MPs slam banks for focusing on bonds while Kenyan MSMEs struggle

MPs accused banks of abandoning their role in supporting start-ups and small businesses in favour of the lucrative but less impactful investments in government bonds.

A parliamentary committee has criticised commercial banks for over-investing in government securities, arguing that this focus on low-risk returns is depriving micro, small, and medium-sized enterprises (MSMEs) of the vital cash flow they need to thrive.

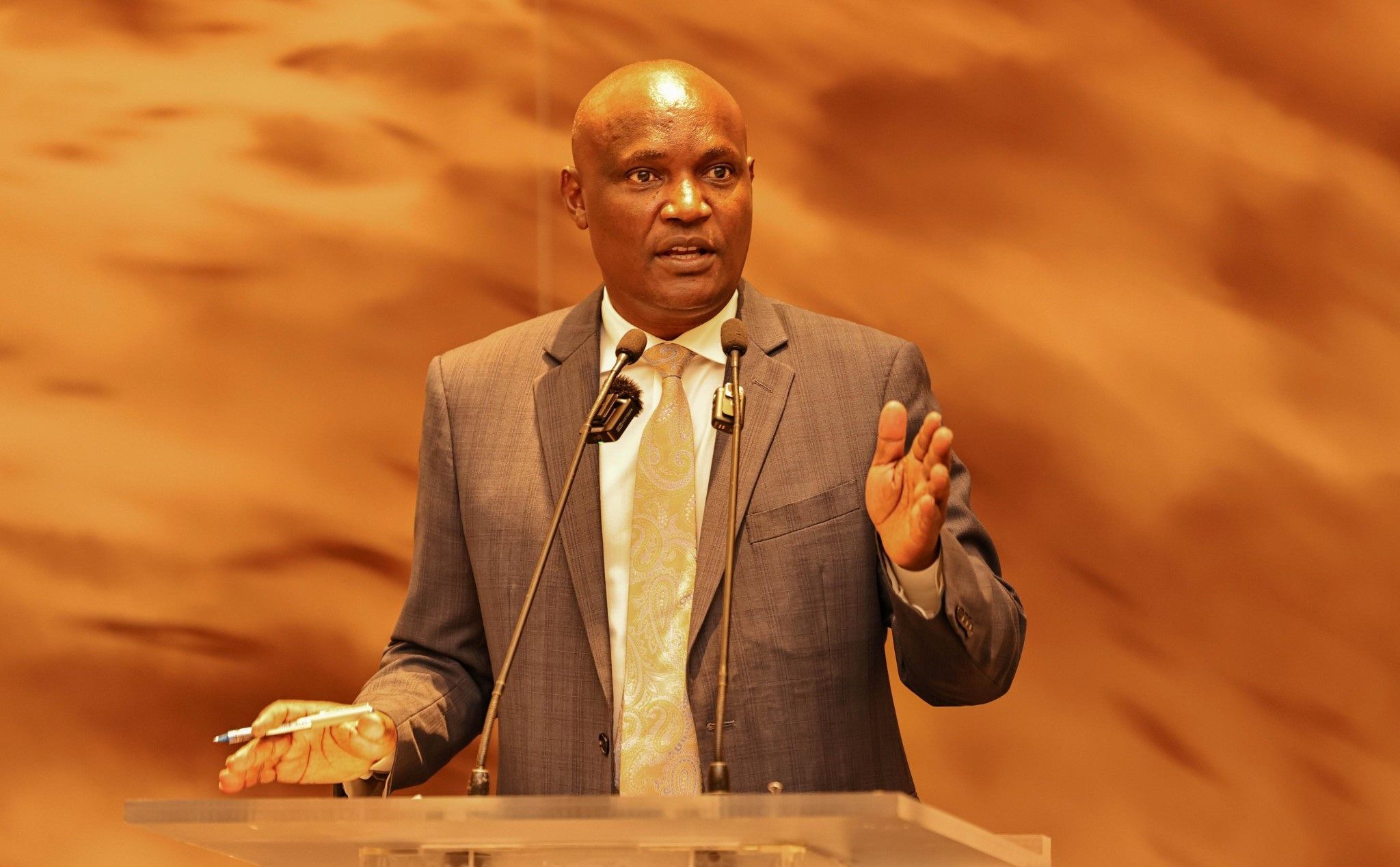

During a heated session with the Kenya Bankers Association (KBA) on Wednesday at the KICC Amphitheatre, lawmakers, led by the Finance and National Planning Committee Chairperson Kuria Kimani accused banks of abandoning their role in supporting start-ups and small businesses in favour of the lucrative but less impactful investments in government bonds.

More To Read

- How collaboration is redefining Kenya's e-commerce playbook

- SMEs sound alarm over rising failure rates amid investment gaps

- Kenyan banks pay Sh194.8 billion in taxes despite slower growth, high costs - report

- Senate sets stage for tough action against counties with undeclared bank accounts

- Banks urge CBK to cut base rate to spur private sector lending

- Counties face tightened oversight as Controller of Budget gains access to bank accounts

The committee's reaction followed a proposal from KBA seeking to extend the timeline for increasing core capital in banks, arguing that the current three-year window was too short for many banks to meet the new capital requirements.

"The proposal to raise Sh1 billion every year over the next eight years, as opposed to three years, is a more reasonable approach. The current timeline could trigger a run on 24 banks, making them less attractive to strategic investors," said Raimond Molenje, the acting CEO of KBA.

However, the committee was less sympathetic to the banks' concerns about meeting the capital requirements.

Instead, they directed their frustration towards the banks' prioritisation of government securities.

Return to core business

"What challenges would you face if you were to raise the required core capital? You cannot just be collecting deposits from the public and then, instead of supporting your depositors, many of whom are running start-ups or MSMEs, you prioritise investing in government securities," Kimani said, insisting on the need for banks to return to their core business of supporting small businesses.

