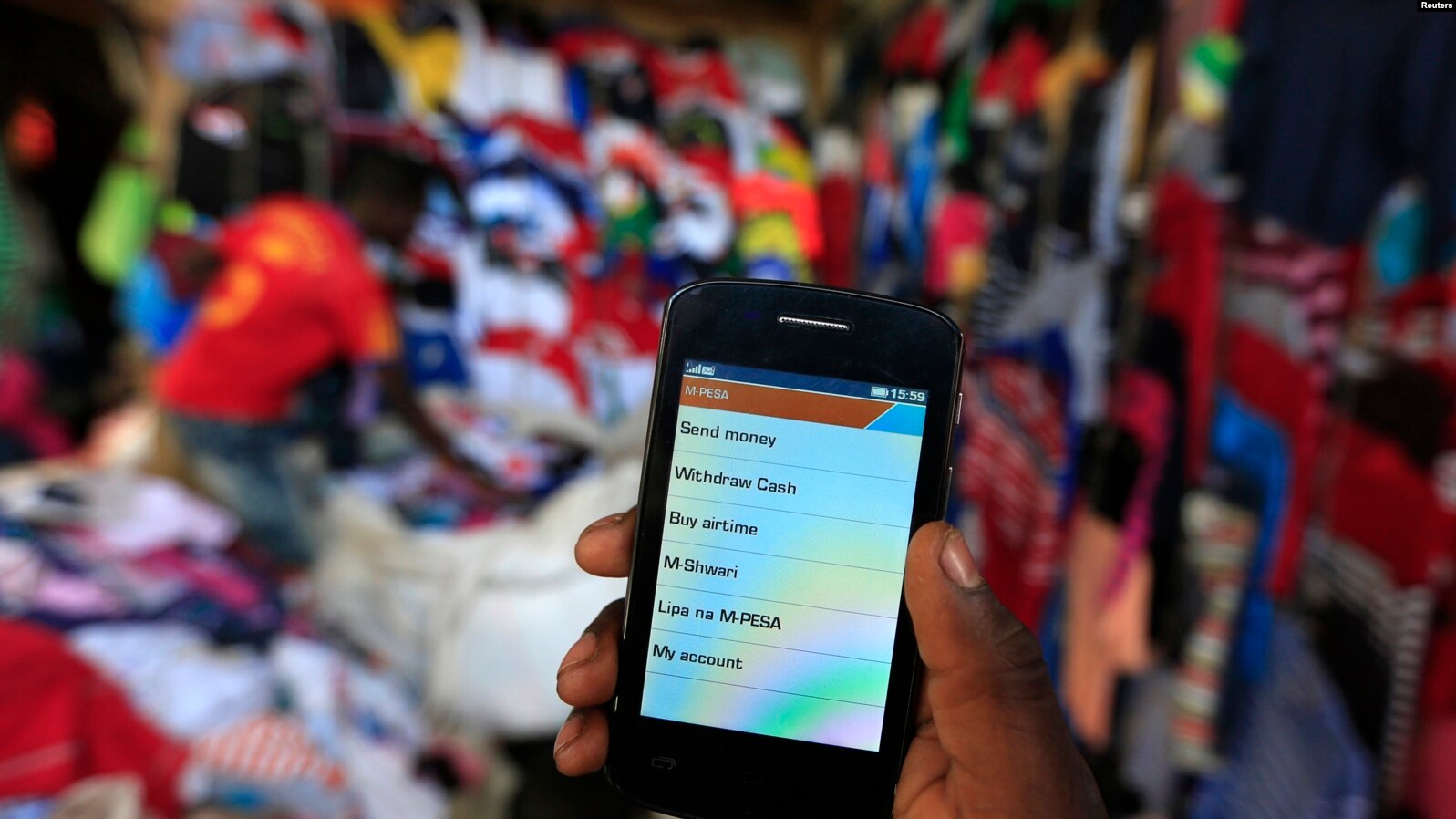

Kenya's mobile money transactions hit record Sh6.5 trillion

By Maureen Kinyanjui |

Airtel's policy change allowed users to receive funds directly into their e-wallets without being compelled to withdraw within a week or risk having the funds returned to the sender.

Mobile money transactions in Kenya surged to Sh6.5 trillion in the first nine months of 2024, reflecting a 13.2 per cent growth compared to Sh5.8 trillion during the same period last year.

This growth was largely driven by Airtel Kenya's policy revision, which eliminated restrictive withdrawal codes in February.

Keep reading

Data from the Kenya National Bureau of Statistics (KNBS) revealed that the increase marked a significant turnaround from a 2.7 per cent dip recorded in the corresponding period last year.

Airtel's policy change allowed users to receive funds directly into their e-wallets without being compelled to withdraw within a week or risk having the funds returned to the sender.

"This development effected on February 6, 2024, comes in response to the Central Bank of Kenya (CBK) and industry players' collaborative efforts to ensure seamless mobile money interoperability as outlined in the CBK National Payments Strategy 2022-2025," Airtel stated earlier this year.

Surge in mobile money usage

The highest monthly transaction value was recorded in February at Sh790.8 billion, while September saw the lowest at Sh670.52 billion.

Meanwhile, the number of mobile money accounts increased by 3.4 per cent, adding 2.6 million new subscriptions to reach a total of 79.4 million.

The number of active mobile money agents also grew significantly, rising 14.4 per cent to 367,551 agents.

"The removal of the withdrawal codes for transactions sent from M-Pesa to Airtel Money enabling funds to be transferred directly into the Airtel Money account could have enhanced the uptake for mobile money services," the Communications Authority of Kenya (CA) noted in its latest telecommunications sector review.

Despite Airtel's gains, M-Pesa maintained its position as the dominant mobile money platform in Kenya, commanding a 93.4 per cent market share as of June 2024, while Airtel Money held 6.6 per cent.

Mobile money remains a cornerstone of Kenya's financial system, driven by improved network coverage, user convenience, and regulatory efforts to reduce transaction costs.

The CBK has been instrumental in advocating for interoperability among platforms and cutting transaction fees, further enhancing mobile money's appeal.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!