Reality on the ground is different, Kenyans tell Moody's on 'positive' rating

Critics are questioning whether external observers and global investors truly understood Kenya’s realities.

Kenyans have reacted with mixed reactions after Moody’s decided to upgrade the country’s credit outlook from “negative” to “positive”.

While some have welcomed the improved rating as a sign of progress, others argue that the country should recognise its own advancement without relying on external validation.

More To Read

- Kenya’s economic recovery in limbo as fiscal, debt pressures persist - Moody’s

- Kenya’s economy stable under Ruto, says Treasury CS Mbadi in response to Gachagua's claims

- Ruto defends economic reforms, vows to push ahead with affordable housing, cost of living agenda

- KIPPRA flags job creation as key concern despite Kenya’s economic growth

- Bleak outlook as CBK reveals one in three firms won’t hire in 2025

- World Bank downgrades Kenya's GDP growth to 4.5 per cent in June projection

In a report released on January 24, the global ratings agency highlighted Kenya’s improving fiscal position, stating that the country has a high potential to reduce liquidity risks and improve debt affordability.

“Domestic financing costs have started to decline amid monetary easing and could continue if the government sustains its more effective management of social demand and fiscal consolidation,” the agency said.

Moody’s also noted that if President Ruto’s administration continues along this path, Kenya could see its credit score rise and attract more funding.

“Such a track record would also boost Kenya’s access to concessional and commercial external funding. Revenue collection efforts, if successful, present the potential for further improvements in debt affordability, although Kenya has struggled to expand revenue significantly and durably in the past, notwithstanding recent measures,” the agency said.

Despite the positive findings, many Kenyans were unimpressed with the external assessment. Critics argued that the rating failed to reflect the everyday struggles faced by the public.

“If things are working, you don’t even need these observers. Kenyans will acknowledge on their own. Too much explanation simply means nothing is working,” said Victor Patience Oyuko.

Others echoed similar sentiments, questioning whether external observers and global investors truly understood Kenya’s realities.

“The neutral observers and global investors are not voters in Kenya; the citizens are, and they make the final verdict,” Alexander Odhiambo said.

Economic growth

Kaka Jombah said, “If the economy is really doing well, we need no observers or hired firms to observe. Economic growth speaks volumes of itself by the increase of investors, local businesses thriving better without the closure of small scale entrepreneurs and money in people’s pockets.”

Collins Odhiambo also emphasised that Kenyans understand their situation better than any external rating agency.

“We understand this country’s challenges and strengths first-hand. No paid foreign investor or their ratings can speak for us better than we can ourselves. Relying on outsiders to define our progress undermines the lived experiences and expertise of the people who call this home,” he said.

“Why can't you get information from Kenyans on how the economy is fairing? Relying on information from outside will not [change the fact] that we're in the worst economic times. We're the victims of bad economic policies. Fikeni ground,” said another Kenyan identified as Njoroge.

“Things are only working for the people in government. The rest of the country is living hand to mouth. Even sacco deposits have dropped and loan defaulters’ rates have increased. The only people celebrating are in the government,” said Wathangara, another X user.

Ratings praised

Meanwhile, a contrasting view was voiced by government allies including the President himself.

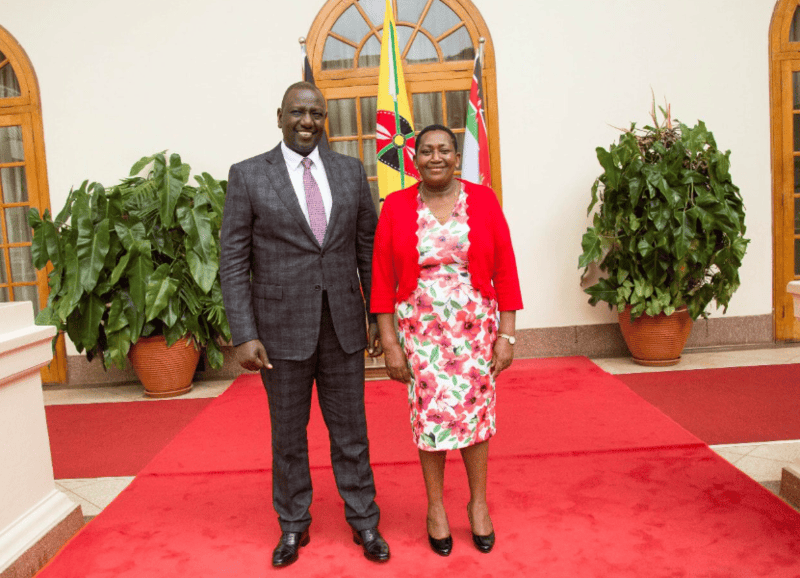

President William Ruto took to his X platform on Saturday evening, posting the latest Moody’s report with the caption: “We are doing well.”

