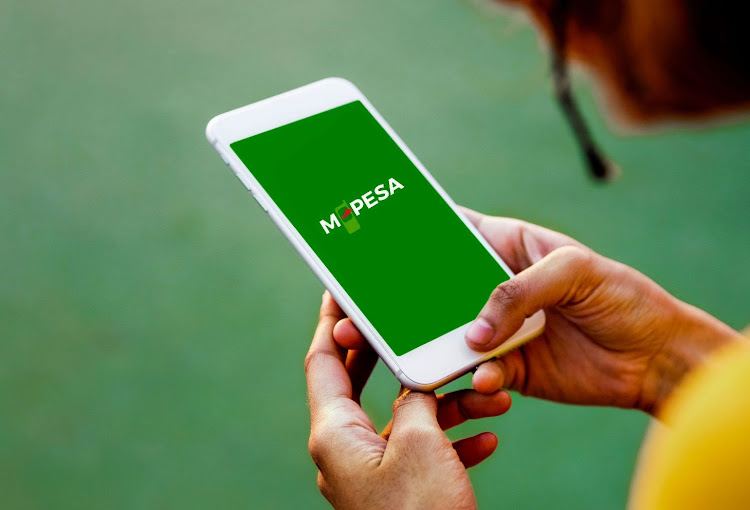

Safaricom petitions Parliament for exemption from electronic tax invoices on M-Pesa fees

The company revealed that the M-Pesa platform handles approximately 200 million transactions per month, a volume that has overwhelmed its systems as well as those of KRA.

Communication service provider Safaricom PLC has petitioned Parliament to exempt it from the requirement to produce electronic tax receipts for the millions of shillings in M-Pesa transaction fees processed every month.

Appearing before the Finance and National Planning Committee of the National Assembly on Tuesday, Safaricom outlined the challenges it faces in complying with the electronic tax invoice system under the Tax Laws (Amendment) Bill, 2024.

More To Read

- Weak taxation of wealthy costs Kenya Sh130 billion annually, report finds

- Bill targets unsafe pesticide sales on online platforms

- M-PESA Ethiopia works to fix App blocked on Ethio Telecom data

- Ex-Nairobi governor Sonko gets relief as Tribunal directs KRA to unfreeze his bank accounts

- Uwezo Fund disburses Sh2.2 million to 14 community groups in Kamukunji

- Safaricom rolls out Daraja 3.0 in major M-Pesa API redesign

The company revealed that the M-Pesa platform handles approximately 200 million transactions per month, a volume that has overwhelmed its systems as well as those of the Kenya Revenue Authority (KRA).

Safaricom is seeking an exemption from generating electronic tax invoices (eTIMs) for M-Pesa transaction fees, arguing that both its internal systems and the KRA’s infrastructure are ill-equipped to manage the scale of these transactions.

"In a month, the M-Pesa platform completes approximately 200 million transactions. To generate electronic tax invoices for each of these kinds of transactions, seamless integration of several systems from both Safaricom's and the KRA's end is required," Fred Waithaka, Safaricom's acting chief corporate affairs officer, told the committee during his submission.

Under the Finance Act of 2023, all business expenses qualifying for tax deductions must be backed by invoices generated through eTIMs, but mobile money transaction fees were not exempted from this requirement.

This has meant that Safaricom is obligated to produce eTIMs receipts for businesses seeking tax deductions related to M-Pesa transaction fees.

Safaricom highlighted a technical issue with the current system, pointing out that the worksheet for declaring standard-rated customer sales can only accommodate 75,000 rows, which is insufficient for the vast number of transactions carried out in a given period.

The Finance Act allows exemptions for certain categories of expenses, including emoluments, imports, and services provided by non-residents without a local permanent establishment, among others.

Financial institutions' fees are also exempted, but Safaricom has expressed concerns that M-Pesa transaction fees have not been granted the same exemption, despite similarities in transaction volumes and values.

"Whilst the Tax Procedures (Electronic Tax Invoice) Regulations, 2024 have provided exemption on the fees charged by financial institutions, the same has not been extended to M-Pesa transaction fees. Since M-Pesa transaction fees are in character similar to financial institution fees in terms of transaction volumes and quantum, we propose the extension of the same exemption to M-Pesa transaction fees," Safaricom added.

As part of the eTIMS system, businesses are required to issue electronic invoices and transmit them to KRA for tax purposes. The system is designed to reduce tax compliance costs, allow taxpayers to maintain records of invoices, and simplify return filing.

M-Pesa's growth highlights the scale of the challenge.

For the six months ending September 30, 2024, Safaricom reported a 30.6 per cent increase in transaction volumes, reaching 17.1 billion transactions compared to 15.2 billion in the same period last year.

Of these, 7.4 billion transactions, or 41.8 per cent of the total, were chargeable, representing a volume of electronic tax invoices that could only be generated in an ideal system.

The value of M-Pesa transactions during the same period rose 10.7 per cent to Sh20.9 trillion, up from Sh18.8 trillion the previous year.

As of December 2023, the value of person-to-person transfers on M-Pesa stood at Sh1.1 trillion, nearly ten times greater than the combined value of transactions on Airtel Money and T-Kash, which amounted to Sh169.2 billion each.

Top Stories Today