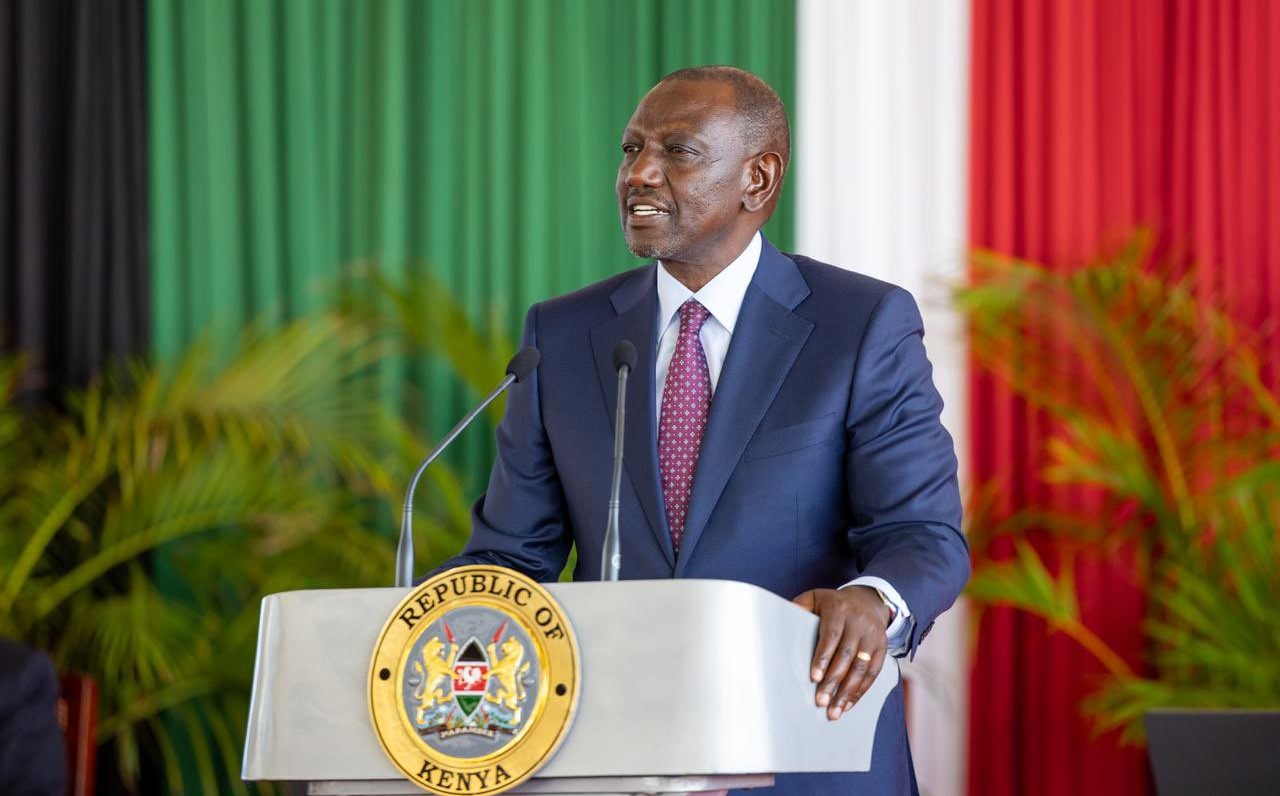

Parliamentary budget advisers warn Ruto against introducing new taxes

Parliamentary Budget Office said numerous annual tax policy adjustments over the years have not resulted in higher revenue.

Budget experts advising Parliament have warned President William Ruto against introducing new tax measures and tax policies, arguing that such changes do not guarantee improved revenue collections.

The Parliamentary Budget Office (PBO) said that numerous annual tax policy adjustments over the years have not resulted in higher revenue.

