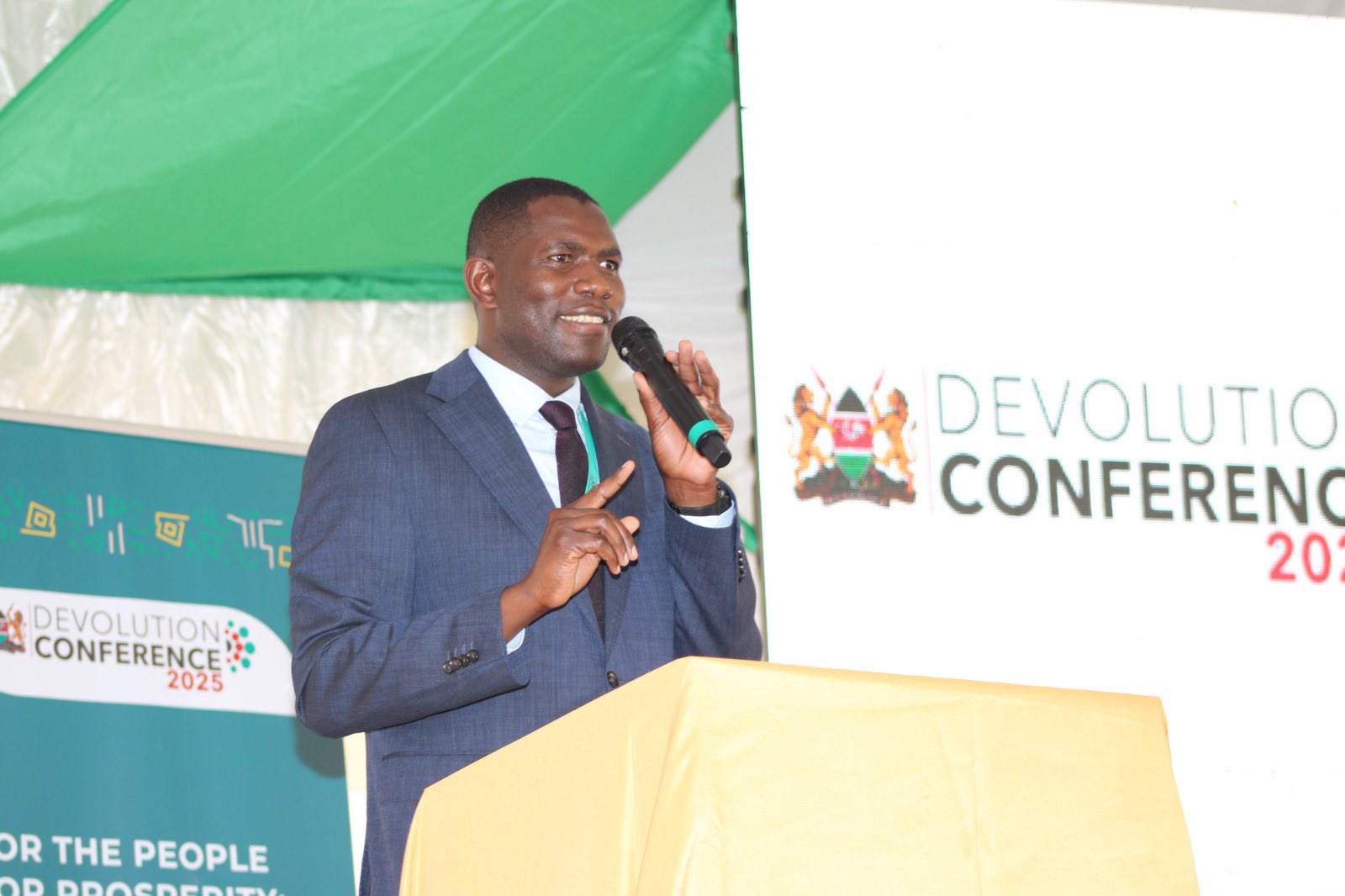

Treasury CS warns counties on growing Sh103 billion pension debt, calls for reforms

Speaking at the devolution conference in Homa Bay, Mbadi said the surge in pension debt owed by counties, which has increased from Sh23.3 billion to over Sh103 billion in recent years, was a major concern.

