Treasury halts new funding for loan guarantee scheme for small traders

The suspension comes as the Treasury works on transitioning the scheme to a new public-private venture, the Kenya Credit Guarantee Scheme Company (KCGSC).

The National Treasury has halted new funding for the Credit Guarantee Scheme (CGS) designed to help small traders secure affordable loans.

The suspension comes as the Treasury works on transitioning the scheme to a new public-private venture, the Kenya Credit Guarantee Scheme Company (KCGSC).

More To Read

- Kenyans drop fridges, sofas and cars as loan collateral, turn to livestock

- Kenya's loan defaults hit 20-year high as economic woes deepen

- Banks raise loan margins as deposit rates decline

- Counties turn to expensive loans to cover essential expenses amid Treasury delays

- Kenya seeks Sh37.6 billion IMF funds cut citing lower financing pressures

- Appetite for loans rises as Kenyans grapple with squeezed disposable income

The CGS, which was established in December 2020, aimed to provide financial support to micro, small, and medium enterprises (MSMEs). However, over the past four years, the Treasury has allocated just Sh3 billion to the scheme, well below its original target of Sh10 billion per year.

In the latest budget proposal for the upcoming financial year, the Treasury notes that additional funding will be considered once the CGS is formally incorporated as a company.

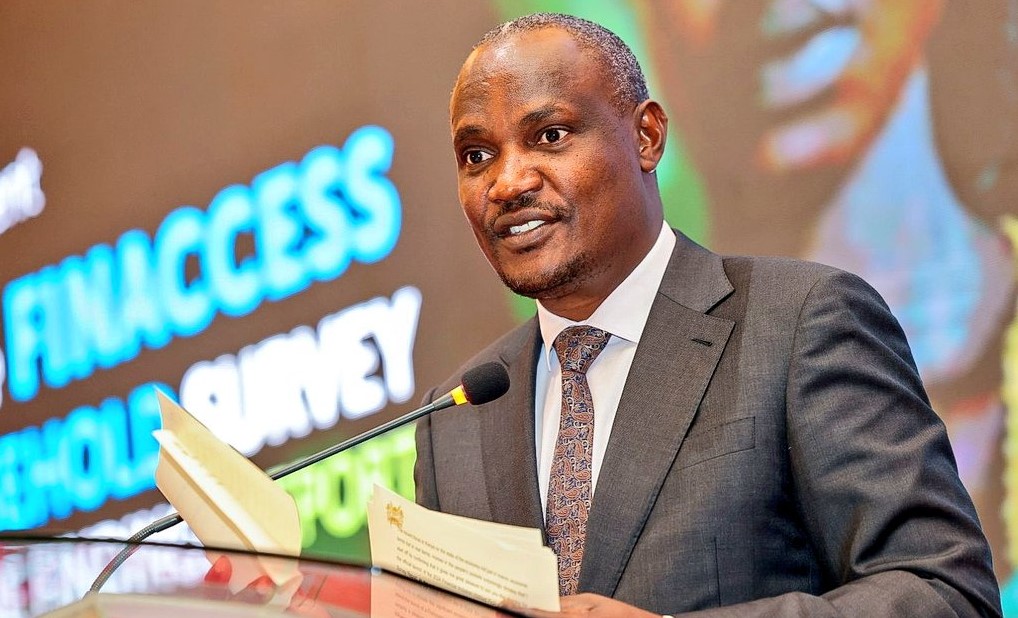

“The government will convert the Credit Guarantee Scheme (CGS) into the Kenya Credit Guarantee Scheme Company (KCGSC) to ensure sustainability and develop a credit guarantee policy,” the Treasury’s director-general for budget, fiscal, and economic affairs Albert Mwenda told Business Daily.

He added that the scheme aims to leverage private sector liquidity while promoting financial discipline.

The transition to KCGSC is still in its early stages, with the Treasury targeting full operational status by June 2028. Initial projections indicate that the new company will be 10 per cent operational this year, reaching 30 per cent by June 2026, 80 per cent by June 2027, and 100 per cent by 2028.

International best practices

The new credit guarantee model is expected to be based on international best practices. As part of the ongoing process, the Treasury has been in talks with the Central Bank of Kenya and other stakeholders.

“Credit guarantees enable us to leverage abundant private sector liquidity to finance MSMEs, while also inculcating financial discipline,” Mwenda explained.

Currently, the scheme absorbs up to 25 per cent of loan losses in the event of default. Based on the Sh3 billion capital injected into the scheme, the Treasury had hoped participating banks would lend up to Sh12 billion. However, by last August, only Sh6.3 billion had been accessed by small traders.

Despite the scheme’s potential, most of the country’s 39 commercial banks have shown little interest, with only seven lenders participating. These include KCB, NCBA, Co-operative, Absa, DTB, Stanbic, and Credit Bank. Loan amounts are capped at Sh5 million per borrower, and banks set interest rates based on the borrower’s risk profile.

The transition to a public-private partnership is aimed at unlocking higher-value loans for MSMEs as they move beyond the Hustler Fund, President William Ruto’s financial inclusion initiative.

Mwenda said the new model will allow MSMEs currently borrowing from the Hustler Fund to access larger loans at lower costs.

As of August, over 4,100 MSMEs in 46 counties had benefited from the State-backed loans, a significant increase from the previous year. Despite this, the uptake has been slower than expected, with banks continuing to assign high-risk profiles to MSMEs, resulting in higher interest rates.

“Participating lenders must demonstrate that the credit risk covered by the company is reflected in the pricing of any qualifying loans,” Mwenda said.

“We expect there will be a demonstrable benefit in the overall interest charged to borrowers under the company, alongside other benefits such as relaxed requirements.”

Top Stories Today