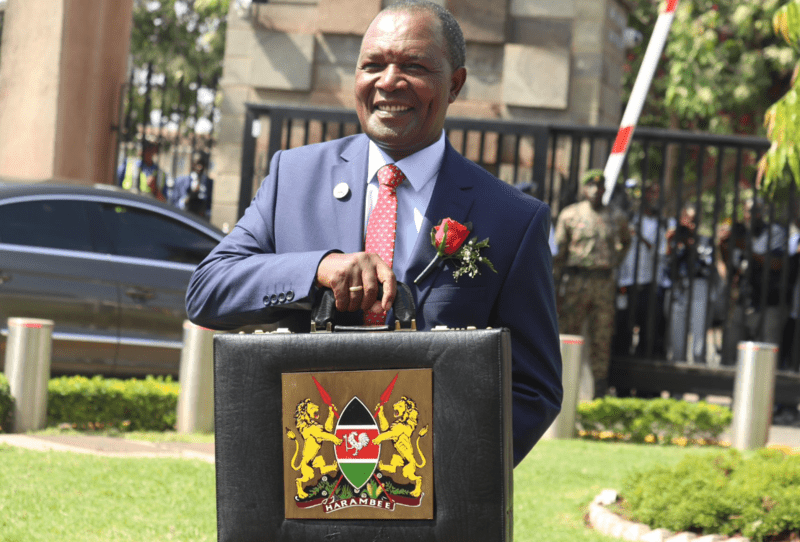

National Treasury Cabinet Secretary Njuguna Ndung'u poses with the briefcase ahead of the 2024/25 budget presentation in Parliament on June 13, 2024. (Photo: X/Parliament)

National Treasury Cabinet Secretary Njuguna Ndung'u poses with the briefcase ahead of the 2024/25 budget presentation in Parliament on June 13, 2024. (Photo: X/Parliament)

Top Stories Today