Ethiopia Central bank rolls out bi-weekly forex auctions as reserves surge

The decision to hold bi-weekly auctions followed discussions between NBE regulators and commercial bank executives on 31 March 2025 regarding foreign currency management reforms.

The National Bank of Ethiopia (NBE) has announced the launch of bi-weekly foreign exchange auctions.

According to the Central Bank’s statement, this decision aims to allocate a portion of the foreign exchange accumulated at the NBE to the private sector. The auctions will continue at least until the end of the current fiscal year.

More To Read

- Ethiopia unlocks banking sector to foreign investors in landmark reform

- Ethiopia’s Central Bank caps forex transaction fees to 4 per cent starting May 26

- Boost for Kenyan importers on adequate reserves and stable Shilling

- Ethiopia set to hold first dollar auction in decades to boost Birr

- Ethiopia's inflation rate drops by 9.4 per cent

- Kenya Power gets green light to charge some of its consumers in foreign currencies

The introduction of bi-weekly auctions follows the implementation of a market-based exchange rate regime, which replaced the crawling peg system on 28 July 2024. This reform is part of broader macroeconomic measures designed to correct long-standing economic distortions.

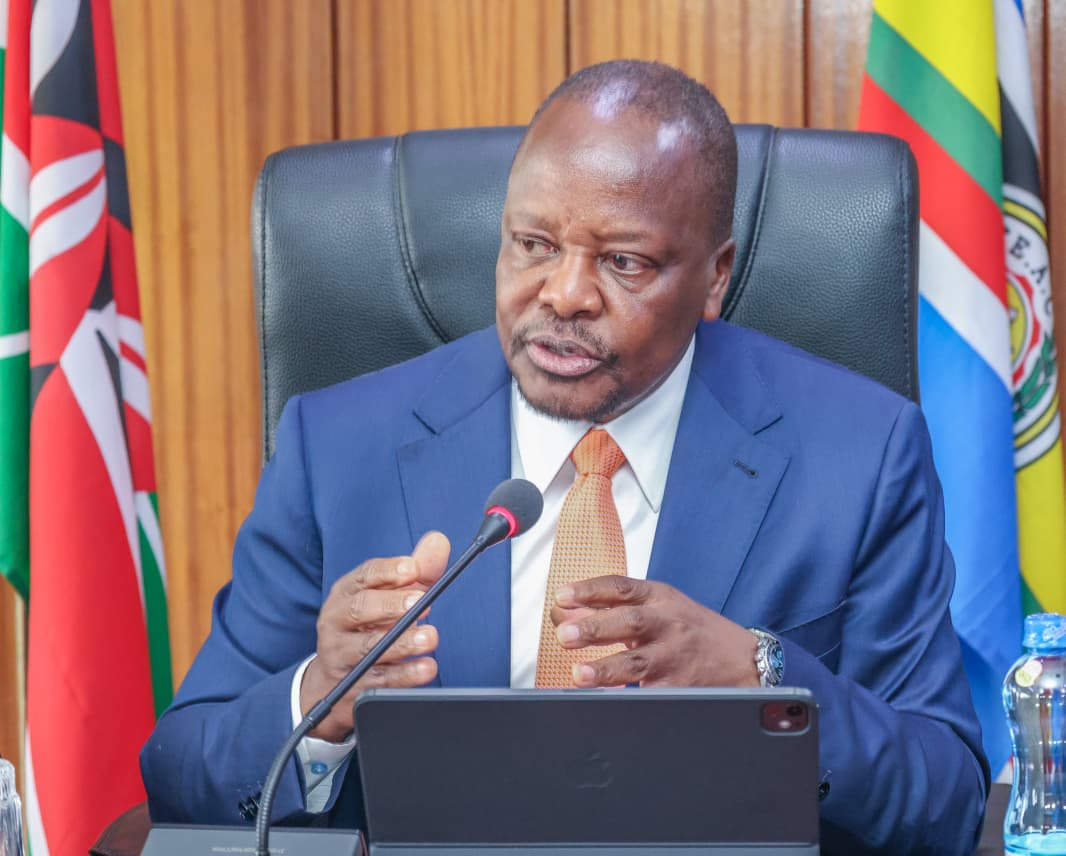

Explaining the rationale behind the decision, NBE Governor Mamo Mihretu stated that the reform has led to improved foreign currency inflows and a significant increase in the bank’s foreign exchange reserves.

“In the nine months since July, foreign exchange reserves have grown by 200%,” Mamo noted. “With three months remaining in the current fiscal year, the plan has been achieved.”

However, he acknowledged ongoing challenges in foreign currency management, affecting the public, businesses, and banks. “Some uncertainties have been observed, and it has been deemed timely to address and rectify these issues,” he added.

The decision to hold bi-weekly auctions followed discussions between NBE regulators and commercial bank executives on 31 March 2025 regarding foreign currency management reforms. During these discussions, directives were issued to address operational shortcomings and ensure stricter enforcement of regulations, according to the governor.

Mamo further disclosed that an agreement had been reached to make bank-imposed commission fees and service charges more reasonable, thereby facilitating an adequate supply of foreign currency.

In October 2024, Addis Standard reported that importers faced difficulties accessing allocated foreign currency. Businesses seeking foreign currency from banks raised concerns over delays in decision-making and procedural bottlenecks, particularly regarding the issuance of Letters of Credit (LCs).

Top Stories Today