Kenya’s economy projected to grow by 5 per cent in 2025, easing cost of living pressures

The Treasury’s projection of 5.3 per cent growth in 2025 is slightly lower than the CBK’s December 2024 forecast of 5.5 per cent.

Kenya’s economy is projected to grow by 5 per cent in 2025, with the National Treasury citing improved macroeconomic stability, easing inflation and a stabilised exchange rate.

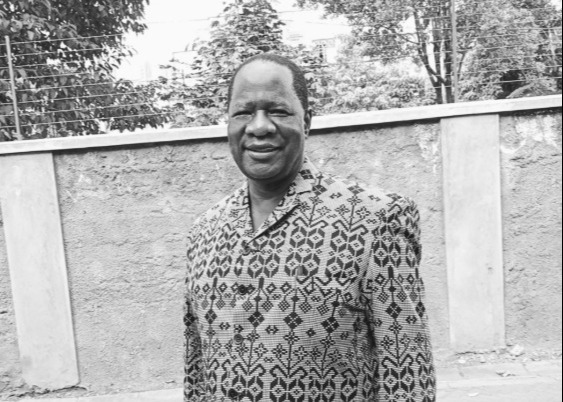

Speaking at the Diamond Trust Bank Economic Forum, Treasury Principal Secretary Chris Kiptoo highlighted key indicators pointing to economic resilience.

More To Read

- Kenya borrowing Sh3.4 billion every day- MP Ndindi Nyoro

- Kenya deviates from debt plan, risks debt trap amid soaring interest payments – CoB

- State agencies owe Sh6 billion in unpaid statutory deductions, Treasury warns

- 1,420 public agencies now on government’s e-procurement platform

- SMEs warn soaring prices of raw materials, costly licences threaten survival

- Foreign workers in Kenya remitted home Sh91 billion - CBK

He noted that interest rates were easing, with the Central Bank of Kenya (CBK) cutting the Central Bank Rate (CBR) to 10.75 per cent, while commercial banks had lowered lending rates to boost private sector credit.

“Kenya’s economy is strong, and we have always overcome the challenges we face. Inflation has come down. A 2kg packet of sugar or maize has seen a huge reduction in prices,” Kiptoo said.

“Through monetary policy, the Central Bank has been making adjustments to CBR rates and cash rates to increase liquidity in banks, and we now see banks adjusting interest rates,” he added.

However, Kiptoo acknowledged that the budget deficit, projected at Sh862.7 billion, remains a challenge, with revenue collection falling short by Sh92.6 billion in January.

“We still need to balance the budget. We have challenges because of revenue-raising measures to match our expenditure. But we have seen good progress,” he said.

The Treasury’s projection of 5.3 per cent growth in 2025 is slightly lower than the CBK’s December 2024 forecast of 5.5 per cent. In a statement on December 5, CBK estimated the economy would grow by 5.5 per cent in 2025 and 5.1 per cent in 2024, supported by resilient service sectors, agriculture, and improved exports.

According to the draft 2025 Budget Policy Statement, the economy slowed in the first half of 2024, with real GDP growth averaging 4.8 per cent compared to 5.5 per cent in the same period of 2023. Growth further dropped to 4 per cent in the third quarter of 2024, down from 6 per cent in the corresponding period of 2023, marking the slowest expansion in four years.

The decline was attributed to contractions in key sectors such as construction, mining, and quarrying.