Environment Cabinet Secretary Aden Duale also praised the rating upgrade, attributing it to President Ruto’s economic leadership.

“Moody’s rating agency has revised Kenya’s outlook from negative to positive, reaffirming the country’s economic recovery under the leadership of H.E. President William Ruto,” he said.

“This positive shift reflects the Ruto-led administration’s success in addressing key economic challenges, including reducing inflation, lowering interest rates and creating an environment that has boosted private sector lending.”

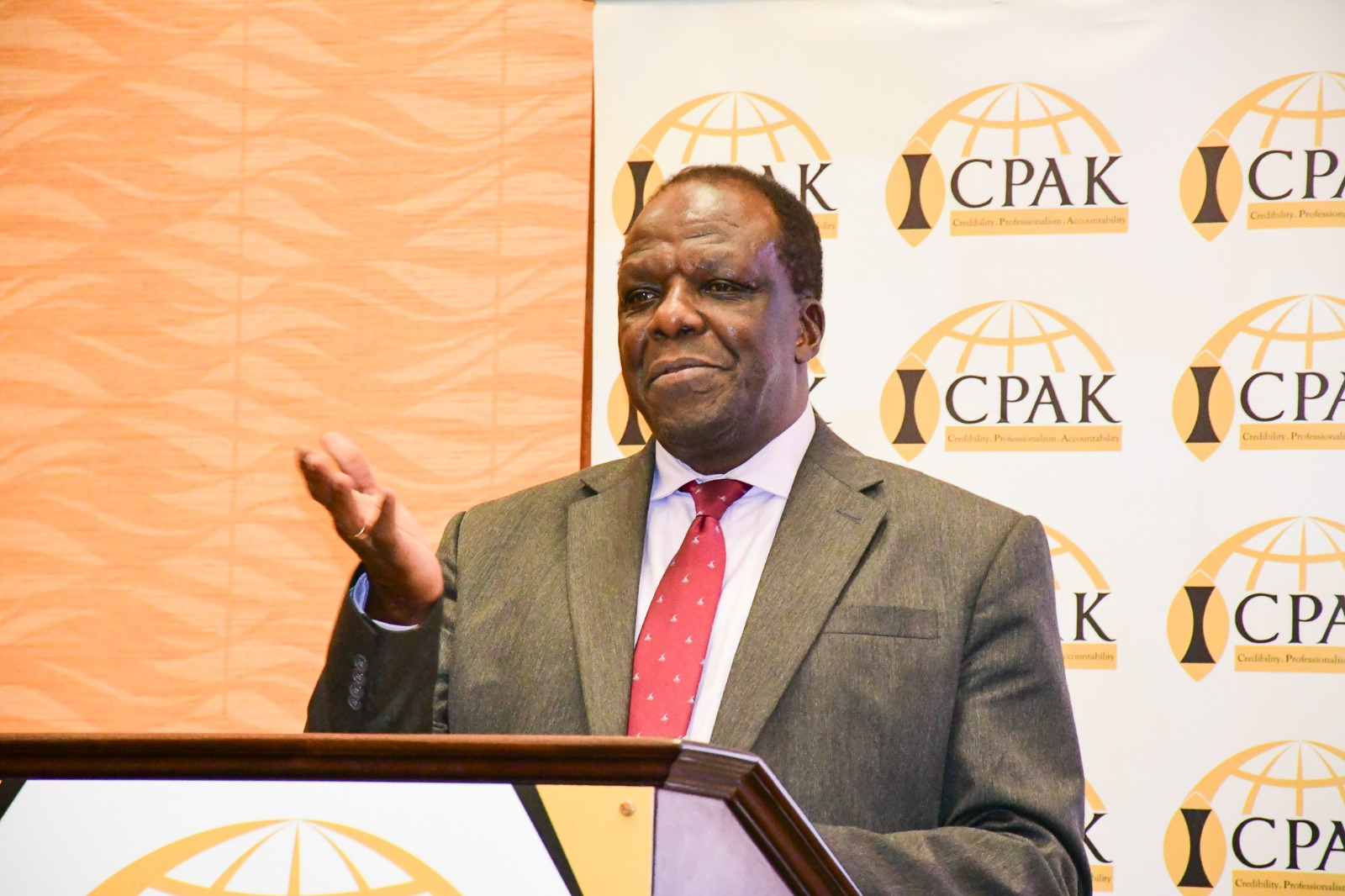

The National Treasury also expressed optimism over the upgrade, terming it a “strong vote of confidence” in Kenya’s fiscal policies.

“The upgrade is important as it boosts investor confidence, lowers borrowing costs, and strengthens Kenya’s growth prospects,” it noted.

