Savannah Clinker withdraws Sh27.7 billion bid for Bamburi Cement

As the dust settles, Bamburi Cement's shareholders will now face a pivotal decision, with the Amsons offer standing as the only remaining option.

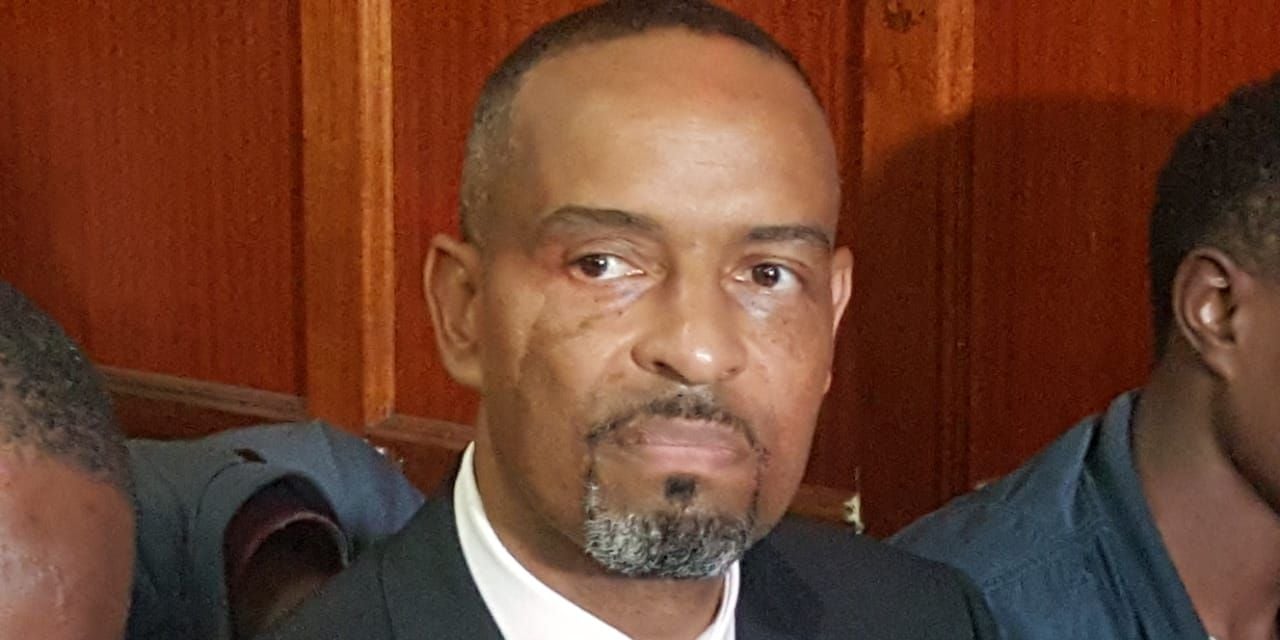

Businessman Benson Ndeta has abandoned his bid to acquire Bamburi Cement, a move that removes competition for the Tanzania-based Amsons Group, which had previously made a lower offer.

Ndeta's firm, Savannah Clinker, had proposed a Sh27.7 billion buyout of the Nairobi Securities Exchange-listed cement giant, equating to Sh76.55 per share.

More To Read

However, the bid was withdrawn on Wednesday, following a withdrawal of support from its financier, Global Infrastructure Finance & Development Authority Inc (GIFDA).

According to a statement from the Capital Markets Authority (CMA), the exit of Savannah Clinker means that Amsons' offer, valued at Sh23.5 billion or Sh65 per share, remains the only valid offer for Bamburi Cement.

"Following this development, shareholders of Bamburi Cement who had accepted the offer by Savannah Clinker Limited have until 5 pm on Thursday, December 5, 2024, to reconsider their decision," the statement read.

The regulator further clarified that shareholders who do not change their minds will be assumed to have rejected Savannah Clinker's offer and will remain shareholders in Bamburi Cement.

Savannah's withdrawal follows Ndeta's recent legal troubles, which appear to have undermined the financing for his proposed acquisition.

The businessman was arrested and later released in connection with an alleged $35 million (Sh4.5 billion) loan fraud involving Absa Bank Kenya.

This scandal, coupled with the CMA's rejection of a request from Savannah Clinker for a 60-day extension of the offer period, appears to have triggered the sudden pullout.

"The withdrawal of the competing offer has been occasioned by the recent well-publicised arrest and indictment of the chairman and main shareholder of Savannah Ndeta), which has led to the financier of the competing offer seeking additional due diligence," Savannah Clinker explained in a statement.

"This is further compounded by the CMA's decision to decline a request made on December 2, 2024, to extend the offer period by 60 days," it read further.

Ndeta had initially secured the backing of GIFDA, which markets itself as a non-profit financier focused on infrastructure projects.

However, the firm's sudden hesitance to proceed with the bid suggests that the legal issues surrounding Ndeta have cast doubt on the viability of the offer.

The withdrawal of Savannah Clinker marks a rare instance in which a rival bidder has walked away from an acquisition of a firm without either completing the takeover or reaching a settlement with competing bidders.

This leaves Amsons Group as the sole bidder for Bamburi Cement.

As the dust settles, Bamburi Cement's shareholders will now face a pivotal decision, with the Amsons offer standing as the only remaining option.

The outcome of this saga could have huge implications for the future of the cement giant, as well as for the wider East African business landscape.

Top Stories Today