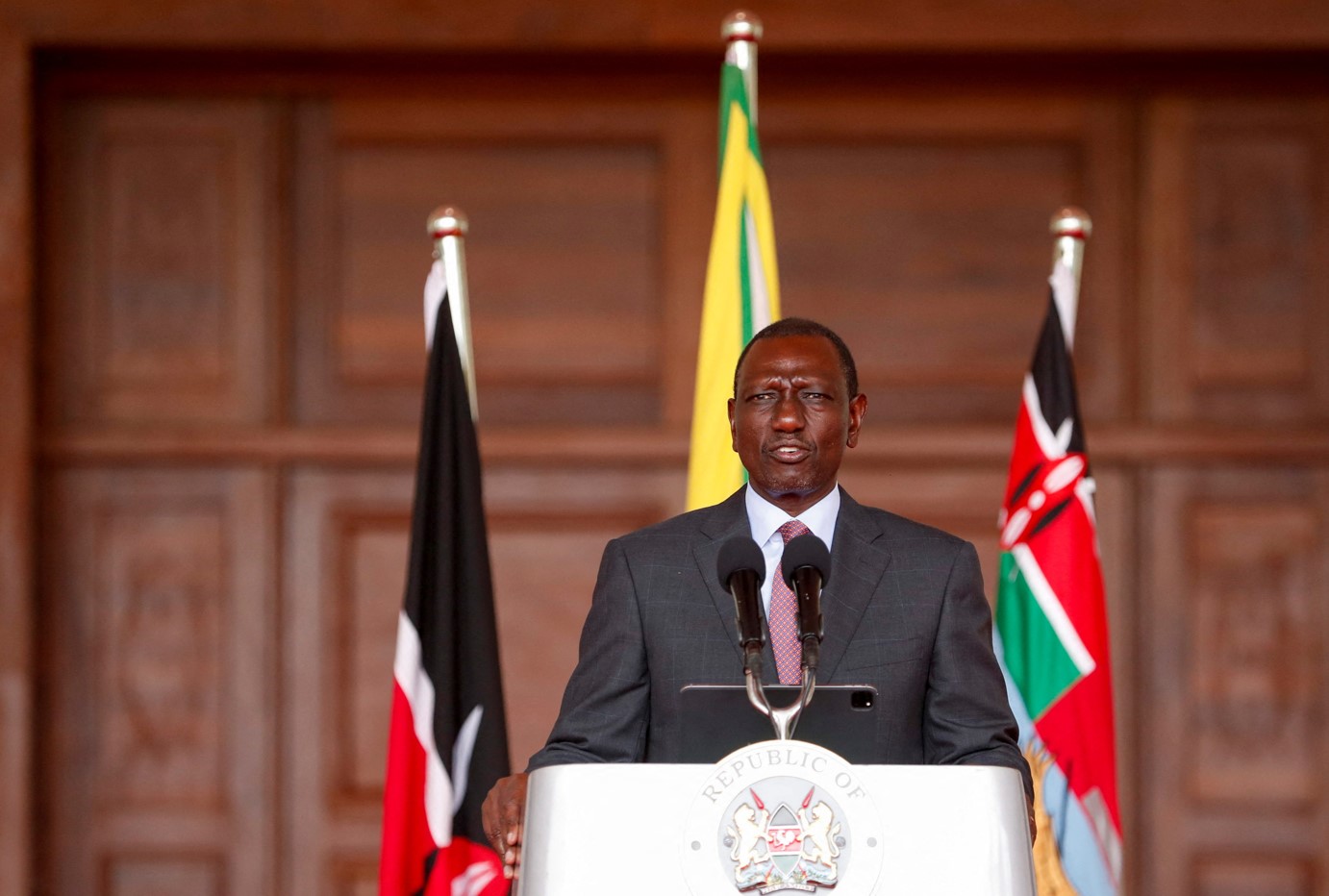

Ruto decries opaqueness in tax refunds at the expense of taxpayers

Tax expenditure refers to the government's estimated revenue loss that results from giving tax concessions or preferences to a particular class of taxpayer or activity.

President William Ruto has raised concern over the Sh400 billion paid annually in VAT refunds to certain firms, terming it not right for the country.

Speaking on Wednesday in Nairobi, Ruto expressed dissatisfaction with how the process was being done at the expense of Kenyan taxpayers.

"About Sh400 billion is spent on tax expenditure every year, especially on VAT refunds, a process that is largely opaque, and with limited accountability," Ruto said.

Tax expenditure refers to the government's estimated revenue loss that results from giving tax concessions or preferences to a particular class of taxpayer or activity.

To address this, Ruto said in the coming three months, he will consult with the National Assembly to provide a legislative and regulatory framework to make the process transparent, open, and accountable.

"This is with a view to reduce the huge public expenditure and direct the savings to the productive areas of the economy."

He noted that the procedure will be crucial for engaging lawmakers in public deliberations about whether it is appropriate for the country to spend Sh400 billion per year to pay a few corporations for VAT refunds.

VAT refunds are issued under Section 17(5) of the VAT Act 2013, which allows for the payment of excess input tax to a registered person in the case of refunds arising from zero-rated supplies, where registered VAT taxpayers deal with taxable supplies listed in the VAT Act's second schedule.

The refund could also arise from tax withheld by appointed tax withholding agents and the registered person lodges the claim for the refund of the excess tax.

For example, where a contractor supplies goods or services to an appointed withholding VAT agent, the agent withholds the tax.

Other cases where input tax can be claimed include tax paid in error and bad debt, which occurs when a supplier is not paid by the buyer for the products given.

Notably, President Ruto is building up on what former Treasury CS, Njuguna Ndung'u, said while tabling the budget in June.

In his second budget speech, Ndung'u said the government is pursuing an overhaul of the 1st & 2nd Schedules of the VAT Act so that going forward, goods that are currently exempt will now be subject to standard-rated VAT at 16.0 per cent.

In line with that, zero-rated goods & services will now be migrated to exempt status and the zero-rating will now be limited to goods & services that are for export only.

VAT refunds are a key factor driving the country's tax expenditures.

In 2022, out of Sh393.6 billion worth of tax expenditures, Sh248.3 billion was attributable to domestic VAT.

It's worth pointing out that the clean-up of tax expenditures is part of Kenya's commitment to the IMF in the ongoing US$3.6 billion programme.

Top Stories Today