Inside Aviator: The addictive betting game pushing Kenyans into debt

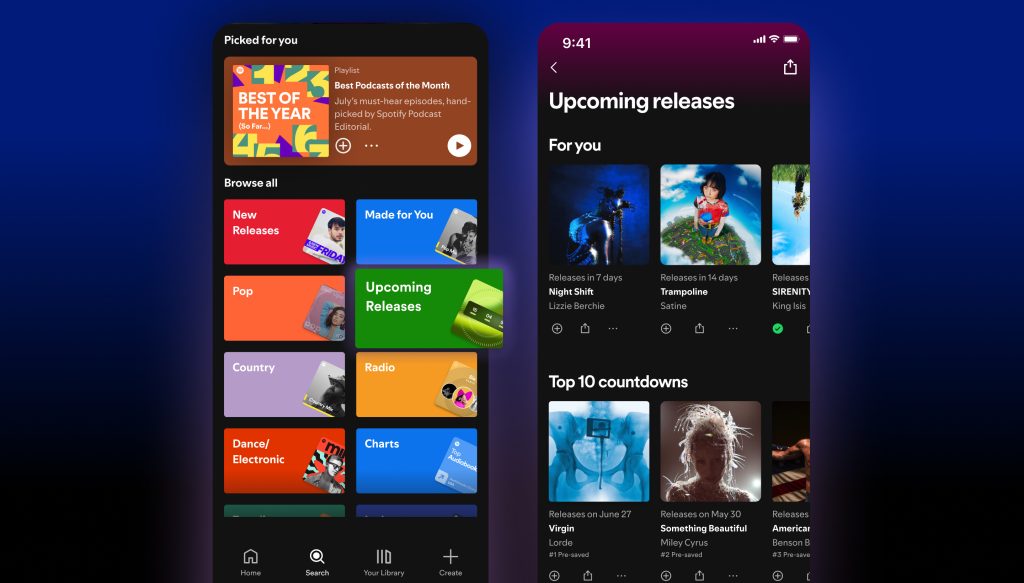

Underneath its flashy interface lies a complex algorithm designed to hook, thrill, and sometimes confuse users.

If you have spent some time in betting circles, whether online or at your local, you have probably heard about the Aviator game. It is a game that involves a red plane that takes off and flies higher... and higher... and if you do not cash out in time, it crashes, taking your money with it.

The game looks simple; so simple that even a mama mboga or a nanny, or a grandmother can play.

More To Read

- Crackdown on illegal betting sites sparks renewed calls for total gambling ban in Kenya

- Government suspends gambling adverts for 30 days in move to tackle growing crisis

- Government forms rapid response team to tackle rising gambling addiction

- Police launch crackdown on operators of illegal gambling machines in Kwale

However, underneath its flashy interface lies a complex algorithm designed to hook, thrill, and sometimes confuse users.

So, one might ask, how does Aviator really work? And is the game really rigged?

Aviator is a crash-style online game developed by Spribe back in 2019, a tech company known for creating games for the betting industry. It has created cutting-edge casino games, such as Aviator, Plinko and Turbo Games.

Spribe has also offered Aviator to platforms like Betika, SportPesa, 22Bet and others popular in Kenya.

“Players bet money, watch the plane climb, and try to "cash out" before it crashes. The higher the plane flies, the more money you win. That is if you cash out in time. Miss it, and you lose your stake,” they explain in a video on their YouTube channel.

We asked an expert, is it really that easy?

“It feels like timing a jackpot, but it’s math, not magic,” says Martin Mwangi, a mobile gaming expert based in Nairobi.

Mathematically random

Mwangi says Aviator runs on a system called Provably Fair RNG (Random Number Generator), and what this means is that every game round is mathematically random.

“The result is generated using a combination of server seeds and client seeds, verified by cryptographic hash functions.”

In simple terms, each time you play, the game is already “decided” before the plane takes off, but the crash point is hidden until the round ends.

“So, there’s no pattern to guess, and no amount of watching the screen guarantees you’ll know when to cash out.”

Mwangi further describes the venture as a TikTok-like design; short, fast and highly addictive, making it especially risky for young Kenyans hoping for quick wins.

For Millicent and Gregory (not their real names), their addiction to Aviator has come at a heavy financial cost.

They disclosed to The Eastleigh Voice that the venture has at some point landed them into debt from various digital lending platforms, banks and even friends.

Despite it all, they note that they would continue to play, clinging to the hope that with just one more bet, they will win back their money.

For 27-year-old Millicent (not her real name), what started as a harmless thrill quickly spiralled into a financial nightmare.

Loans from friends

She estimates to have lost over Sh800,000 across several months, money that came from loans, friends and even her sacco.

