National Assembly suspends bill granting Sh15bn tax exemptions to 14 firms

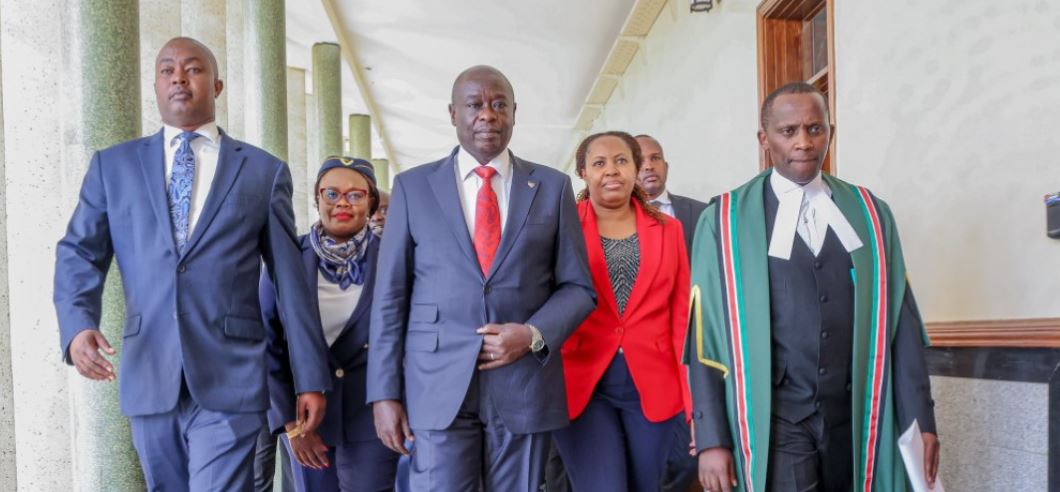

Speaker Moses Wetang’ula granted the request, allowing the Finance and National Planning Committee more time to examine whether the exemptions on capital goods were proportional to the investments made by the firms.

The National Assembly has suspended debate on a government-sponsored Bill seeking to amend a printing error in tax legislation that controversially granted 14 manufacturing firms VAT exemptions amounting to Sh15 billion, despite their control of investments totalling Sh93.53 billion.

Debate on the Value Added Tax (Amendment) Bill, 2025, was halted following a request by Majority Leader Kimani Ichung’wah, who called for further scrutiny of the firms benefiting from the exemptions.

More To Read

- National Assembly freezes Sh4.5bn for Bomas renovations, questions priorities

- Kenyans invited to submit views on Finance Bill 2025 by May 27

- Counties cry foul over Sh405bn budget, demand Sh536bn to avert crisis

- Katiba Institute challenges MPs' push to anchor CDF, other funds in Constitution

- National Assembly wants court to strike out case challenging IG Kanja's appointment

- National Assembly given 21 days to review proposed changes to two Bills Ruto declined assent

Speaker Moses Wetang’ula granted the request, allowing the Finance and National Planning Committee more time to examine whether the exemptions on capital goods were proportional to the investments made by the firms.

Ichung’wah emphasised the importance of ensuring transparency. “The committee needs to establish the actual value of what is being exempted, who the beneficiaries are, and whether these investments have genuinely been made in the country.”

The exemptions—granted while the government continues to grapple with a cash crunch, have sparked criticism, especially due to their retrospective application under the Tax Laws (Amendment) Act, which came into force in January 2024.

Critics argue that the backdating of the law violates legislative norms and constitutional principles.

Suna East MP Junet Mohamed questioned the government’s priorities. “This Bill proposes exemptions worth Sh15 billion, yet we can’t fund the National Government-Constituency Development Fund. It must be properly scrutinised to verify the existence and value of these investments.”

Committee Chair Kuria Kimani explained that the Bill was initially introduced to correct a drafting error in the Tax Laws (Amendment) Act, which became operational in December 2024. The Act amended the VAT law to allow exemptions for capital investments of at least Sh2 billion.

Kimani said the committee would act with diligence. “It’s not our habit to delay matters before this House. We’ll complete this task in record time. While policy changes have boosted manufacturing, we must ensure the exemptions stimulate genuine investment and are not abused.”

A document submitted to Parliament by National Treasury Principal Secretary Chris Kiptoo listed the 14 firms that had already received exemptions before the amendment was passed.

“In the interest of enhancing transparency in the administration of tax incentives, we are submitting the list of companies granted VAT exemption,” Kiptoo stated.

The companies include Devki Steel Mills, which received VAT exemptions of Sh1.33 billion for an Sh8.32 billion steel project in Samburu and Kwale counties since March 7, 2023, and a further Sh1.1 billion for an iron ore processing plant worth Sh6.9 billion in Voi, Taita Taveta County, since October 30, 2024.

National Cement Company Limited was granted Sh516.5 million in exemptions for a waste heat recovery plant in Kaloleni, Kilifi County, valued at Sh3.23 billion, and another Sh921.35 million for a cement grinding plant worth Sh5.8 billion in Eldoret, Uasin Gishu County, since October 30, 2024.

Soit Sugar Company Limited benefited from VAT exemptions of Sh465.1 million for Sh2.91 billion worth of investments since October 17, 2024. Angata Sugar Mills Limited received Sh343.31 million in exemptions for an investment of Sh2.15 billion since August 2, 2024, while Rai Cement was granted Sh1.01 billion in tax relief for a Sh6.34 billion investment since October 1, 2024.

Taifa Gas Kenya Limited enjoyed VAT exemptions amounting to Sh827.9 million for capital investments worth Sh5.2 billion since September 26, 2024, while SBC Kenya Limited was granted exemptions of Sh643.2 million for an investment of Sh4.02 billion since August 28, 2024.

De Heus Animal Nutrition Limited received Sh335.6 million for Sh2.1 billion in capital investment since December 19, 2024.

DPL Festive Limited enjoyed Sh391 million in VAT relief for Sh2.44 billion in investments since October 18, 2024. Nakuru Mining was the biggest beneficiary, with a VAT exemption of Sh6.2 billion for projects valued at Sh38.74 billion since August 18, 2023.

Rainham Steel Plant Limited received exemptions of Sh388.9 million for a Sh2.43 billion project since May 16, 2023, while CEMTECH Limited, which operates a clinker grinding and production plant in West Pokot County, got Sh488.74 million in tax exemptions for an investment worth Sh3.1 billion since March 7, 2023.

Kiptoo defended the exemptions, assuring MPs that the companies would undergo thorough vetting, including site inspections.

“Tax policies that promote local manufacturing have a proven economic impact—creating jobs, boosting local industries, and supporting growth. However, it is essential to ensure these exemptions are not misused.”

However, Budget and Appropriations Committee Chair and Alego Usonga MP, Samuel Atandi, warned of the fiscal consequences. He cited a Parliamentary Budget Office report indicating that tax exemptions have cost Kenya over Sh300 billion in the current financial year.

“We are struggling to raise revenue. We’re targeting Sh2.8 trillion in ordinary revenue next year. Continuing with exemptions of this magnitude undermines that goal.”

“These exemptions must be carefully reviewed before this Bill can return to the House,” he concluded.

Top Stories Today