Cash-strapped Moi University to reopen next week as Treasury pledges Sh2.9 billion

This decision comes after significant intervention from Parliament and the Higher Education State Department.

Cash-strapped Moi University is expected to reopen on November 4 after closing on October 3 due to a prolonged lecturers' strike over unpaid salaries and unresolved issues related to the 2017-2022 Collective Bargaining Agreement (CBA).

Protests were primarily focused on delayed payments, unremitted pensions, and outstanding loan deductions.

More To Read

- President Ruto pitches National Infrastructure Fund as engine for long‑term growth

- World Bank warns political interference weakening Kenya’s state-owned enterprises

- Women secure majority of contracts in inclusive government procurement programme

- Treasury CS John Mbadi defends ballooning State House budget

- Government, miners form joint committees to curb exploitation, protect communities

- Treasury’s plan to abolish six development authorities raises fears over 423 projects, 1,500 jobs

The anticipated reopening follows a commitment from the National Treasury to release Sh2.9 billion aimed at addressing the institution’s financial and operational challenges amid being burdened by Sh10 billion in debt and allegations of mismanagement.

This decision comes after significant intervention from Parliament and the Higher Education State Department.

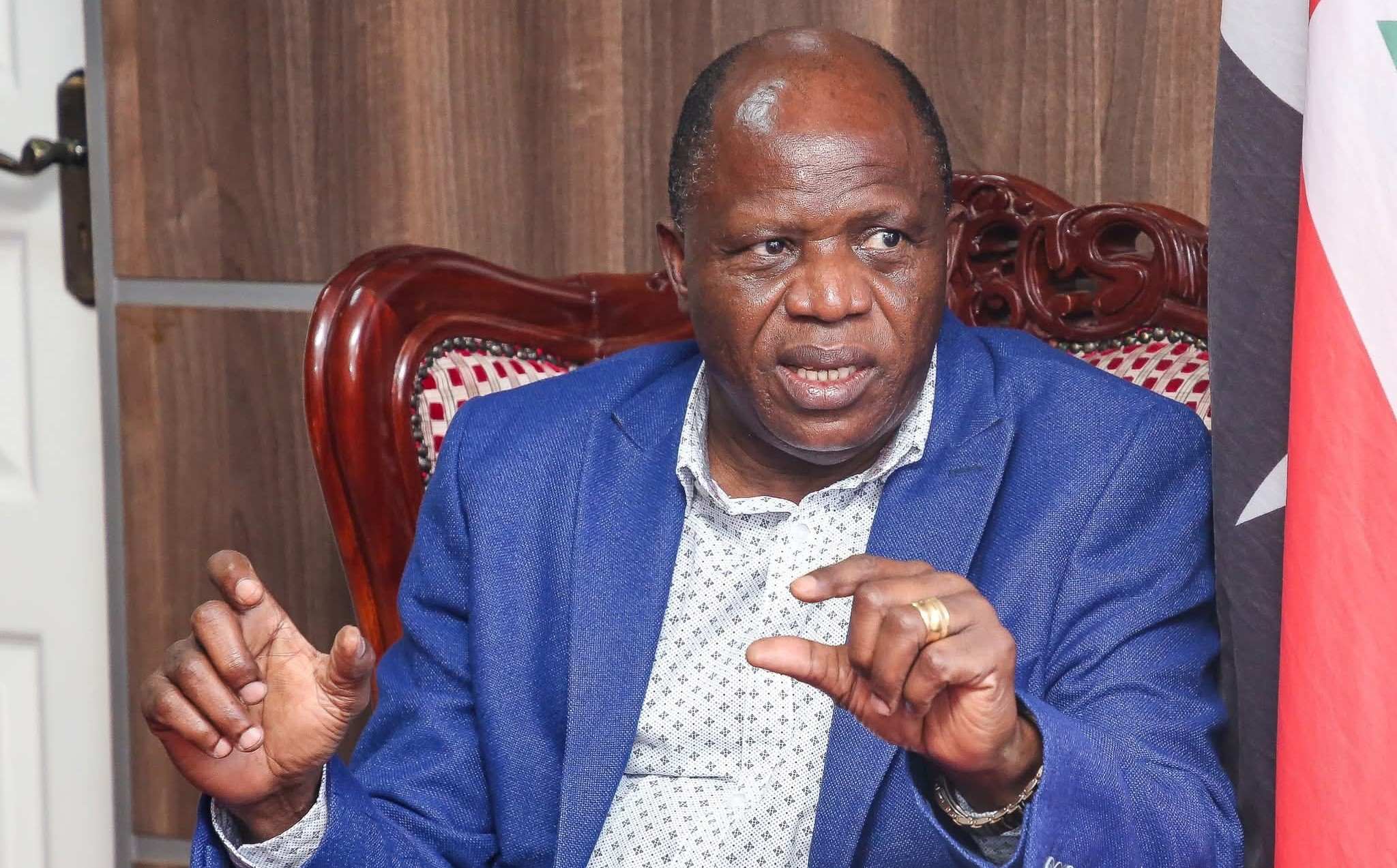

Chairman of the National Assembly’s Committee on Education, Julius Melly, announced that critical actions have been taken to facilitate the university's return to normal operations.

“Some Sh300 million will go towards scholarships this October, in addition to Sh217 million disbursed in August. Another Sh219.9 million will cover tuition, adding to the Sh127.2 million allocated in August, while Sh89 million will be allocated as capitation for current students, complementing the Sh269 million disbursed in August,” Melly said.

The funds are aimed at addressing immediate financial obligations, including the payment of Sh807 million in outstanding salaries for university staff.

To bridge the remaining Sh198 million gap, Melly indicated that the university would utilise its projected monthly revenue of Sh206 million.

Additionally, he noted that by November 15, the Treasury is expected to release an extra Sh500 million to further support the institution’s financial stabilisation and recovery.

Moi University. (Handout)

Moi University. (Handout)

In a bid to strengthen the university's management during this challenging period, Melly stressed that a caretaker committee will be established to devise a sustainable recovery plan.

The committee comprises representatives from the Executive, National Treasury, and Ministry of Education, who will collaborate with the University Council and management to tackle financial issues and ensure long-term viability.

“This committee has held initial meetings, resulting in immediate recommendations to ensure that critical university data is documented and that funding requests are analysed thoroughly. An additional Sh315 million in monthly payroll support is required to maintain operations, and the university’s pending bills, as of July 1, 2022, stand at Sh2.4 billion. Negotiating a manageable payment plan with creditors is crucial,” Melly said.

National Assembly Speaker Moses Wetang’ula termed the closure of Moi University a grave national concern calling for resolutions.

“I will instruct the Chairman of the Committee on Education to provide a statement from the Ministry of Education on the status of Moi University and any relevant measures for accelerating a resolution and reopening,” he said.

He also urged Education Cabinet Secretary Julius Ogamba to appear before Parliament in the coming week to discuss the matter and present a detailed recovery plan for the university.

Wetang’ula underscored the urgency of stabilising the institution, emphasising the need to restore not only academic programmes but also confidence in its operations.

The university had previously requested monthly financial support of Sh315 million for two years, along with a one-time allocation of Sh2.4 billion to settle outstanding debts, including penalties and interest on unpaid bills.

Additionally, it sought Sh1.05 billion to cover salary arrears in accordance with the 2017-2021 CBA.

Top Stories Today