“I was introduced to the game by a friend back when I had a cosmetic shop. She showed me how it works, and I thought, wow, if I can make money by just watching a plane, while still working, how convenient a side hustle. At first, I won Sh3,000 from just Sh100. It felt easy,” she said.

“But after a while, I started losing. Still, I couldn’t stop. I kept chasing that feeling, that I can win again.”

Gregory, aged 24, echoes the same pain.

“I am in school, I’ve sold my laptop, my phone, even furniture. I’m behind on rent. But in my head, there’s always that one round I think will change my life,” Gregory said.

Second most popular form of betting

According to a GeoPoll report titled ‘Betting in Africa 2025’, football remains the most popular form of betting across countries in Africa, with 61 per cent of respondents in the survey stating they mainly bet on football matches, continuing the trend observed in 2024.

Notably, Aviator has quickly risen in popularity, coming second with 19 per cent of the respondents choosing it as their primary betting option.

Basketball follows distantly, preferred by six per cent of respondents.

“These findings highlight football’s enduring appeal, while also pointing to a growing interest in alternative, high-speed betting formats like Aviator,” the report reads.

Cost of gambling

This comes as nearly Sh1 trillion is reportedly spent on gambling each year in Kenya, a figure that’s expected to keep rising.

In June 2024, the Kenya Revenue Authority (KRA) collected Sh24.3 billion from gambling and betting companies, a significant increase from Sh19.2 billion in 2023.

Additional reports show that Kenyans bet Sh24,000 per second, amounting to Sh2.1 billion daily.

In 2024 alone, at least Sh766 billion was spent on gambling.

The GeoPoll report says Kenya's gambling landscape has experienced significant growth, positioning the country as a prominent player in Africa's betting industry.

The survey shows 79 per cent of Kenyan respondents reported engaging in betting activities, placing Kenya third in Africa after South Africa and Uganda. This marks a slight decline from previous years, where Kenya led the continent with over 80 per cent participation.

Average monthly spending on betting

A majority of Kenyans (57 per cent) surveyed in the 2025 gambling report by Geopoll, say they spend less than $10 (Sh1,300) per month.

Higher spending brackets include: 28 per cent between $10 and $25 (Sh3,250), 3 per cent between $25 and $50 (Sh6,500), 6 per cent between $50 and $100 (Sh13,000), 3 per cent between $100 and $500 (Sh65,000), and 3 per cent spending over $500 monthly.

“This reflects predominant low-stakes gambling but also a small group of high-stakes bettors.”

Gambling frequency

In the 2024 Geopoll survey, 32 per cent of respondents in surveyed countries: Kenya, South Africa, Ghana, Uganda, Tanzania and Nigeria, indicated they bet approximately once a week.

Additionally, 20.8 per cent placed bets once a month, 17.8 per cent at least once a day, and 15.6 per cent reported betting more than once a day.

The 2025 findings, however, show a slight increase in weekly betting, with 35 per cent of respondents now gambling once a week.

On the other hand, 22 per cent report betting once a month, while 20 per cent do so less than once a month.

Daily betting has seen a modest decline, with 14 per cent betting once a day and nine per cent placing bets more than once a day. Specifically in Kenya, a large proportion of the respondents indicated to be betting once a week.

Sector projections

With these numbers and data, research firm Statista projects Kenya’s sports betting market to reach approximately $166.46 million (Sh21.6 billion) by the end of 2025.

Revenue, on the other hand,d is expected to grow at an annual rate of 4.02 per cent, resulting in a projected market volume of $194.91 million (Sh25.3 billion) by 2029. Additionally, the number of users in the sports betting market is expected to rise to 1.3 million by 2029.

In general, the gambling market is projected to reach $1.21 billion (Sh157.3 billion) in 2025.

Total gambling revenue is expected to show an annual growth rate (CAGR 2025-2029) of 2.08 per cent, resulting in a projected market volume of $1.31 billion (Sh170.3 billion) by 2029, Statista says in part.

Psychological toll

Psychologists warn that Aviator taps into the same brain pathways as high-stakes gambling and slot machines.

Some reckon that the randomness, paired with rapid outcomes and the illusion of control, makes the game particularly dangerous for unemployed or underemployed youth.

“The game exploits FOMO, the fear of missing out, because even in the game, as you play, it shows you, XXX and YYY have cashed out X amount of money in that round” explains Dr Ruth Mwende, a psychologist based in Nairobi.

“It gives you just enough reward to make you believe the next round is your breakthrough. It becomes obsessive.”

While Aviator is legal in Kenya under the Betting Control and Licensing Board (BCLB), she stresses the concern about its impact on mental health, particularly in low-income areas.

“We’re seeing a new wave of addiction that is digital, silent and deeply isolating,” Mwende said.

Top Stories Today