NHIF, SHA and SHIF: What you need to know about new health fund

The new fund has been touted as the cure for what ailed the longstanding NHIF that is said to have had inadequacies.

President William Ruto’s government will soon replace the 57-year-old National Health Insurance Fund (NHIF) with the Social Health Authority (SHA), which will oversee three critical funds, as part of efforts to streamline medical billing and insurance.

The three are the Social Health Insurance Fund (SHIF), the Primary Healthcare Fund, and the Emergency, Chronic and Critical Illnesses Fund.

More To Read

- How high costs, confusion are hindering workers in informal sector from enrolling on SHA

- Ruto proposes law to allow housing levy contributors access Sh5 million loans

- Over 800,000 youths to benefit from Sh20 billion Nyota project- Ruto

- Government launches flexible health insurance payment plan to boost access for informal sector

- Ruto nominated me but as IEBC chair I won't favour him, or anybody else- Ethekon

- Watch: IEBC chair nominee Erastus Ethekon faces vetting panel

The new fund has been touted as the cure for what ailed the NHIF, which has come under fire on allegations including irregular tendering processes and fraud in the payment of claims.

To facilitate the switch, NHIF contributions will be transferred to the SHIF while the mandatory registration of all citizens into the new fund will begin on March 1, a process expected to take 90 days.

The ministry says SHIF funding will come from the expansion of the pool of premium contributions from the formal and informal sectors, while the Primary Healthcare Fund and Emergency, Chronic and Critical Illnesses Fund will be financed by the government through taxes, donations and gifts.

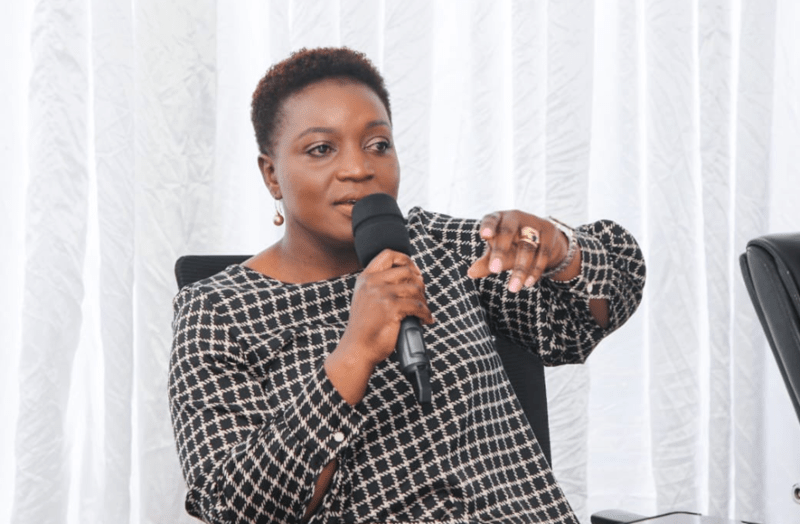

Recently, Health Cabinet Secretary Susan Nakhumicha said contributions for the new scheme could start in February.

As the public prepares for the SHIF's official rollout, here is an overview of the NHIF and the SHIF.

What is the difference?

The SHIF emphasises a shift from a curative model, in which the NHIF was established, to a preventive and promotional approach.

“The NHIF predominantly has been curative in nature - it waits for you to get sick then it treats you. What we’re moving to is preventive and promotional in nature, so that we try as much as possible to prevent citizens from getting sick,” Nakhumicha recently told Citizen TV in an interview.

What are the contributions?

Premium contributions for the SHIF will likely change from the Sh500-Sh1700 range under the NHIF, to a fixed rate based on a household’s income.

Salaried employees will make a monthly contribution of 2.75 per cent while the unsalaried will contribute a minimum of Sh300 per month.

CS Nakhumicha says the NHIF was only designed for salaried Kenyans who could afford to pay for it, thereby overlooking unemployed citizens and those who do not get payslips at the end of the month, a flaw that the SHIF seeks to resolve.

The government will continue providing health insurance subsidies to orphans, people living with severe disabilities and other vulnerable populations.

#AfyaNyumbani pic.twitter.com/pkpUPZQCcg

— Ministry of Health (@MOH_Kenya) January 20, 2024

What is the extent of coverage?

Whereas the NHIF had limitations in coverage, especially for critical illnesses like cancer, the SHIF aims to rectify this by offering comprehensive coverage from the beginning to the end of the treatment of any disease.

Also, the SHIF will cover screening and illnesses acquired at birth, unlike the NHIF,.

“Some congenital conditions are not covered by NHIF, even with private insurance, but Kenyan did not choose to be born with certain illnesses, so we now have a package that will take care even of congenital conditions,” she said.

Thus far, CS Nakhumicha has inaugurated a transition committe, chaired by e to oversee the switch from the NHIF to the SHIF. She has also assured Kenyans of a seamless transition and given progress reports in the verification of the pending claims that will be transferred to the SHA, which she says will be settled progressively.

The committee will be chaired by Kap-Kirwok Jason. His team members are Daniel Mwai, Kipruto Chermusoi Chesang, Jacinta Wasike, Gladys Mburu, Stephen Kaboro Mbugua, Elizabeth Wangia, Christopher Leparan Tialal, Jacob Otachi Orina and Stanley Bii.

Top Stories Today