NSSF's Haba Haba savings plan gives hope to Kenyans in informal sector

Haba Haba targets small-scale business people and those not formally employed, allowing them to contribute a small amount of money daily for their retirement.

The NSSF's introduction of the Haba Haba savings plan has given Kenyans in informal employment hope for a better future, allowing them to save as little as Sh25 every day or Sh750 per month.

Jonathan Mrenzi, a boda boda operator in Kwale County, said saving for the future has not been an easy task considering his source of income and the tough economic times.

More To Read

- State agencies owe Sh6 billion in unpaid statutory deductions, Treasury warns

- Pension savings soar as NSSF collections jump to Sh59 billion

- MCAs to pay NSSF Tier II contributions after senate rejects exemption

- Police intensify search for missing pistol following NSSF chairman's car crash

- NSSF holds Sh158 million for 18,000 untraced pensioners, Auditor-General's report reveals

- House team raises alarm over pension delays as arrears pile up to Sh86 billion

"Sometimes I make as little as Sh200 per day so saving is a challenge but with the Haba Haba arrangement I can deposit Sh25 every day which is affordable," he said.

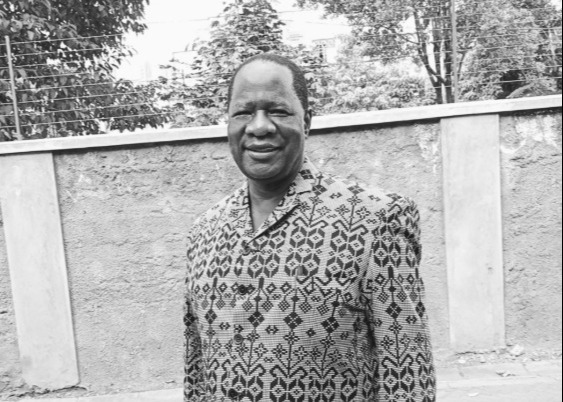

He spoke at a local hotel on Monday during a workshop with officials from the National Social Security Fund (NSSF). NSSF Managing Director David Koros sensitised locals in informal employment on how to save for their retirement even with meagre incomes.

Noting the importance of saving for retirement, he urged more members of the public to sign up for the scheme.

Haba Haba targets small-scale business people and those not formally employed, allowing them to contribute a small amount of money daily for their retirement.

"Our main goal is to ensure more Kenyans start investing. It is also to ensure that Kenyans who do not yet have any retirement savings join us," he said.

He also explained that any investor can receive benefits in less than 14 days, unlike in the past, when remittances took longer.

"This is the ideal arrangement for people with little income," Koros said, adding that withdrawals can be made before retirement age as is customary for government employees.

The NSSF wants to collaborate with all sectors, including boda boda and tourism, to raise awareness and encourage people to invest in the fund.

"We understand that there are many people who are self-employed or not formally employed and that it is often difficult to have a savings plan that will help them sustain themselves when they reach old age," he said.

He also highlighted digital services, which eliminate the need to go to the NSSF's offices.

Top Stories Today