State to use KRA, lands, and hustler fund data to enforce SHA payments

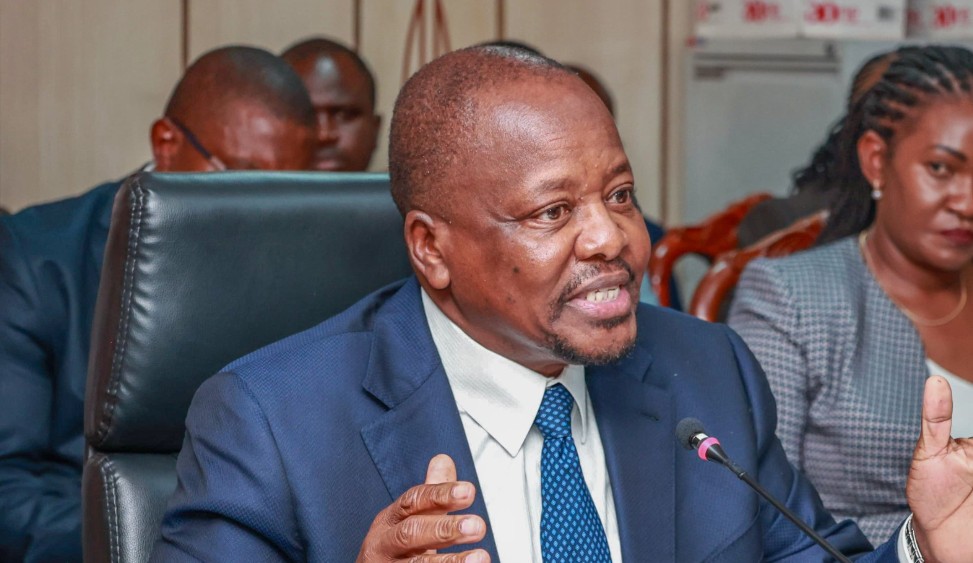

Deputy President Kithure Kindiki has directed SHA to roll out the new algorithm by February 28, saying it will make premium contributions more predictable.

The Social Health Authority (SHA) will from February 28, 2025, begin using data from multiple government sources, including the Kenya Revenue Authority (KRA), Hustler Fund, Ministry of Lands, and the Registrar of Companies, to ensure self-employed Kenyans pay health premiums that reflect their financial status.

The initiative aims to address cases where individuals misrepresent their financial standing to qualify for lower premiums under the Means Testing Tool, which determines contributions based on self-declared information.

More To Read

According to the Ministry of Health, some Kenyans have been falsely claiming to be landless or living in mud houses to reduce their monthly payments.

“To improve the accuracy of the Means Testing (MT) model, SHA is developing a new algorithm that will cross-check financial data across multiple government databases. The updated system will rely on data triangulation from sources such as the Kenya National Bureau of Statistics (KNBS), KRA, Immigration Department, Hustler Fund, Communications Authority, Registrar of Companies, Kenya Power, Insurance Regulatory Authority (IRA), National Transport and Safety Authority (NTSA), Ministry of Cooperatives, and the Ministry of Lands through the Kenya Agricultural Management and Information System (KIAMIS),” Ministry of Health said during a leadership consultative meeting at the Deputy President’s Kithure Kindiki residence.

Health CS Deborah Barasa said the new system will ensure fair contributions and increase the average monthly premiums for self-employed Kenyans from Sh560 to Sh880.

“Previously, people would cheat the system, and this has had great impacts in terms of our average. Our average currently is at Sh560 and yet we need Sh880 from means testing for the SHA system to be sustainable,” she said.

SHA has already requested access to the necessary data, and once the updated Means Testing instrument is ready, Insurance Premium Financing (IPF) will be introduced to assist households with irregular incomes in meeting their premium obligations.

The focus will also shift to enrolling more informal sector workers through organised groups such as cooperatives, boda boda riders, Jua Kali artisans (4.3 million), and drivers and conductors (1 million).

Deputy President Kithure Kindiki has directed SHA to roll out the new algorithm by February 28, saying it will make premium contributions more predictable.

He noted that while SHA has registered approximately 19.5 million members, only 3.5 million—mainly those in formal employment—are actively paying premiums.

The government has been covering the premiums for 1.5 million indigent Kenyans, while 14.5 million SHA members are only accessing primary healthcare services, which are free.

“For them to access care in Level 4 facilities and above, they need to pay. From March 1, we will roll out a huge national campaign to increase enrolment and make premiums predictable,” Kindiki said.

The move to raise average premiums for self-employed Kenyans is expected to impact compliance, as previous health schemes such as the National Health Insurance Fund (NHIF) faced widespread defaults.

In the 2021/2022 financial year, NHIF membership grew from 13.94 million to 15.4 million, yet only 6.7 million—mainly those in formal employment—paid their contributions consistently. The Kenya Kwanza administration had initially reduced the lowest SHA premium to Sh300 last year, hoping that more informal sector workers would enrol.

According to the KNBS, Kenya’s poverty rate stands at 39.8 per cent, meaning over 20 million Kenyans struggle to afford basic necessities, raising concerns over the sustainability of the revised SHA contributions.

Other Topics To Read

Top Stories Today