MPs push to review controversial tax exemption granted to Kenyatta and Moi estates

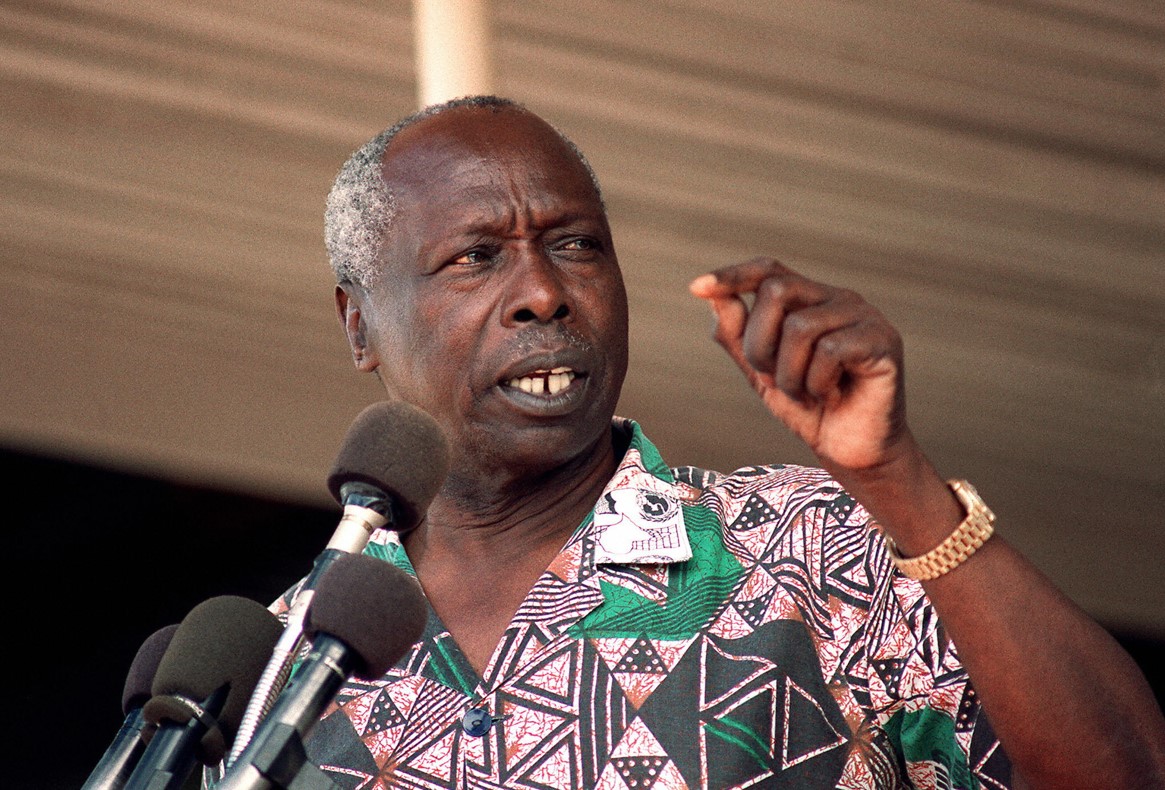

The petition, filed by public interest advocate John Wangai, targets Section 7(3) of the Estate Duty Act (Cap 483), which explicitly states that inheritance tax shall not apply to the estates of the two late presidents.

A petition before the National Assembly has triggered fresh scrutiny of a legal provision that exempts the estates of former Presidents Jomo Kenyatta and Daniel arap Moi from paying inheritance tax, with MPs now pushing for a review of the controversial clause in the Estate Duty Act.

The petition, filed by public interest advocate John Wangai, targets Section 7(3) of the Estate Duty Act (Cap 483), which explicitly states that inheritance tax shall not apply to the estates of the two late presidents.

More To Read

- Kenya sees sharpest decline in domestic excise revenue since Covid-19 pandemic, says KRA

- Miguna: Fred Matiang’i unfit to lead after orchestrating my 2018 torture, deportation

- President William Ruto reinstates Charles Nyachae to Kenya School of Government post

- KIPPRA flags job creation as key concern despite Kenya’s economic growth

- Tax relief boost as KRA slashes fringe benefits rate for workers

- Kenya enforces mandatory certificate of origin for all imports under new 2025 tax law

Wangai argues that this exemption offends Article 27 of the Constitution on equality before the law and fair treatment, and amounts to preferential treatment for political elites at the expense of ordinary citizens.

“Whenever any person dies, a tax known as estate duty shall, save as is hereinafter provided, be levied and paid on all property of which the deceased was at the time of his death competent to dispose,” the law reads.

It also applies to property held for the deceased’s use or enjoyment and any benefits payable under a life assurance policy.

However, the clause under review adds, “This section shall not apply to His Excellency Mzee Jomo Kenyatta, nor His Excellency Daniel Toroitich arap Moi,” thereby excluding their estates from the tax that applies to other Kenyans.

Inheritance tax, also known as estate duty, is a levy imposed on the value of property left behind by a deceased person.

It is often justified as a tool for promoting economic equity, unlocking idle assets, and generating public revenue.

The petitioner told Parliament that maintaining the exemption undermines national values and the integrity of the tax system.

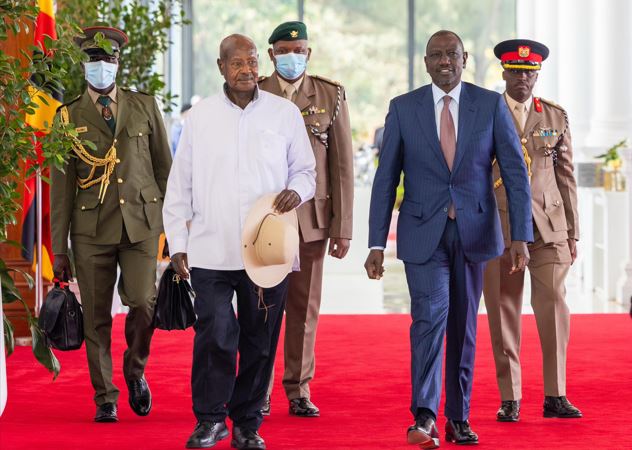

The petition drew attention following public remarks by President William Ruto in 2023, when he accused certain individuals of evading taxes and using state instruments to shield their wealth.

“This country is not the animal farm where some are more equal than others. We are going to have a society where every citizen carries [his or her] fair share of our burden to raise taxes,” the President said on the same day Wangai, together with John Maina and Muhia Kagwe, submitted the petition to Parliament.

The matter is now before the National Assembly’s Petitions Committee, where members strongly indicated that the provision needs to be reviewed to align it with constitutional values and modern democratic standards.

“Are you aware that the estate duty was abolished through an Act of number 10 of 1982?” asked committee chair Janet Sitienei, MP for Turbo.

In response, Wangai affirmed he was aware of the repeal, but told the committee the current law remains operational, including the controversial exemption, and must therefore be addressed by Parliament.

The MPs said the provision may be part of a wider group of outdated laws that still benefit privileged individuals, and pledged to look into whether such exemptions serve any public interest today.

Top Stories Today