Landlords move to cushion consumers with modest increase in rental prices in Q2

The latest property price index report by real estate firm Hass Consult says as a result, rental prices experienced only a slight increase of 0.01 per cent in the three months to June this year.

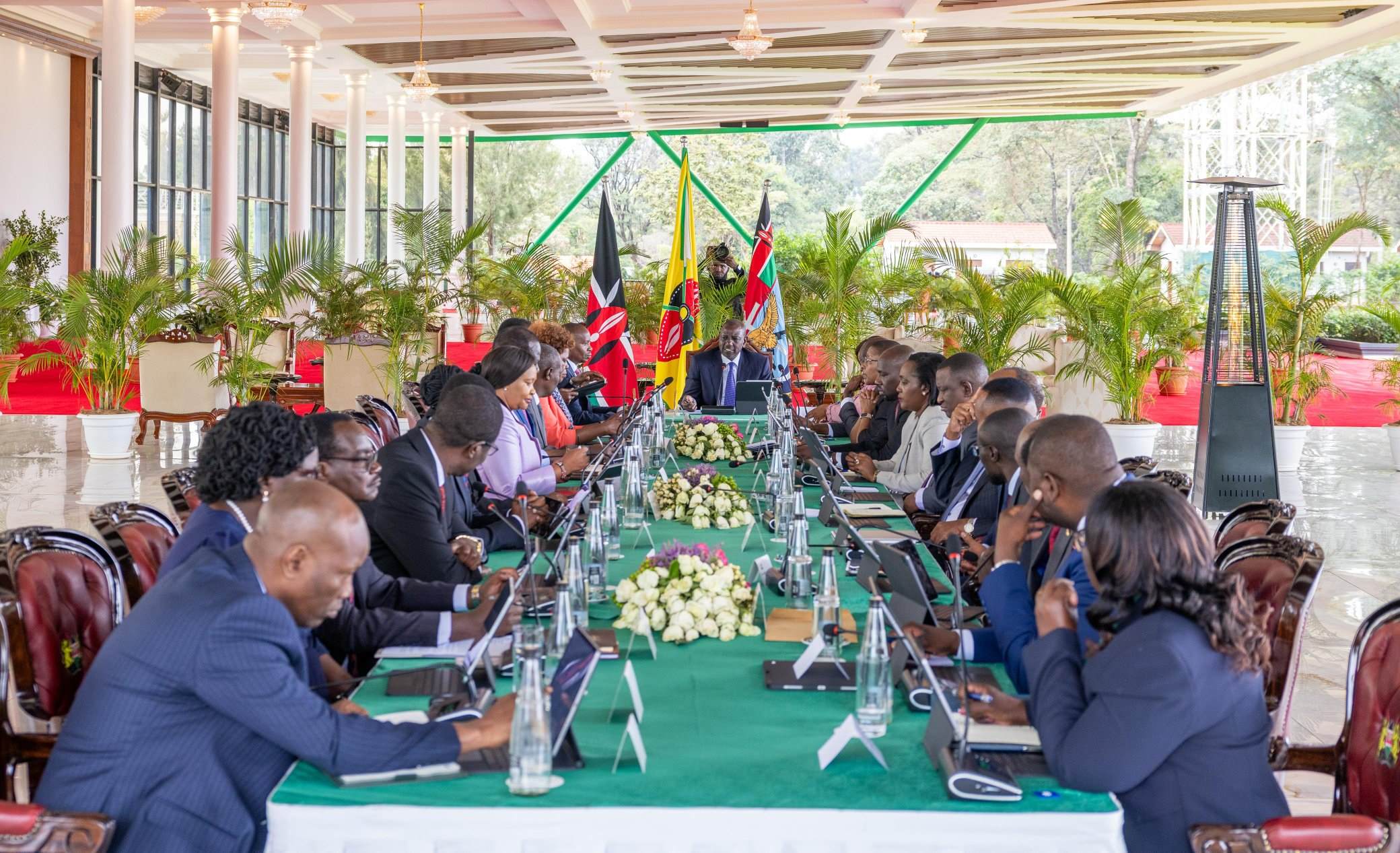

Property owners in Nairobi have remained cautious not to raise rental charges to avoid losing tenants at a time when a majority of them are grappling with reduced disposable income stemming from high taxation and the post effects of high inflation.

The latest property price index report by real estate firm Hass Consult says as a result, rental prices experienced only a slight increase of 0.01 per cent in the three months to June this year.

More To Read

- Kenya secures Sh167.9 billion to expand affordable housing, low‑cost mortgages

- Only 4 per cent of Kenyans can afford Sh10 million homes - survey

- MPs demand trader-centered designs in ESP market projects

- Construction sector rebounds as cement demand hits record high

- MPs push for faster delivery of affordable housing, economic stimulus projects

- Construction growth slows amid rising costs, labour shortages

Compared to the previous two quarters, the decline rate is slow from 0.4 and 2.5 per cent in Q1 2024, and Q4 2023, respectively.

Rents have been on a continued increase over the past two decades, increasing by 4.37 fold since 2001.

The index's annual rent average, which is representative of the average rent of all properties offered to let in Kenya, has gone up from Sh38,516 in December 2000 to Sh168,380 as of June 2024.

"The average annual rent for a 4-6 bedroom property is currently Sh238,878 while one for a 1-3 bedroom property is Sh93,851," the report reads.

Regarding property sales prices, the report reveals a modest one per cent increase across Nairobi.

This growth, while slower than the previous quarter's 2.7 per cent, marks the eighth consecutive period of price increases, highlighting a trend of stability in the property market.

Rise in property sale prices

The recent data illustrates that, despite high interest rates and a strengthened shilling impacting foreign buyer advantages, property sales prices have continued to rise albeit at a lower rate.

"While higher interest rates on mortgages don't have a significant impact on market-wide property price movements due to the low mortgage participation in the country, the rise in rates has the effect of reducing market liquidity in general resulting in a dampening of demand," said Sakina Hassanali, the head of development, consulting, and research at Hass Consult.

She added that so far, the property market has shown resilience with price stability still being witnessed across most areas.

In terms of price growth, Nairobi's satellite towns outperformed its suburbs with an average 2.1 per cent increase compared to a 0.9 per cent decrease in the suburbs.

The satellite category includes towns like Athi River, Juja, Kiambu, Syokimau, Thika, Mlolongo and Ngong.

On the other hand, the City's suburbs include Karen, Runda, Westlands, Kilimani, Upperhill and Lavington.

This rise in satellite towns can be attributed to accelerated urbanisation, which has bolstered demand and pushed up asking prices.

Nevertheless, the report highlights that rental yields differ significantly between Nairobi's suburbs and satellite towns.

In the suburbs, the average yield increased to seven per cent by the end of June from 6.9 per cent in March.

Conversely, rental yields in satellite towns decreased slightly from 4.9 per cent in March to 4.8 per cent in June, reflecting varying market conditions in these areas.

Top Stories Today