Counties under pressure as Treasury moves to curb misuse of funds with new single account system

While county leaders have raised concerns over losing financial independence, senators proposed a hybrid system, where the Treasury can monitor balances without interfering with county operations.

County governments have come under renewed scrutiny as the National Treasury rolls out the Treasury Single Account (TSA) system, a key reform aimed at tightening financial controls and enhancing transparency in the management of public resources.

The Central Bank of Kenya (CBK) will oversee the new system, which consolidates all government revenues and receipts into a centralised structure, marking a shift away from the current fragmented framework where counties maintain hundreds of commercial bank accounts.

More To Read

- Treasury CS John Mbadi faults parastatals for prioritising profits over public service

- EACC busts Sh10.5 million bribery ring at Treasury, arrests four officials

- Treasury CS Mbadi tells IEBC to cut costs, reuse equipment to curb rising election expenses

- PSs told to submit petty cash audit reports by August 14

- Universities Fund faces Sh9.6 billion deficit as pending bills soar to Sh72.2 billion

- EACC recovers Sh67 million fraudulently paid as irregular allowances to Treasury official

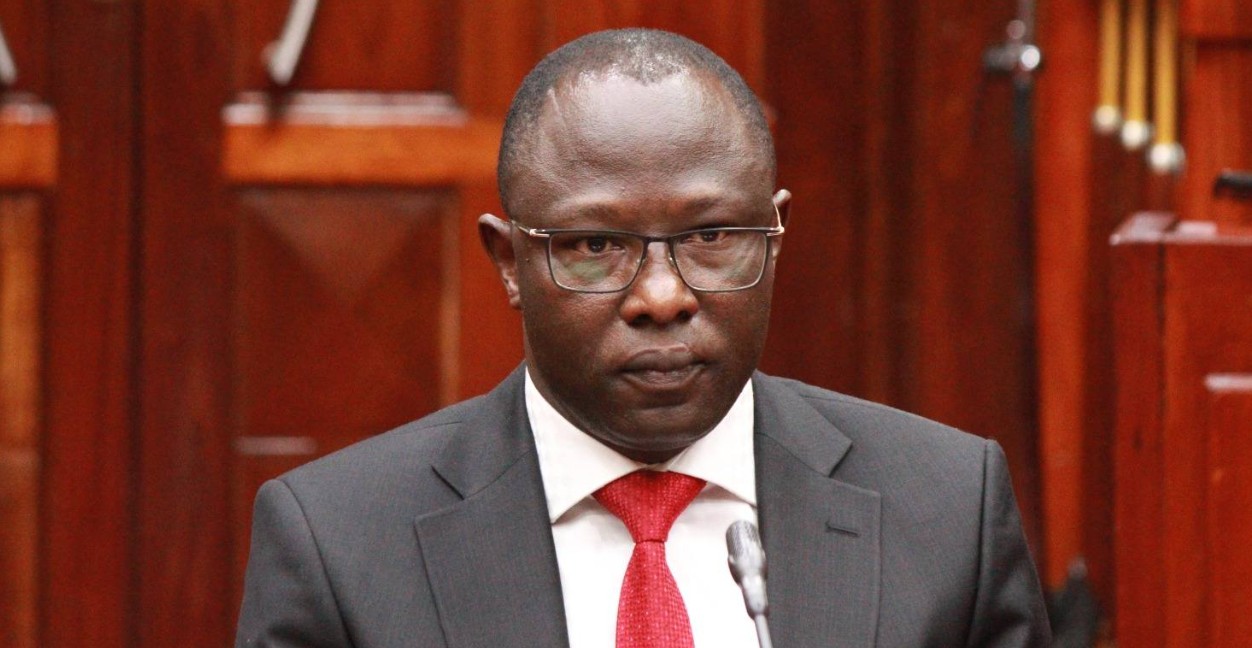

Appearing before the Senate Standing Committee on Devolution and Intergovernmental Relations on Thursday, Treasury Cabinet Secretary John Mbadi said counties must align with the TSA policy, which seeks to streamline public finance operations and reduce opportunities for misuse.

“The implementation of this policy is part of the broader Treasury Single Account action plan that is expected to improve financial governance and control over public funds. The primary goal of the policy is to ensure accountability and transparency in the use of public resources,” Mbadi told senators.

His remarks followed the submission of a report by the Controller of Budget (CoB), which revealed that counties currently operate 1,854 commercial bank accounts in breach of the Public Finance Management Regulations, 2015. The CoB warned that the practice undermines transparency and hampers effective budget tracking.

In response, senators urged the Treasury to develop a county-specific TSA framework in consultation with the Council of Governors and relevant Senate committees.

Committee Chair Mohamed Abbas said the move should balance fiscal discipline with county autonomy.

“Hon. Mbadi, your Ministry needs to review the existing regulations to provide clarity on the requirements for county governments to open commercial bank accounts, and explore options to compel full disclosure of all accounts,” Mohamed said.

President William Ruto had earlier criticised the practice of parking public funds in commercial banks, where individuals benefit from interest earnings.

“Government funds are banked in commercial bank accounts, and individuals keep earning interest. This must stop. All the benefits of public funds must only accrue to the people of Kenya and no one else,” he said during a Cabinet meeting that approved the TSA rollout.

While county leaders have raised concerns over losing financial independence, senators proposed a hybrid system, where the Treasury can monitor balances without interfering with county operations.

Mbadi assured lawmakers that the TSA framework will be designed to respect devolution while tightening loopholes that have allowed for wastage, fraud, and inefficiencies in county public finance management.

Top Stories Today