More To Read

- Parliamentary Budget Office warns Sh2.2 trillion projects at risk over funding delays

- Treasury’s plan to abolish six development authorities raises fears over 423 projects, 1,500 jobs

- Funding cuts spark urgency in state corporation shake-up, says Parliamentary Budget Office

- Government’s increased revenue strategy faulted amid missed targets, public backlash

- Parliamentary Budget Office warns government borrowing risks slowing economic recovery

- From detention to global recognition: Rose Njeri named in 2025 Time100 Next list

"This points to a fundamental problem in that simply introducing new tax policies does not guarantee better compliance or higher revenue," said the team led by Dr Martin Masinde.

The experts also raised concerns about the costly tax expenditures and the negative impact of tax amnesties on revenue targets.

They emphasised the need for future tax policies to consider the broader effects of such measures to avoid undermining revenue collection in key sectors.

As a result of poorly tested measures, the government has consistently missed its tax collection targets, falling short by Sh123.6 billion in the year ending June 2023 and by Sh205 billion for the 2024 target.

Public protests

The current administration faced significant backlash this year, culminating in public protests against new tax proposals.

This unrest led President Ruto to withdraw the Finance Bill, 2024, which aimed to raise an additional Sh344.3 billion.

In these protests, commonly referred to as the Gen Z protests, Kenyans rejected the introduction of new taxes, including a vehicle tax and an eco-levy on plastics.

The National Treasury acknowledged the challenge of overtaxing a small portion of the population while the majority contributed little to tax revenue.

Recently, Treasury Cabinet Secretary John Mbadi announced that the government is working on a system to enhance tax visibility, particularly focusing on improving Value Added Tax (VAT) collection.

However, experts believe the government should prioritise improving tax administration instead.

"The loss of the Finance Bill gives the government a perfect opportunity to consider the improvement of tax administrative systems," PBO noted.

The report suggested that better enforcement of existing policies, enhanced data analytics, and the use of technology could simplify tax processes and boost compliance.

"Stricter enforcement and continuous evaluation of these policies will help address such challenges and improve the outcomes in tax administration," the PBO stated.

Tax refunds and exemptions

In their report, the experts expressed concern over the burden of tax refunds and exemptions on taxpayers.

They pointed out that tax expenditures, including exemptions and deductions, significantly reduce potential VAT revenue.

An earlier report by the Kenya Revenue Authority (KRA) indicated that these reliefs often favour large corporations and multimillion-dollar entities.

National Treasury data revealed that tax expenditures surged to approximately Sh395 billion in 2022, a significant increase from Sh292 billion in 2021.

A large portion of this, Sh310 billion, was attributed to VAT expenditures, driven by domestic exemptions and VAT applications on fuel.

"The growing cost associated with these measures raises concerns about the sustainability of such policies," PBO remarked.

Experts stressed the importance of improving revenue mobilisation and fiscal consolidation rather than granting tax reliefs or settling refunds.

The experts advised the government to balance between maintaining a stable tax base and promoting economic activity.

They also emphasised the need for tax waivers to support economic growth, equity, and public welfare without undermining the tax base.

On tax amnesty, the team suggested a review, as the policy risks encouraging non-compliance.

"Tax amnesty policy risks undermining the overall tax compliance culture as businesses and individuals may choose to evade taxes believing they will benefit from waived penalties and interests," the report warned.

Monitor upcoming amendments

To improve tax collection, experts urged MPs to closely monitor upcoming amendments to tax laws, particularly concerning VAT, which the Treasury is considering reducing to 14 per cent.

They emphasised that these planned changes warrant careful scrutiny, as VAT has historically accounted for a significant share of tax expenditures.

Moreover, the experts recommended that the KRA's systems be fully integrated with county and government entities.

Many ministries and counties currently operate outside the Integrated Financial Management Information System (IFMIS), leading to revenue losses.

PAYE arrears have reached Sh97 billion, primarily attributed to public sector entities.

Reports from the Controller of Budget have consistently highlighted inconsistencies between payroll databases and IFMIS as potential sources of revenue collection issues.

Top Stories Today