Treasury Cabinet Secretary John Mbadi has raised concerns over fiscal inefficiencies in counties, calling on county governments to fully adopt e-procurement and comply with Public Finance Management (PFM) reforms to strengthen accountability in public finances.

Speaking at the devolution conference in Homa Bay, Mbadi said the surge in pension debt owed by counties, which has increased from Sh23.3 billion to over Sh103 billion in recent years, was a major concern.

More To Read

- Gitobu Imanyara: Why President Ruto does not believe in devolution

- Leaders at Devolution Conference raise alarm over suppression of dissent, rights violations

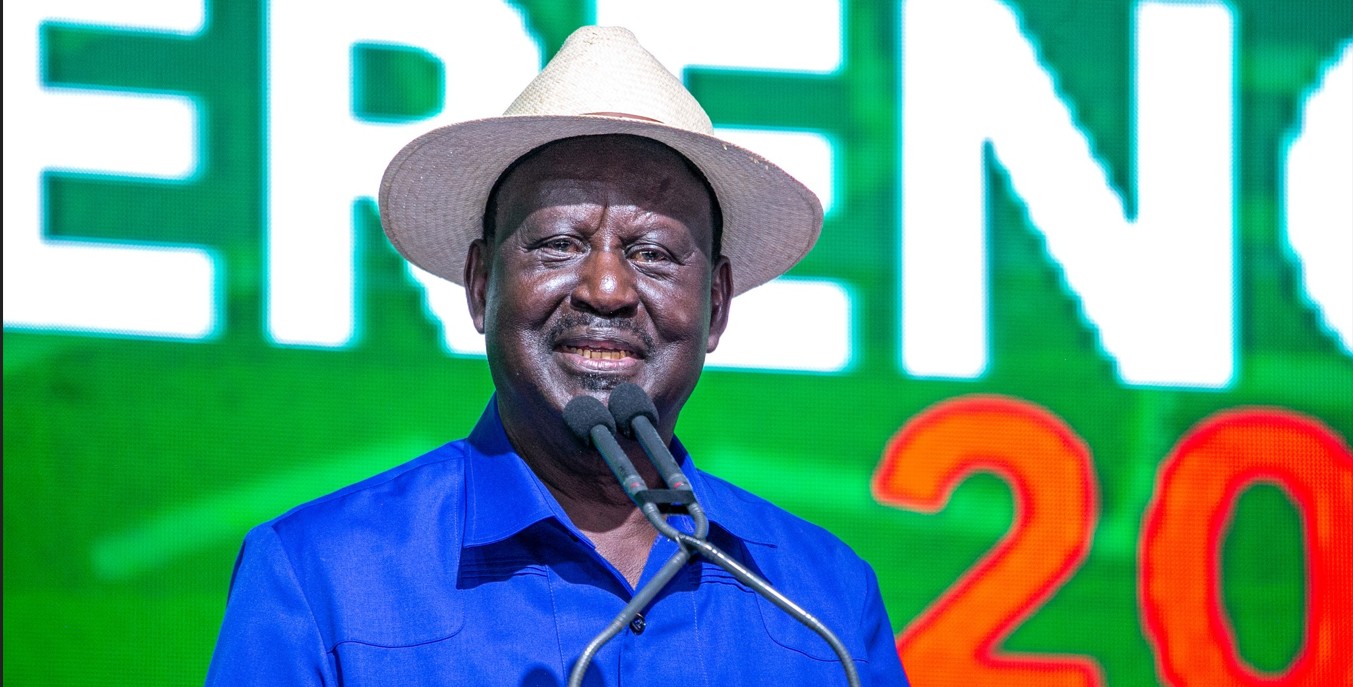

- Raila pushes for expanded devolution, says counties should run schools and local infrastructure

