IMF upgrades Kenya’s economic growth to 4.8pc in 2025 despite regional, global slump

The country’s GDP growth forecast has received a notable upgrade in the latest economic outlook by the International Monetary Fund (IMF).

Despite widespread global economic uncertainty expected to weigh down many economies in 2025, Kenya has emerged as one of the bright spots in Sub-Saharan Africa.

The country’s GDP growth forecast has received a notable upgrade in the latest economic outlook by the International Monetary Fund (IMF).

More To Read

- Goods moved within EAC are transfers, not imports or exports - KAM

- Kenya's inflation climbs to 4.1 per cent amid fluctuating food prices, fuel costs

- Kenya’s economy stable under Ruto, says Treasury CS Mbadi in response to Gachagua's claims

- Ruto defends economic reforms, vows to push ahead with affordable housing, cost of living agenda

- KIPPRA flags job creation as key concern despite Kenya’s economic growth

- World Bank downgrades Kenya's GDP growth to 4.5 per cent in June projection

In the report, the lender projects Kenya’s economy to grow by 4.8 per cent this year, up from 4.5 per cent in 2024, and further consolidate at 4.9 per cent by 2026.

Although the lender did not give reasons for the upgrade, the country’s positive trajectory could be a result of the reportedly improving investor confidence, robust domestic demand, and steady policy reforms aimed at fiscal consolidation and economic resilience.

A March 2025 survey by the Central Bank of Kenya (CBK), for instance, shows sustained optimism about the Kenyan economy over the next 12 months.

Company heads surveyed across the country attributed the optimism to favourable weather conditions, continued stability of the shilling, expectations of further interest rate declines, and low, stable inflation.

