NHIF lost Sh21 billion in fake insurance claims - petitioner claims

Insurance companies commonly use IBNR as a reserve account to set aside funds for unreported claims.

A fraud risk management consultant has alleged that the National Hospital Insurance Fund (NHIF) lost Sh21 billion to a fraudulent scheme operated by unknown individuals.

Former National Treasury internal auditor Bernard Muchere asserted that manipulation of NHIF's financial records led to significant losses.

More To Read

- SHA denies wiring Sh20 million to ghost hospital in Homa Bay, confirms payment to Nyandiwa Level 4

- Counties urged to ditch costly overseas benchmarking tours amid fiscal constraints

- Private hospitals give Duale two weeks to settle NHIF arrears

- High Court quashes Aden Duale's NHIF pending bills verification committee

- Senate faults SHA over delayed Sh8 billion payment to families of deceased civil servants

- Over 23 million Kenyans registered for SHA, but more than 17 million aren’t contributing to the fund

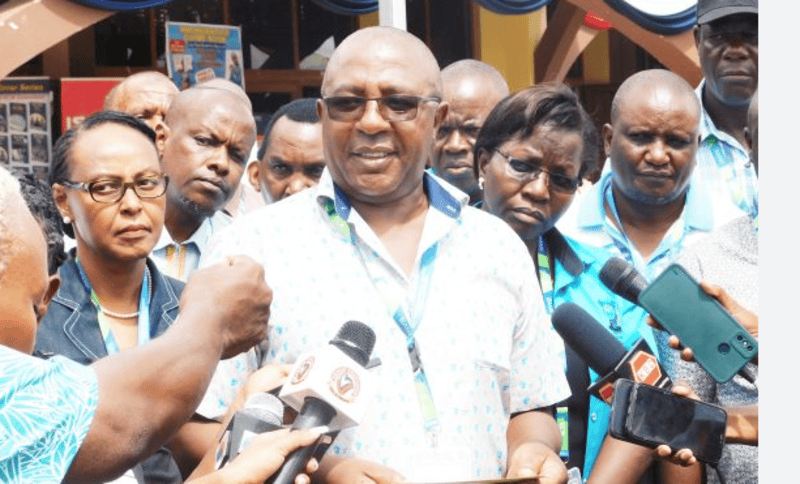

Muchere made these allegations while presenting his petition to the National Assembly Public Petitions Committee chaired by Vihiga MP Ernest Ogesi.

He explained that the fraudulent scheme involved making false claims through a mechanism called Incurred But Not Reported (IBNR) claims.

Insurance companies commonly use IBNR as a reserve account to set aside funds for unreported claims.

According to Muchere, NHIF abused this system by making engineering claims that were outdated, raising no suspicion from auditors or the public.

He further alleged that the fraudulent IBNR claims were created with the assistance of Kenbright Actuarial and Financial Services, an actuarial firm, and were backdated to the financial year 2019-2020.

"I can conclusively state that the IBNR reserves were fraudulently created to syphon NHIF funds," Muchere told the committee.

In response, the committee's chairperson, MP Ogesi, pledged that the committee would thoroughly investigate the allegations, emphasising the seriousness of the claims.

He called on NHIF's top management, alongside Kenbright Actuarial and Financial Services, to appear before the committee and explain the situation.

NHIF has undergone changes since the alleged fraud, including renaming itself the Social Health Insurance Authority in accordance with new legal changes.

Members of Parliament during a past session. (Photo: National Assembly)

Members of Parliament during a past session. (Photo: National Assembly)

However, the Sh21 billion scandal from the 2021-2022 financial year still casts a shadow over the institution.

The petitioner had previously written to Parliament, stating that the national health insurer suffered a significant loss due to fake claims during the period.

He explained that while preparing the financial statements for the financial year ending June 30, 2022, NHIF management created IBNR claims amounting to over Sh21 billion.

These claims, he said, were backdated to the 2019/2020 financial year and included cumulative IBNR claims from previous years.

Impact on Contributors

According to Muchere's petition, the unbudgeted claims weighed heavily on NHIF members, particularly those who contributed to its insurance schemes.

He pointed out that NHIF struggled to pay hospital bills for legitimate contributors because of the financial strain caused by these fraudulent claims.

"The unbudgeted claims were charged on NHIF members' contributory schemes, causing a huge financial crisis that made NHIF unable to pay hospital bills for genuine contributors," Muchere stated in the petition.

To back his claims, Muchere cited the National Health Insurance Fund Act (2022), the Public Finance Management Act (2012), and the State Corporations Act (Cap 446).

The National Hospital Insurance Fund building in Nairobi. (Photo: Handout)

The National Hospital Insurance Fund building in Nairobi. (Photo: Handout)

He noted that in NHIF's audited financial statements for the financial years 2020-2021, 2019-2020, and earlier, no IBNR reserves existed.

However, they appeared suspiciously in the financial year ending June 2022.

"This brings into question the authenticity of the cumulative Sh19.9 billion supposedly brought forward from previous years and the basis for these IBNR claims," Muchere's petition stated.

Dubious Payments

The petition further outlined the various schemes from which the fraudulent paym2ents originated.

These included Sh9.7 billion from the National Health Scheme, Sh4.01 billion from the National Police Service and Kenya Prisons Service, Sh2.9 billion from the Civil Servants Scheme, and Sh2.3 billion for the Linda Mama Programme.

Dubious payments also affected several schemes. These included Sh780.7 million from the Parastatal Scheme, Sh683.92 million from the EduAfya Scheme, Sh525.3 million from the County Scheme, Sh190.2 million from the Retirees' Scheme, Sh31.3 million from the HISP-OVCs, and Sh6.5 million from the HISP-OPPSD.

Top Stories Today