Kenyan households’ wages remain stagnant as cost of living rises - Study

A notable portion of households, 55 per cent, have experienced stagnated income year-to-date.

A significant number of households in Kenya are grappling with stagnant wages in an economy marked by an ever-rising cost of living.

According to a study by the fund management company ICEA Lion on Kenyan households, many families say their incomes have not kept pace with the economic shifts, leading to financial strain and uncertainty.

More To Read

- We just want to survive: Small traders plead for lower taxes, fuel prices and honest governance

- Increased food, energy costs push inflation to 4.1% in April

- Raila demands justice for police brutality victims as ODM seeks to revamp grassroots support

- Survey: Kenyans switching to cheaper lifestyles as financial strain worsens

- CBK projects cheaper fuel in 2025 will ease burden on businesses, households

- Relief for consumers as commodity prices are set to fall 5 per cent next year

Dubbed the 'Consumer Spending Index' for the third quarter of this year, the survey report notes that a notable portion of households, 55 per cent, have experienced stagnated income year-to-date, exacerbating the challenges posed by rising prices for essentials such as food, housing and healthcare.

On the other hand, 26 per cent of the surveyed respondents reported an increase in their income while 19 per cent reported a decrease.

"Although the majority of individuals reported that their income remained the same, workers in the wholesale and retail sector reported the highest decrease at 26 per cent," the report says.

"Conversely, people working in the manufacturing and trade sector saw the highest increase, with 30 per cent of respondents reporting an increase in income."

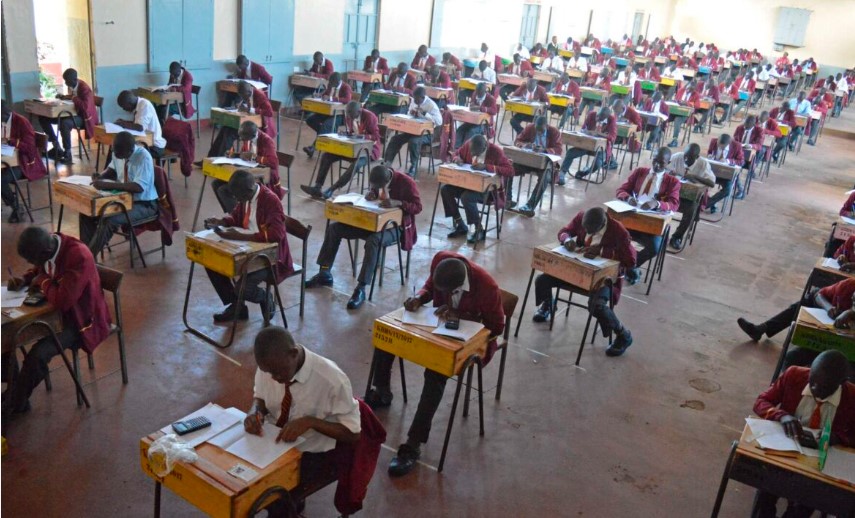

Notably also, 26 per cent of people working in the education/training sector reported an increase in their income whereas 10 per cent reported a decrease.

The hotel, tourism and leisure sector saw 19 per cent of the respondents note an increment while 22 per cent noted a decrease.

Nevertheless, 21, 26 and 31 per cent of respondents from transport, real estate and other sectors, respectively, reported an increment in wages over the past year.

On the contrary, 19, 16 and 17 per cent of the respondents working in the respective aforementioned sectors reported a decrease in wages.

Most respondents who reported a decrease in their wages largely attributed it to poor performance in their businesses or investments, accounting for 44 per cent.

The second most common reasons cited for decreased income were increases in taxes and job losses, both at 22 per cent.

Pay cuts were the least mentioned cause, representing only 11 per cent.

On the other hand, respondents who reported an increase in wages attributed the gain mainly to getting a side job, at 28 per cent and a salary increment at 26 per cent.

As inflation continues to impact daily expenses, the fund manager says households surviving on constrained incomes are reportedly adopting various survival strategies to make ends meet.

"In response to rising prices, the majority of respondents (29 per cent) cut out non-essential spending, while (23 per cent) dig into their savings," the report reads.

"Additionally, (20 per cent) have reduced quantities of essential (non-discretionary) spending."

The International Labour Organisation (ILO) recently highlighted a year-on-year decline in monthly wages worldwide as a cause for concern, with recent report figures showing a significant drop in real monthly wages.

The report estimates that global monthly wages fell in real terms to (–0.9) per cent in the first half of 2022, the first negative global wage growth recorded since 2008.

"This erosion of real wages comes on top of some significant wage losses incurred by workers and their families during the Covid-19 crisis," the organisation says.

"Although average wages increased globally by 1.5 per cent in 2020 and by 1.8 per cent in 2021, the increase in 2020 at the height of the pandemic was largely due to job losses and the change in the composition of employment in some large countries, such as the United States of America."

In Africa, data by the organisation suggests a sharp fall in real wage growth of (–10.5) per cent in 2020 and thereafter real wage growth of (–1.4) per cent in 2021 and (–0.5) per cent in the first half of 2022.

ILO reckons that the falling in real incomes are particularly hard for the poorer households which risk slipping into poverty and food and energy insecurity.

"Globally, 241 million working people make less than $2.15 (Sh280 at the current exchange rate) a day, meaning they and their families live in extreme poverty," it notes.

Top Stories Today