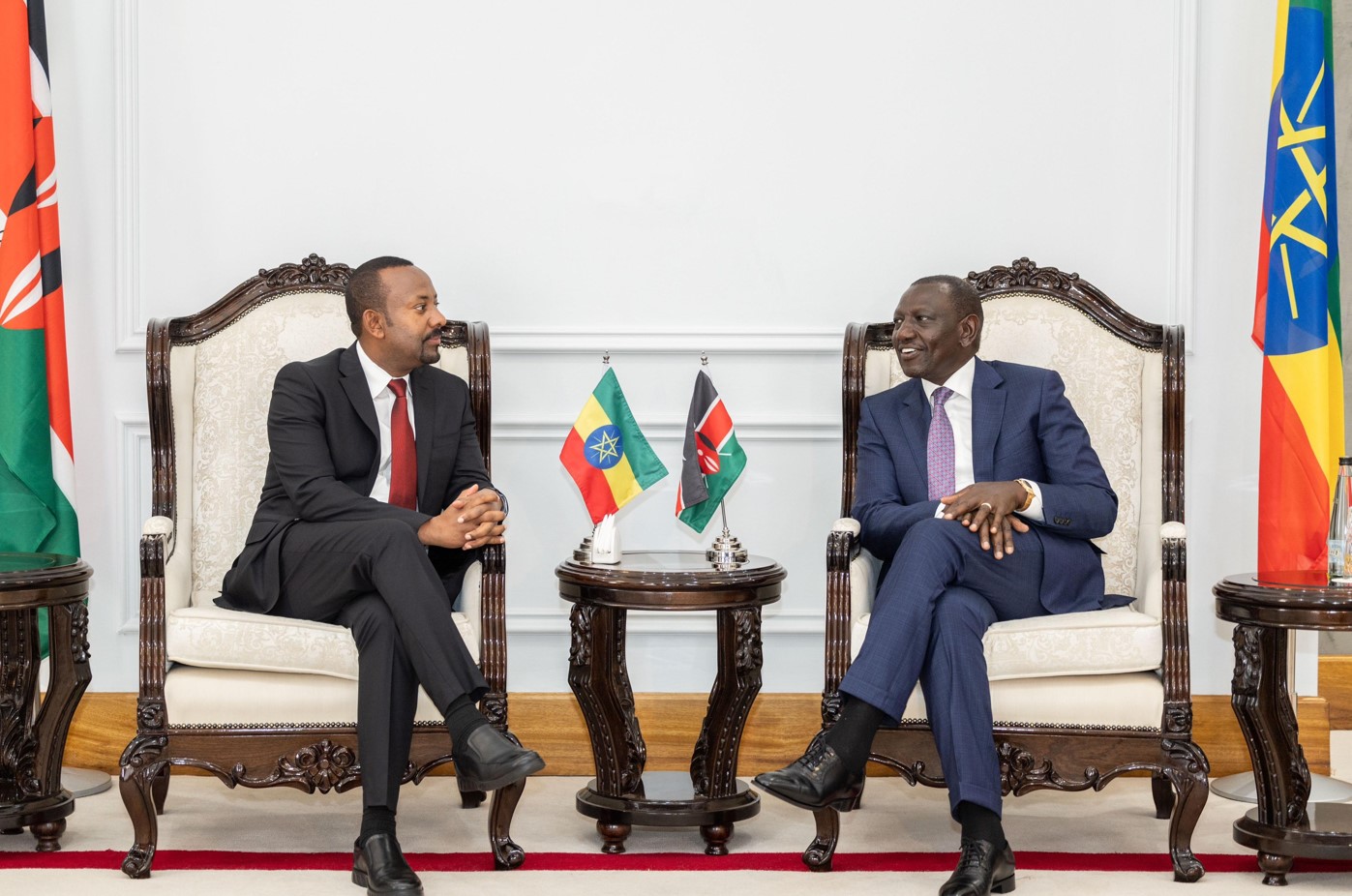

Compared to its East African Community (EAC) peers, Kenya’s outlook alongside Tanzania’s and South Sudan’s is the only upgrade.

The lender forecasts Tanzania’s economic growth at 6.0 per cent this year, up from 5.4 per cent in 2024, while South Sudan’s is at (-4.3%) from (-27.6%) in the previous year.

On the other hand, the GDP growth prospects for Uganda, Rwanda, DRC and Burundi have been downgraded to 6.1, 7.1, 4.7 and 1.9 per cent, respectively. These are from 6.3, 8.9, 6.5 and 3.5 per cent, respectively.

Geopolitical tensions

Notably, the upward projection of Kenya’s economic growth comes amid a backdrop of lingering geopolitical and trade tensions that are poised to slow further recovery efforts across both developed and developing nations in general.

The lender in the global outlook notes that the world’s economic growth is poised to shrink this year, triggered by the protectionist tariffs imposed by the world’s largest economy, the US, in January and at the beginning of this month.

It says the global economy is now expected to expand at a pace of 2.8 per cent, down from 3.3 per cent last year.

Regionally, the Sub-Saharan Africa (SSA’s) growth is also expected to decline slightly from 4.0 per cent in 2024 to 3.8 per cent in the year under review, and recover modestly in 2026 to 4.2 per cent.

The lender reckons that the regional downgrade reveals that a hard-fought economic recovery over the past years, post-Covid-19, is now being overtaken by recent events.

“Economic activity exceeded expectations in 2024, with regional growth reaching 4 per cent compared to 3.6 per cent in 2023. Reflecting improved policies, macroeconomic imbalances narrowed, including decelerating inflation and the stabilisation of public debt,” the lender said.

It adds that median headline inflation reached 4.5 per cent in early 2025, while the median debt-to-GDP ratio held steady below 60 per cent.

“But after four years of crisis, many countries in sub-Saharan Africa are not yet out of the woods, and the region faces yet another shock in the form of an abrupt shift in the external economic landscape as governments around the world reorder their policy priorities.”

This includes, in particular, a series of sizable tariff measures by the United States and countermeasures by trading partners, it adds in part.

Top Stories Today