Sharp fall in private business activity as anti-tax demos choke sector

Christopher Legilisho, an economist at Standard Bank, said the anti-tax demos experienced during the month did enough to restrain output and new business because customers delayed spending decisions amid uncertainty.

Private business activity in the country fell sharply in June, mainly on the back of a sales downturn and policy uncertainty occasioned by the anti-Finance Bill protests.

According to Stanbic Bank's latest Purchasing Managers' Index (PMI), the headline index fell below the 50.0 neutral mark to 47.2, signalling a solid deterioration in the health of the Kenyan private sector economy.

More To Read

- Private sector warns against government plan to control business advocacy under new Bill

- Kenya’s private sector posts fastest growth in five years on soaring demand

- MPs to private sector: No tax incentives without proof of public good

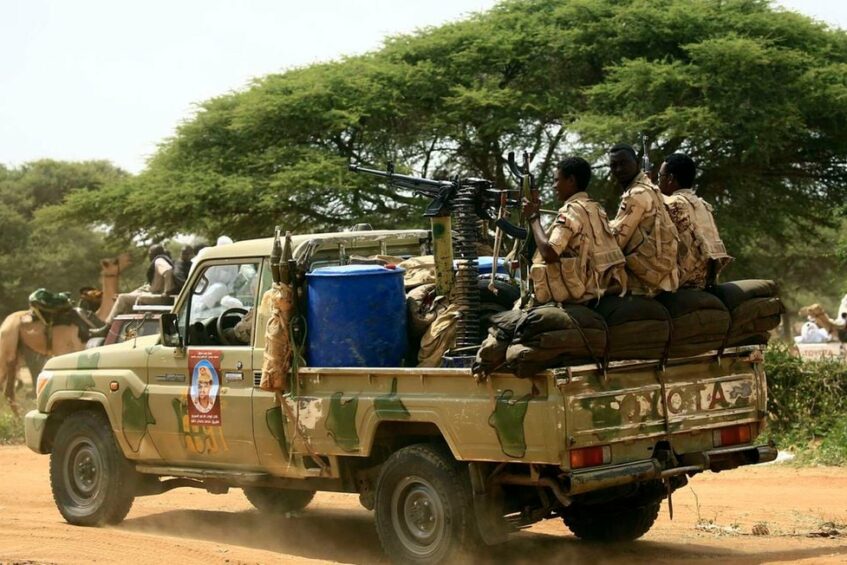

- Ruto defends ‘shoot-to-leg’ order amid outcry, cites public safety

- Private business activity growth surges in October on strengthening sales

- June sees deepening slump in Kenya’s private sector following protests, weak consumer spending

The decline is the sharpest recorded in seven months, which contrasted with the PMI's 16-month high of 51.8 in May.

The PMI survey examines private sector activities in the country in a bid to offer policymakers and investors insights into economic trends for decision-making and planning purposes.

Readings of the index above 50.0 signal an improvement in business conditions in the previous month, while readings below 50.0 show a deterioration.

The downturn in private business activities in June was, however, partially softened by a rise in new orders across manufacturing, which was the only monitored sector to register growth in the period under review.

The drop in sales tempered efforts to expand capacity at Kenyan companies as the purchasing activity decreased for the first time in three months, leading to a fresh reduction in firms' inventories of inputs.

The pace of stock depletion was only modest while employment numbers continued to rise, but the increase was the weakest seen year-to-date.

The job creation improvement is now at a sixth-month running streak as firms increased capacity.

Christopher Legilisho, an economist at Standard Bank, said the anti-tax demos experienced during the month did enough to restrain output and new business because customers delayed spending decisions amid uncertainty.

"After two months of increased purchasing activity by firms, there was a dip in purchasing quantities and inventories because of reduced sales in several sectors, namely construction, agriculture, wholesale and retail," Legilisho said.

Notably, input, purchase, and output prices recorded a mild increase during the month as a result of anticipation that the Finance Bill would pass hence increasing taxation.

However, a stronger exchange rate and lower pump prices managed to restrain the cost.

Business optimism for the year ahead remains fragile, according to Legilisho.

Top Stories Today