Kenya to enforce local marine insurance for importers from July after system delays

The Insurance Regulatory Authority is working with the KRA to implement the new system, which is expected to enhance compliance and help local insurers benefit from the marine insurance business that has often gone to foreign companies.

Importers will now have to wait until July for the rollout of a directive requiring them to buy marine insurance from local providers, following a four-and-a-half-month delay caused by system challenges.

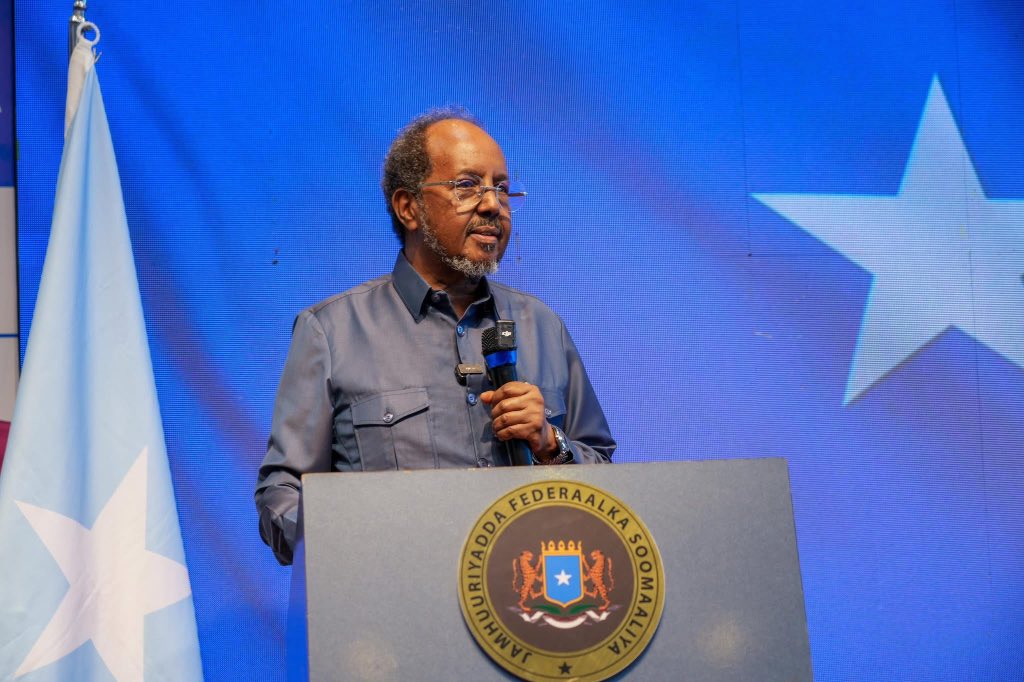

Insurance Regulatory Authority (IRA) Chief Executive Godfrey Kiptum said the rollout, which was meant to begin on February 14, was held back due to technical issues.

More To Read

- IRA deregisters 20 insurance brokers over non-compliance

- Kenyan insurers must disclose major cybersecurity breaches within 24 hours, regulator says

- Insurance Regulatory Authority reveals firms rejected Sh658 million in claims in first quarter of 2025

- IRA flags money laundering risks in life insurance, launches sector review after FATF grey listing

- Insurance fraud up 45% in Q3 2024, motor industry lead surge - regulator

- Capitalise on microinsurance for underserved to boost insurance coverage - IRA

The authority is working with the Kenya Revenue Authority (KRA) to implement the new system, which is expected to enhance compliance and help local insurers benefit from the marine insurance business that has often gone to foreign companies.

“This was to take off in February but has been delayed... We think we will roll it out in the month of July. There was a challenge with the system, but we are now ready,” Kiptum told journalists in Naivasha, as reported by the Business Daily.

The marine insurance policy protects goods from risks such as loss, theft, and damage during transportation by sea, air or land.

It also gives financial institutions confidence to lend to businesses importing goods, since the risks are covered.

Despite the law prohibiting importers from using insurers not licensed locally, through the Marine Insurance Act CAP 390 and the Insurance Act, compliance has remained low.

This is mainly because KRA has continued to clear goods regardless of whether the marine cover is sourced from a local or foreign firm.

KRA had indicated earlier this year that enforcement would require importers to obtain marine insurance digitally from local companies before their goods are cleared through customs.

The delay in launching the system means foreign insurers continue to underwrite goods entering Kenya, even though the law favours local firms.

IRA figures show that marine and transit insurance premiums grew to Sh4.66 billion in 2024, up from Sh4.44 billion the previous year and a significant increase from Sh2.7 billion in 2016, just before the directive was introduced.

Still, Kenya’s import value rose to Sh2.71 trillion in 2024, up 3.6 per cent from Sh2.61 trillion in 2023 and 64.7 per cent higher than Sh1.64 trillion five years ago, suggesting local insurers have barely tapped into the full potential of the marine insurance market.

Once the system goes live, importers will be required to request digital marine insurance certificates via clearing agents and mobile apps.

Top Stories Today