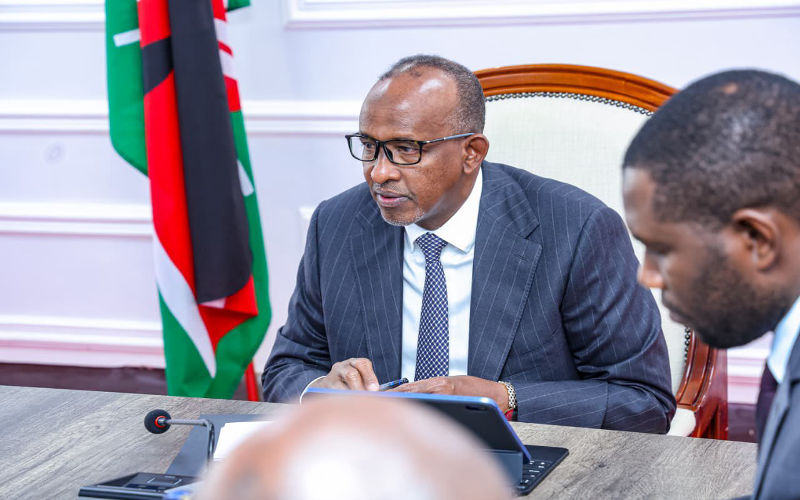

Trade Cabinet Secretary Lee Kinyanjui also welcomed the upgrade, pointing to its potential to position Kenya as an attractive investment destination.

“Foreign investors and fund managers heavily rely on such ratings to make informed decisions on where to allocate their capital,” he said.

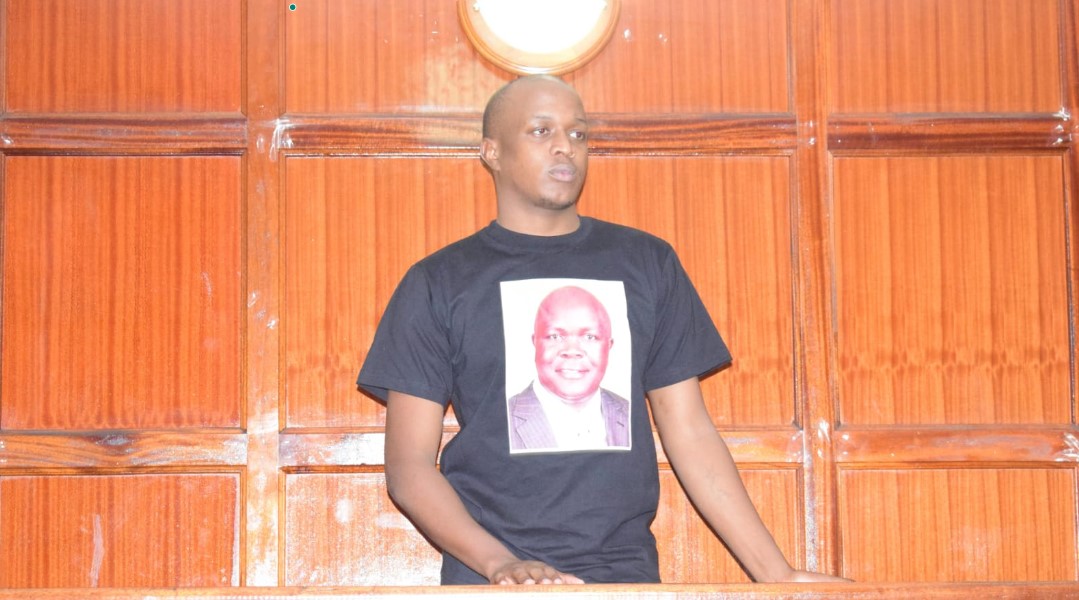

Dennis Itumbi, the head of the Presidential Special Projects and the Creative Economy, also took to social media, to celebrate the move.

“Moody’s has upgraded Kenya to a positive outlook, recognising significant progress in economic stability and governance. This means enhanced opportunities for investors and the Kenyan people alike,” he said, praising Ruto’s leadership.

Moody’s caution

However, Moody’s itself cautioned that Kenya’s fiscal health is still precarious, given the increasing public needs and limited funding.

The report acknowledged progress but suggested that challenges remain, particularly with high poverty levels. It recommended strengthening financial policy effectiveness, curbing corruption, and improving rule of law implementation.

At the time of the report, Kenya’s public debt stood at Sh10.6 trillion ($82.5 billion), with critics continuing to accuse President Ruto’s administration of slowing down the economy due to corruption and wastage of resources.

Despite this, Ruto has remained firm that his policies have stabilised the economy, pointing to a stronger Kenyan shilling and declining inflation as evidence of progress.

Top Stories Today