Capitalise on microinsurance for underserved to boost insurance coverage - IRA

The call to refocus on microinsurance comes at a critical time when climate-related disasters are becoming more frequent and severe, further exacerbating the vulnerability of many communities.

The Insurance Regulatory Authority (IRA) has called on insurance companies in the country to prioritise the underserved and disaster-prone communities by expanding their focus on microinsurance.

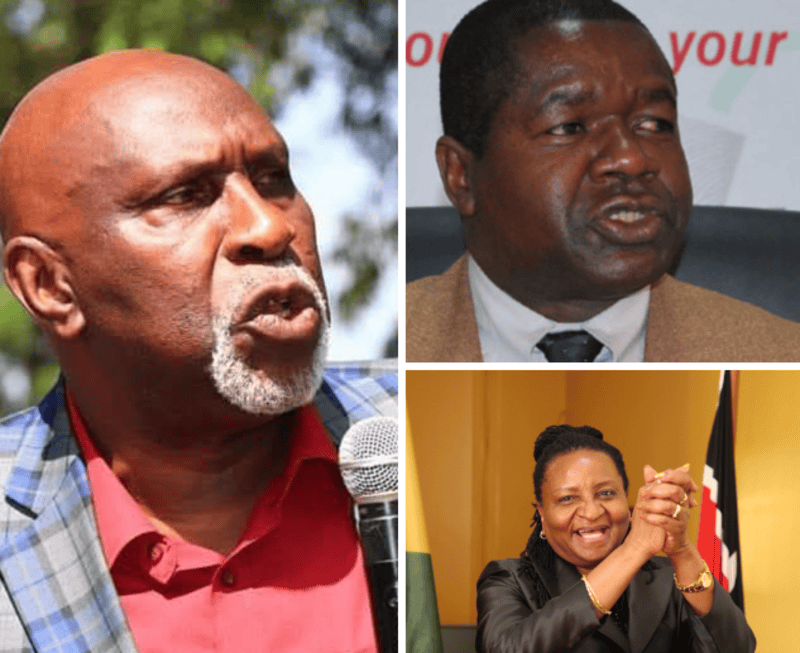

The Director of Supervision at IRA, Kalai Musee, says the segment possesses vast potential in boosting the country's insurance penetration and coverage, which are still at their lows.

“Insurance coverage in the country stood at about 43 percent as of 2023, a figure that we endeavor to move beyond the midpoint towards 100 percent,” Musee said.

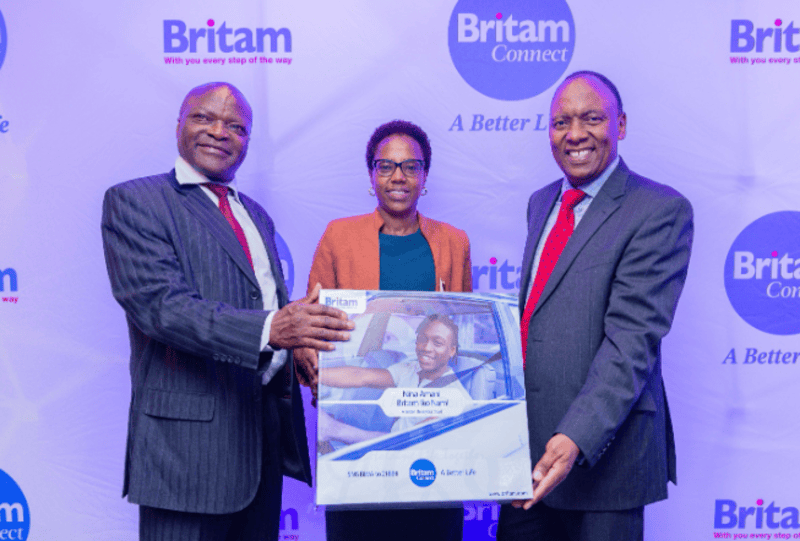

He was speaking on Tuesday when he presided over the launch of Britam’s microinsurance subsidiary, Britam Connect.

He was seconded by Britam MD and CEO Tom Gitogo, who said insurance penetration in Kenya is still low at 2.4 percent because many people believe it’s too expensive or complicated.

Gitogo therefore said the new subsidiary, after certification by the regulator, will seek to address the concern of low penetration by integrating technology and partnerships to make insurance more accessible, affordable and relevant to the everyday lives of millions.

Microinsurance provides products that offer coverage to low-income households, or to individuals who have little savings, and is tailored specifically for lower valued assets and compensation for illness, injury or death.

Despite the availability of microinsurance products, the regulator expressed concern over their limited reach, with the number of individuals covered remaining stagnant for over a decade now.

Musee further reiterated that while microinsurance regulations were enacted in 2020, uptake by insurers has been slow.

“For nearly five years, it felt like we had passed a ghost law of microinsurance, no one was applying for a license. We need companies to rethink insurance, move away from outdated models, and embrace technology.”

He acknowledged Britam for stepping up to the challenge and officially launching its microinsurance subsidiary, saying its launch also signals a turning point for Kenya’s microinsurance sector.

He emphasised that affordability should not be an excuse for exclusion, noting that insurance products can be designed to fit any income level.

The regulator thus noted that it will be supporting insurers by running nationwide financial literacy programmes targeting MSMEs and informal sector workers.

Britam Connect on its end said it is not just looking at Kenya, as it has set an ambitious goal of reaching 25 million people across Africa in the next five years.

Notably, the firm plans to scale its impact by working with InsureTech firms, SACCOs and development organisations to create innovative risk protection solutions.

One such initiative is its partnership with Oxfam, which helped subsidise flood insurance premiums for residents in Tana River County.

Since pioneering microinsurance in 2007 with its first product, Kinga Ya Mkulima, Britam Microinsurance has insured over four million Kenyans as of 2024, and holds the largest market share in Kenya’s microinsurance sector at over 40 percent.

The call to refocus on microinsurance comes at a critical time when climate-related disasters are becoming more frequent and severe, further exacerbating the vulnerability of many communities.

Top Stories Today