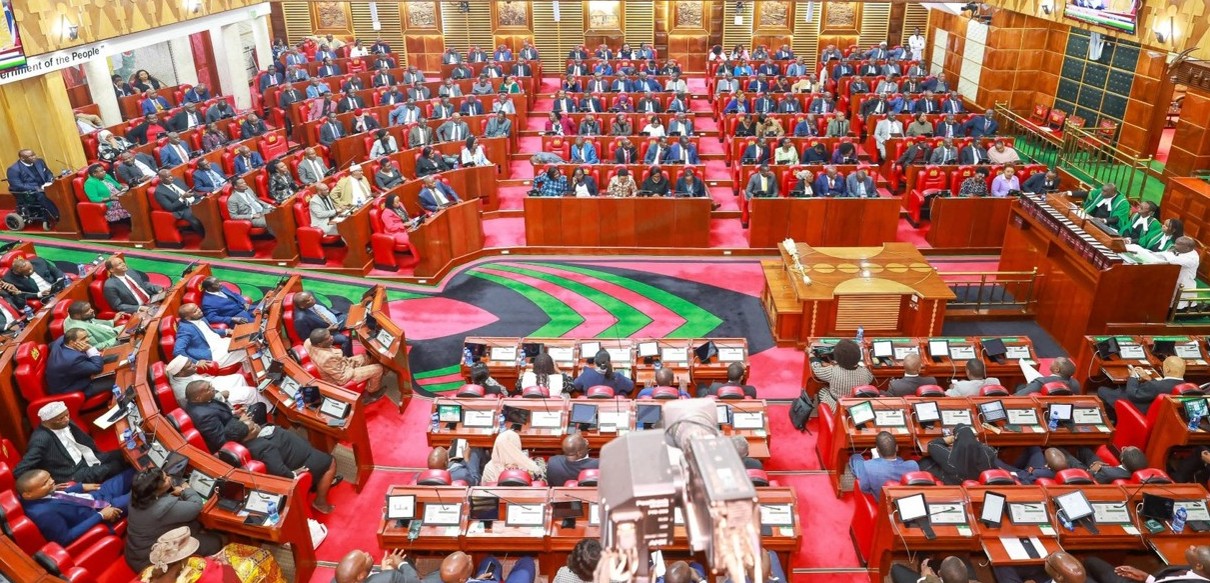

South Sudan launches door-to-door taxpayer registration in Juba

![South Sudan launches door-to-door taxpayer registration in Juba - SSRA Commissioner General Simon Akuei Deng addresses the media on Tuesday. [Photo: SSRA]](https://publish.eastleighvoice.co.ke/mugera_lock/uploads/2025/07/Screenshot-2025-07-02-111053.png)

The capital has been divided into ten administrative zones in an attempt to streamline the registration process and strengthen oversight of tax compliance.

In a bid to widen its tax net and bolster public finances, South Sudan's Revenue Authority (SSRA) has launched an ambitious door-to-door taxpayer registration campaign across Juba City, according to a report by Sudan Tribune on Tuesday.

The capital has been divided into ten administrative zones in an attempt to streamline the registration process and strengthen oversight of tax compliance.

More To Read

- UNMISS report: 739 civilians killed in South Sudan’s deadliest quarter since 2020

- 50 injured in four days of violence along South Sudan border - MSF

- KRA waives penalties, extends tax filing deadline to July 5

- Step by step guide on how to file your tax returns

- IOM sounds alarm over suspension of life-saving transport in South Sudan

- What happens when aid is cut to a large refugee camp? Kenyan study paints a bleak picture

The exercise targets businesses, service providers, and self-employed individuals, signalling a shift toward more structured and data-driven tax administration in one of Africa's youngest states.

In a letter seen by Sudan's Post, Zone 1 includes key commercial areas such as Juba Town, Hai Cinema, Malaki, Kator, and Konyokonyo. Zones 2 to 10 span Giada, Gudele, Gumbo-Shirkat, and diplomatic enclaves such as UN offices and embassies.

SSRA Commissioner General Simon Akuei Deng stated plainly: "We're committed to creating a comprehensive and updated database of taxpayers. This isn't just about bringing in more revenue—it's about getting the right data to make smart decisions and improve how we serve people."

The move represents a critical step in SSRA's effort to formalise the tax base in a largely informal economy, which has long struggled with limited revenue and governance challenges. But the effort is not without risks.

The authority has issued warnings against imposters and unauthorised fee collectors. "We will not tolerate anyone collecting fees they shouldn't or pretending to be one of our officials," said Akuei. "Anyone caught pulling these stunts will face the full force of the law."

While the SSRA's intentions are clear- widen the tax base and sharpen fiscal forecasting- the timeline for completing the registration remains unspecified.

Still, if successful, this data-driven drive could lay the groundwork for more robust fiscal planning and potentially unlock new developmental pathways in a country still emerging from conflict.

Top Stories Today

Reader Comments

Trending