Kenya launches Islamic finance association to unlock growth in Sharia-compliant banking

Spearheaded by Absa Bank, the new umbrella body seeks to close regulatory and operational gaps that have long slowed the sector’s growth.

Kenya has taken a significant step toward strengthening its Islamic finance sector with the launch of the Association of Shari’ah Compliant Service Providers of Kenya.

Spearheaded by Absa Bank, the new umbrella body seeks to close regulatory and operational gaps that have long slowed the sector’s growth.

More To Read

- Absa opens 87th branch in Kawangware to boost banking access in Nairobi's outskirts

- Absa unveils first fully mobile Shariah-Compliant banking platform

- Kenya moves closer to crypto regulation as MPs back joint oversight of digital asset sector

- Kenya moves to modernise investment, pest control laws

- Foreign investor outflows at NSE hit Sh16.6 billion in Q4 on political instability

- State mulls over new platform to allow 'hustlers' invest in Treasury bonds and bills

Although Islamic finance has expanded steadily over the past 20 years, progress has been hampered by fragmented legal frameworks and limited awareness.

“Over the last 20 years, we have had Islamic Banking, which was pioneered by Absa. However, despite making a lot of strides forward, we've had huge gaps,” said Tego Wolasa, head of Islamic Banking at Absa Bank Kenya.

A key mandate of the new association is to lobby for a dedicated legal and regulatory framework that recognises the unique operating model of Islamic finance.

“In Kenya, we do not have an Islamic banking Act or any law governing Islamic finance in general, from banking to insurance, to Islamic pensions, to the Islamic capital market,” Wolasa added.

Seek exemptions

Currently, banks offering Islamic products must seek exemptions from sections of the Banking Act that prohibit full trading in goods and services. Experts at the launch in Nairobi noted this creates a fundamental challenge for Shari’ah-compliant banking.

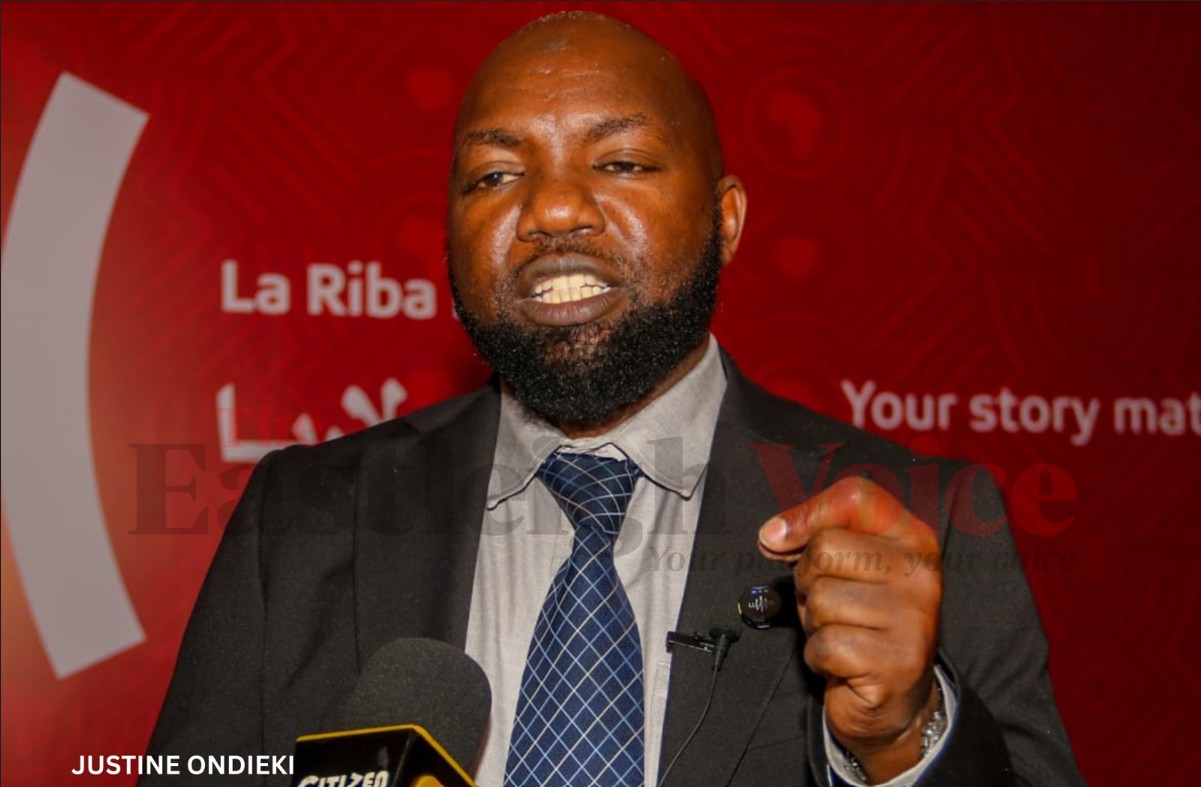

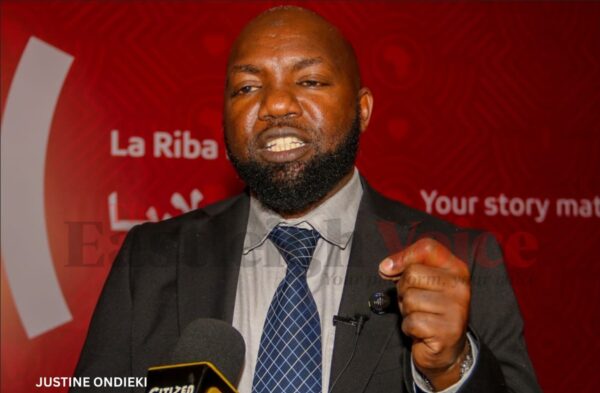

ABSA Kenya’s Head of Islamic Banking Tego Walosa speaks during the launch of the association of Islamic finance practitioners in Nairobi on August 19, 2025. (Photo: Justine Ondieki)

ABSA Kenya’s Head of Islamic Banking Tego Walosa speaks during the launch of the association of Islamic finance practitioners in Nairobi on August 19, 2025. (Photo: Justine Ondieki)

The association will also address liquidity management hurdles that prevent Islamic banks from fully participating in conventional interbank markets, while working to build a broader financial infrastructure.

The Capital Markets Authority (CMA), represented at the event, welcomed the initiative but stressed the need for stronger coordination.

“The issue is not lack of interest, it is lack of alignment,” said Justus Agoti, senior manager for market deepening at CMA.

Beyond regulation, challenges such as low awareness and uptake remain pressing. Despite Kenya’s six million Muslims, less than 10 per cent use Shari’ah-compliant banking, according to Wolasa.

Education and capacity-building

To change this, the association plans to roll out education and capacity-building initiatives, including a standardised certification framework for Islamic finance professionals.

At present, Kenya lacks a unified system for qualifying scholars or practitioners, leading to inconsistencies across institutions.

Drawing from models in Malaysia and the Gulf, the body also intends to promote talent development, research, and data-driven policy advocacy as part of long-term infrastructure building.

With the association now officially incorporated, expectations are high for its impact. Wolasa is optimistic about the sector’s outlook, projecting rapid growth in the coming years.

He predicts that within two years, Islamic banking in Kenya will surpass the one million customer mark and secure a stronger foothold in the financial market.

“We are very confident that the regulatory framework will be in place. There will be a lot in terms of knowledge gap, and then there will be a lot in terms of awareness,” he said.

He also noted that more players are joining the space: “The fintech sector is also gaining strong momentum,” Wolasa added, pointing to growing activity in pensions, insurance, and investment banking.

Top Stories Today