- Raila urges Parliament to grant automatic pensions for two-term governors

- Audit uncovers State agencies overspending on salaries despite staff shortages

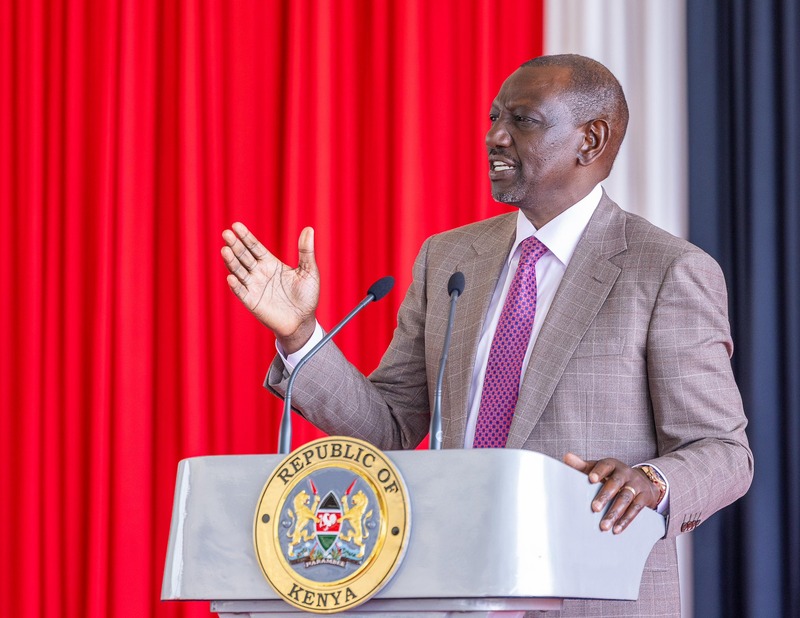

- All 14 devolved functions, assets fully transferred to counties, Ruto says

Mbadi condemned the practice of withholding pension contributions, saying it is unjust and threatens the social security of retiring public servants.

"This is criminal. If you are supposed to pay a salary to a staff member, and part of that salary is supposed to go to a pension, there is no rationality in paying half the salary and keeping the rest. It is not fair. It is unjust,” Mbadi said.“Money belongs to people who will one day retire, and when they retire, they want to go home with something,” he added.

He urged both county and national governments to verify and clear pension arrears promptly, stressing that deductions must be remitted fully and on time.

The CS hailed devolution for bringing services closer to citizens and creating opportunities for inclusive job creation and equitable development across all 47 counties.

Mbadi noted that previously marginalised areas have benefited from improved infrastructure, health services, education, and economic opportunities, narrowing historical inequalities.

He, however, warned that the sustainability of these gains depends on effective financial management at both national and county levels. He stressed the importance of counties implementing the national policy on enhancing county revenue and rolling out tariff and rating policies.

The CS also highlighted delays by Parliament in passing the County Government Additional Allocation Bill, describing them as a perennial problem that has led to late disbursement of funds, disrupted services, and low absorption of allocated resources.

He urged Parliament to fast-track the bill to avoid further fiscal inefficiencies, which have resulted in additional costs, including commitment fees and foreign exchange charges.

“Delays have also led to fiscal inefficiencies, resulting in additional costs in the form of commitment fees and foreign exchange charges,” Mbadi warned.

Mbadi further called on counties to migrate to the Treasury Single Account (TSA) by 2026 to improve cash management, noting that transparency and accountability should be central to all financial operations.

He concluded that, when managed effectively, public finance becomes an engine for economic growth, ensuring that prosperity reaches every community across the country. He called for a renewed culture of transparency, fiscal discipline, and accountability to safeguard the welfare of public servants and sustain the benefits of devolution.

Top Stories Today