Financial crisis looms for 26 counties as Controller of Budget rejects budgets citing irregularities

Eighteen counties had their budget documents returned for failing to link allocations to specific projects, disguising recurrent expenses as development plans, and withholding planning documents.

Counties across the country, including Nakuru, Kisumu, Uasin Gishu, Bungoma and Narok, are bracing for a financial crisis after the Controller of Budget (CoB) rejected 26 county budgets, citing illegal allocations, disguised expenditures and missing documents.

CoB Margaret Nyakang’o said her office declined to approve the 2025/26 budgets of the affected counties, effectively blocking cash disbursements and leaving operations at risk.

More To Read

- Senators defend constitutional right to summon governors, hit back at Raila

- KNUT rejects Raila's proposal to devolve education

- Raila urges Parliament to grant automatic pensions for two-term governors

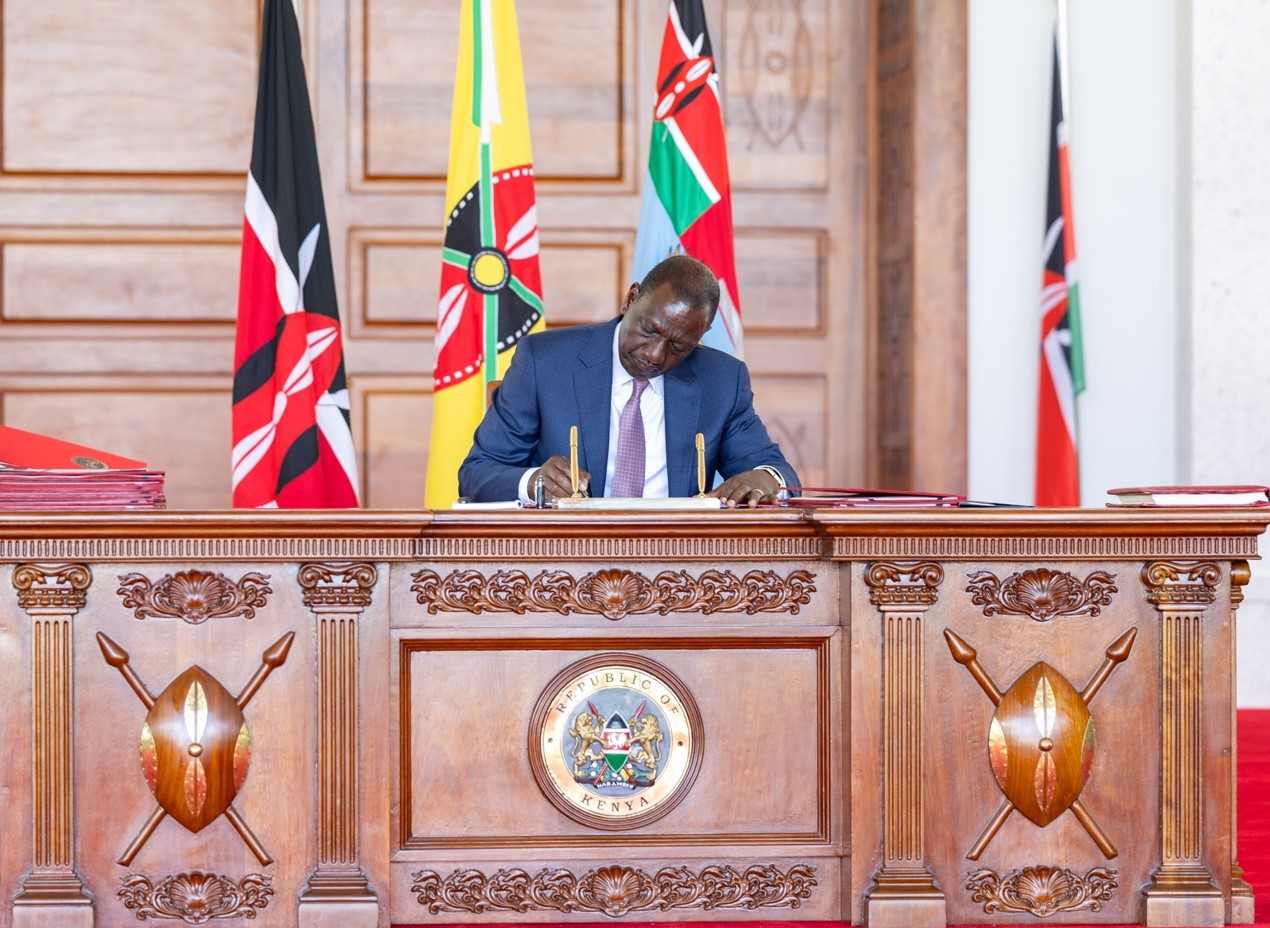

- All 14 devolved functions, assets fully transferred to counties, Ruto says

- Counties given until Friday to submit pending bills clearance plans, CoB warns

- Controller of Budget warns of funding delays as counties miss budget deadlines

Eighteen counties had their budget documents returned for failing to link allocations to specific projects, disguising recurrent expenses as development plans, and withholding planning documents. A further six counties failed to submit their approved budgets by Tuesday’s deadline and therefore could not be funded.

“Only the cleared ones are sent to IFMIS and can therefore requisition funds. The ones with comments mean that we came across non-compliance in the submitted budget and wrote back to the county to explain themselves and commit to correcting any shortcomings within the timelines provided,” Nyakang’o said.

Other counties flagged for non-compliance include Nakuru, Uasin Gishu, Bungoma, Narok, Bomet, Busia, Kajiado, Kisumu, Kericho, and Garissa. Kericho’s documents are still under review, while Isiolo’s were referred to the CoB’s legal department. Wajir, Mandera, Meru, Nyandarua, Trans Nzoia, and Siaya did not submit their approved budgets by Tuesday.

The stalemate now threatens to trigger salary delays, pending bills to suppliers and contractors, and shortages of medicines and medical kits in hospitals.

Quoting the law, Nyakang’o said: “Section 104 (1) of the County Government Act, 2012 stipulates that a county government shall plan for the county and no public funds shall be appropriated outside an approved planning framework.”

She explained that counties are required to present the County Integrated Development Plan (CIDP), the Annual Development Plan, and the County Fiscal Strategy Paper (CFSP) before their budgets can be approved. A CIDP serves as a five-year development blueprint, while a CFSP outlines revenue, expenditure, and fiscal policy directions for the coming financial year. Despite this requirement, the CoB said most of the counties flagged for non-compliance submitted their documents only this month.