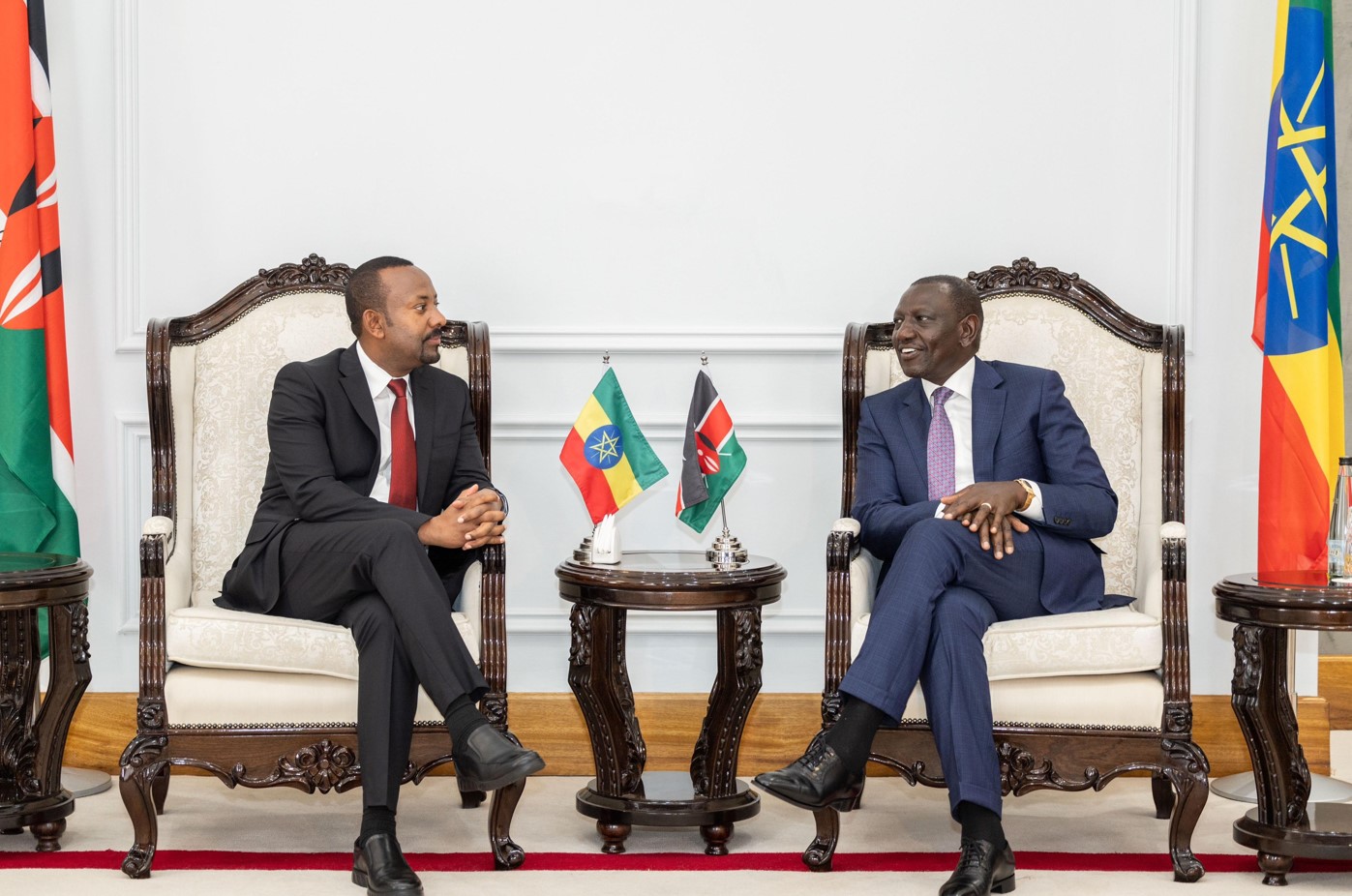

“Economic growth is estimated to have slowed to 4.6 per cent in 2024 from 5.6 per cent in 2023, reflecting a deceleration of economic activity in the first three quarters of 2024 and the slowdown in private sector credit growth to key sectors of the economy,” Treasury Cabinet Secretary John Mbadi said.

“Growth is expected to pick up to 5.3 per cent in 2025 and maintain that momentum over the medium term, largely driven by enhanced agricultural productivity, a resilient services sector, and the ongoing implementation of priorities under Bottom- Up Economic Transformation Agenda (BETA),” he added.

In 2021, Kenya’s economic growth peaked at 7.6 per cent, recovering from a low of 0.3 per cent in 2020 due to the Covid-19 pandemic. The country recorded growth rates of 5.1 per cent in 2019, 4.9 per cent in 2022, and 5.6 per cent in 2023.

However, in late 2024, the International Monetary Fund (IMF) revised Kenya’s Real GDP growth projection downward to 5.0 per cent for 2024 and 2025, making it the only middle-income country in Africa that the Bretton Woods institution did not predict would recover in 2025.

Globally, growth in advanced economies is projected to remain stable at 1.8 per cent in 2024 and 2025, up from 1.7 per cent in 2023.

In the United States, growth is forecast at 2.8 per cent in 2024 due to stronger consumption and non-residential investment, with a slowdown to 2.2 per cent in 2025 as fiscal policies tighten and labour market demand cools.

The euro area is expected to experience a recovery driven by improved export performance, stronger domestic demand, rising real wages, and a gradual easing of monetary policy.

In contrast, Japan’s growth is projected to slow due to temporary supply disruptions and the fading impact of one-off factors that boosted activity in 2023, such as a surge in tourism.

Top Stories Today

Reader Comments

Trending