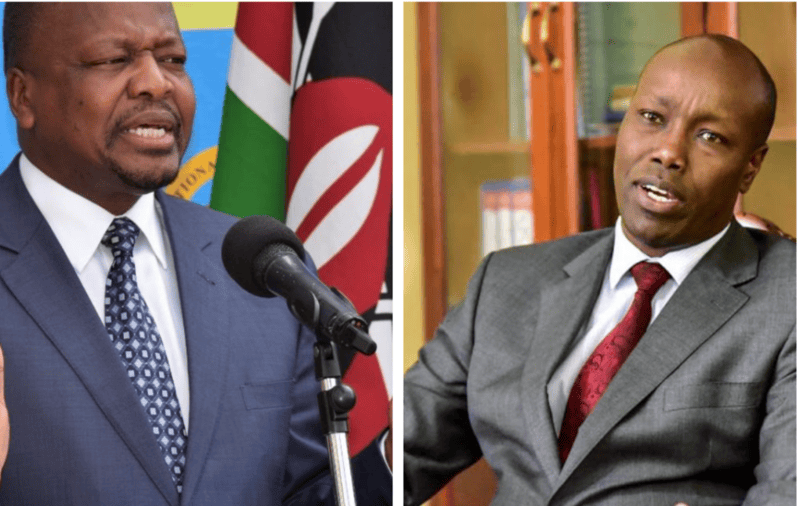

Kenya loses more than Sh600bn yearly on tax loopholes - CS Mbadi

By Alfred Onyango |

According to real-time numbers provided by the CS, the taxman might have collected more than Sh3 trillion in the fiscal year ending June 30, 2024.

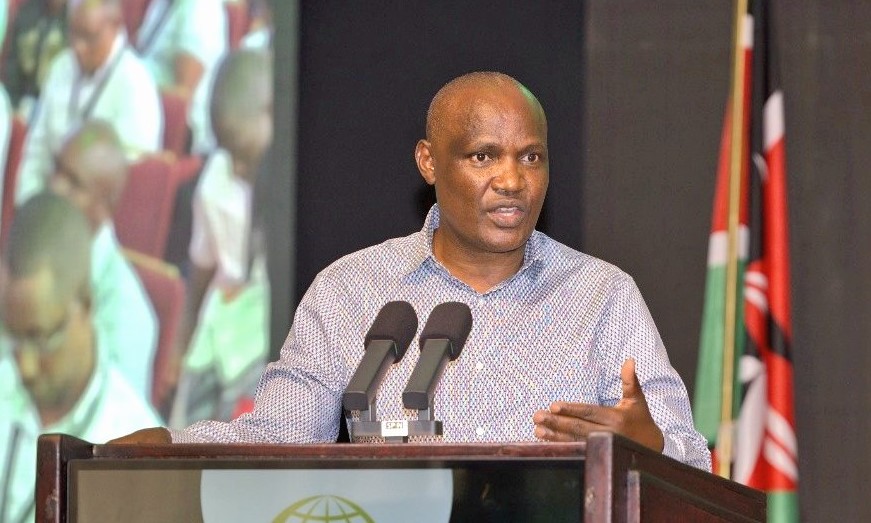

Kenya is losing not less than Sh600 billion of revenue every year through tax loopholes such as tax evasion and avoidance.

This is according to the National Treasury Cabinet Secretary John Mbadi who spoke on Thursday during a live interview on Citizen TV.

Keep reading

"If we can seal all the leakages and reform the Kenya Revenue Authority (KRA), we should be able to collect not less than Sh600 billion more," Mbadi said.

He gave the example of the Value Added Tax (VAT) tax head, where he said the country is currently doing just three per cent of GDP against the potential six per cent.

"We are collecting just 50 per cent of what we could be collecting," Mbadi noted.

According to real-time numbers provided by the CS, the taxman might have collected more than Sh3 trillion in the fiscal year ending June 30, 2024.

KRA received Sh2.407 trillion this year, compared to Sh2.166 trillion in the fiscal year 2022/23.

Compared to the initial target of Sh2.787 trillion that was set in the budget unveiled in June 2023, the collections missed out by Sh380 billion.

The taxman blamed the target miss on the multiple economic shocks experienced during the year that affected its revenue mobilisation efforts.

These included the depreciation of the shilling against the US Dollar, rising bank lending rates, and international conflicts that disrupted supply chains.

His views on revenue losses stemmed from an investigation into the state's present fiscal difficulties, which have led to the state abandoning its prior promise to permanently hire 20,000 Junior Secondary School teachers.

Mbadi noted that there are no funds to facilitate that pledge due to the budget shortage in the education sector of Sh13 billion in Supplementary Estimates 1.

"The budget cuts are almost at their bare minimum, and the only solution we have is to raise more revenue," Mbadi noted.

He clarifies that it does not mean the state raises tax rates every day, but instead ensures proper enforcement of tax certainty and predictability.

"We have to make sure the tax system is strong enough to remove tax leakages and reform the tax authority. Phase 1 of the digitisation has kicked off, and we must make sure that we fully automate revenue collection, boost staff morale and address the taxman's governance issues."

The sentiment recounts the directive he recently gave KRA during the introductory meeting with KRA's top leadership and staff on Wednesday.

During the meeting, he urged KRA to adopt more innovative and technologically advanced strategies to enhance revenue collection emphasising the need for continuous modernisation in tax administration to streamline business processes, leverage cutting-edge systems, and simplify tax transactions.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!