MP Benjamin Langat, the committee's vice-chairperson, echoed these sentiments, pointing out that many banks had shifted focus away from lending to start-ups and MSMEs in favour of government bonds, thus neglecting an essential segment of the economy.

"Some KBA members have long stopped lending to start-ups and MSMEs, concentrating instead on government securities. We need to find a way to discourage banks from abandoning their traditional role of lending to businesses," he said.

The issue of high interest rates was also raised by members of the committee.

"When do we expect to see single-digit interest rates on credit facilities offered by banks?" asked Kitui Rural MP David Mboni.

This was in reference to the burden that high borrowing costs place on businesses, particularly MSMEs which are often unable to access affordable financing.

Tax relief proposal

Another contentious issue was KBA's proposal for tax relief on green bonds, which was met with resistance from lawmakers.

Turkana South MP John Ariko Namoit suggested that green bonds, despite their lucrative returns, should not be exempted from taxation.

In response to the committee's criticisms, KBA acknowledged the concerns and reassured lawmakers of their commitment to supporting MSMEs.

Molenje explained that the banking sector had committed Sh150 billion to MSME financing over the next three years, a figure that represented a doubling of the previous commitment of Sh75 billion.

"We are fully committed to supporting MSMEs by providing more affordable credit to foster their growth and development," Molenje said.

KBA also addressed the issue of interest rates, pledging to lower them but noted that this would require the government to settle outstanding payments to suppliers to help ease the cost of credit.

Meanwhile, the National Treasury, in its latest annual borrowing plan for the Financial Year 2024- 2025 has signalled a move to reduce the dominance of banks in the government securities market by introducing non-bank financial institutions as potential investors.

The goal is to broaden the investor base, which is currently dominated by commercial banks holding Sh2.7 trillion in Treasury bonds 44.8 per cent of all outstanding long-term government securities.

This diversification effort aims to tame the high interest rates that investors demand from government bonds and introduce more competition into the market.

Top Stories Today