The delay in submission, she added, contributed to the lack of disbursements in July.

“There is no way they would have spent any funds. Even after releasing the July disbursement, very few have requisitioned even salaries to date,” she said.

Treasury Cabinet Secretary John Mbadi confirmed that the July allocations were already transferred to the County Revenue Fund (CRF) on August 11, but stressed that counties cannot access the funds until their budget issues are resolved.

“By June 26, the National Treasury had released all the money to cover FY 2024/25, and we sent the July allocations to the CRF on August 11. Treasury has now become timely in sending money, that’s why counties are not complaining,” Mbadi said, adding that only the August disbursement was pending.

The CoB’s review further faulted counties for failing to submit programme-based budgets with details such as project locations, objectives, and cost estimates.

“Information on the geographical location of projects is necessary in ascertaining equity in resource allocation across the county. It would also facilitate the monitoring of projects in a transparent manner,” her office said.

She also noted that some counties disguised recurrent expenditures as development spending to meet the legal threshold requiring at least 30 per cent of budgets to go to development.

Other Topics To Read

- National

- budget allocations

- Controller of Budget Margaret Nyakang'o

- Controller of Budget counties

- counties devolution

- Office of the Controller of Budget

- county expenditures. Controller of Budget

- Financial crisis looms for 26 counties as Controller of Budget rejects budgets citing irregularities

- Headlines

“Development expenditure is expenditure for the creation or renewal of assets. Further, to ascertain whether a budget estimate has met the 30 per cent rule, there is a need to analyse the development expenditure items to eliminate items which appear recurrent in nature,” Nyakang’o explained.

Among the items wrongly classified as development were Members of County Assembly (MCAs) and county staff car and mortgage loans, bursaries and scholarships, foreign travels, benchmarking trips, consultancy services, and procurement of medical supplies.

“Allocation to a bursary and scholarship or any fund where there is no recovery of dispatched funds and does not go to specific development projects, such as a fund for the aged. Allocation for procurement of medical drugs, publicity, advertisement, and general awareness campaigns, and purchase of motor vehicles/office furniture/computers/software, unless under a development programme,” the CoB added.

Her office also directed counties to avoid duplicating national government functions without formal agreements, allocate adequate resources to maintain basic services, keep their wage bills below 35 per cent of revenues, and restrict emergency funds to a ceiling of two per cent of total budgets.

Top Stories Today

Reader Comments

Trending